What Western Game Publishers Need To Know About Gamers In Asia [Industry Contributor]

What Western Game Publishers Need To Know About Gamers In Asia [Industry Contributor]

It's not enough to guess at what motivates Asian gamers -- it's important to look at the data. Niko Partners Senior Analyst, Daniel Ahmad, weighs in on what the data says about Chinese and Southeast Asian gamers.

Daniel Ahmad,Mon, 24 Jun 2019 20:42:00

When global companies headquartered in the West conduct worldwide segmentation analyses, they often find the data misleading or ineffective when using it in a strategy for growth in China or Greater Southeast Asia. Why? Because Asian gamers are motivated by different things than Western gamers are.

Niko Partners conducted two gamer segmentation studies this year: Chinese Gamers Segmentation Analysis and GSEA (Greater Southeast Asia) Gamers Segmentation Analysis. In these studies, we surveyed gamers across China and Greater Southeast Asia (Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam and China Taiwan).

Our study partner, Quantic Foundry, and their data analysts applied quantitative techniques, such as cluster analysis, against their baseline gamer motivation model to identify distinct player segments within the audience. We allowed the data analytics to create the segments, instead of formulating them ourselves. The output is analysis that supports strategies for investment in Asia’s game markets.

The biggest differences between Asia and the west

The surprising outcomes of our studies is how not only similar Chinese and Greater Southeast Asian gamers are to each other, but how different Asian gamers are from western gamers.

Quantic Foundry’s Gamer Motivation Model contains the motivational preferences of gamers from the West. Our joint studies looked at gamers in GSEA and China. This enabled the comparison of U.S. and Chinese gamers and an exploration of how gaming motivations vary across cultures. The initial comparison was between US and Chinese gamers, however Chinese and GSEA gamers are extremely similar in their motivations.

Chinese gamers are most driven by completion and competition, and Gamers in Greater Southeast Asia are primarily motivated by competition, completion, community and challenge. We refer to them as the 4 Cs.

The average Chinese gamer cares more about Competition: duels, arena matches, and leaderboard rankings, than 75 percent of gamers in the U.S. Similarly, Chinese gamers are also more interested in completion — the appeal of collecting points/stars/trophies, completing quests/achievements/tasks. Chinese gamers are less interested in being immersed in a compelling game world (Fantasy), interacting with an elaborate story and large cast of NPCs (Story), exploration and experimentation (Discovery), and customizing their avatar/town/spaceship (Design) relative to U.S. gamers.

Greater Southeast Asia in this report includes Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam and China Taiwan. Overall, Southeast Asian gamers consistently prefer games that foster community, teamwork, and competition. community, competition, and completion. They score lowest for story, discovery and design

Gender differences are also much smaller in Asia. According to Quantic Foundry’s model, male gamers in the West tend to be more driven by Competition, Destruction, and Challenge, whereas female games tend to be more driven by Design, Fantasy, and Completion. Among Asian gamers male gamers in China care more about Destruction, Discovery, and Competition. Overall, the only significant difference is that female gamers in China are less interested in guns, explosions, and mayhem than male gamers.

Age differences are also much smaller. In the U.S., the appeal of Competition declines dramatically with age, and it’s the motivation that changes the most with age. The appeal of Excitement also declines with age in the US. Age-related differences in gaming motivations are much more muted among Chinese gamers. So while the appeal of Competition and Excitement drop rapidly among U.S. gamers as they get older, these effects are much smaller among Chinese gamers.

Asian Gamer Segments

The Chinese gamer segmentation analysis surfaced six distinct sets of gamers:

Hardcore mobile gamers These gamers play 40+ hours per week, primarily complex games on their smartphones.

Hardcore PC gamers Hardcore PC gamers play 30+ hours per week, playing primarily challenging match-based games on high end PCs.

Casual gamers Casual gamers average 11 hours per week, across platforms but with the majority of their time spent on mobile, playing casual games.

Casual demolitionists These gamers play an average of 12 hours a week. They love competition and excitement, but prefer less complex gameplay.

Super consumers With the highest income of all segments, Super Consumers are voracious digital consumers and early adopters. They rack up more than 49 hours of gaming, across all platforms

Core gamers The largest segment, core gamers are true gaming enthusiasts. They average 18 hours of play per week, and also like to talk about and interact with gaming-related content.

Almost all gamers in China spend significant time playing games on their smartphones, even hardcore PC gamers.

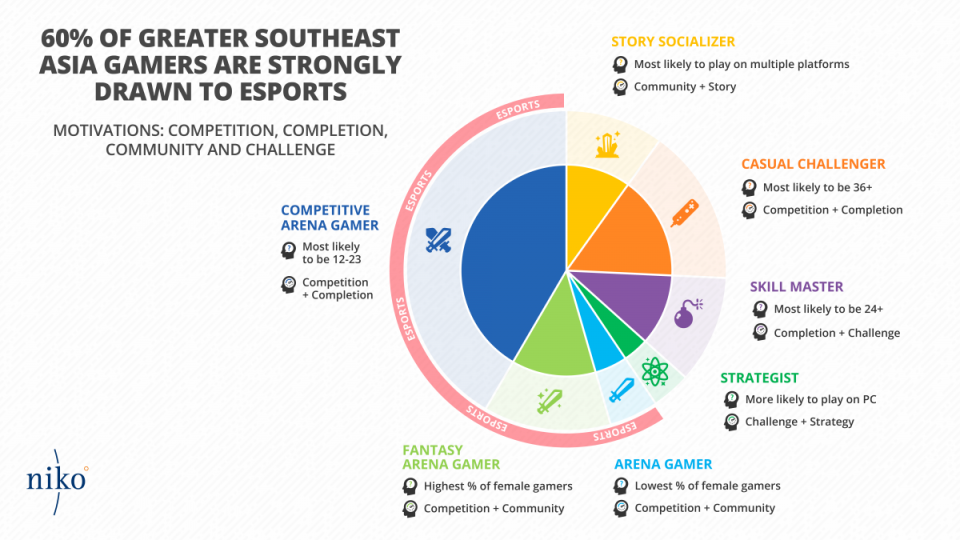

The Greater Southeast Asia study surfaced seven distinct gamer segments:

Story Socializers are looking for highly-social and often collaborative gaming experiences with interesting stories and characters.

Casual Challengers are more casual, detached gamers who primarily play games to challenge others in relaxed, low-stress gameplay.

Skill Masters enjoy skill-based mechanics that they can practice over time, mastering the game, and unlocking trophies and collectibles.

Strategists like to play games that require lots of practice to master as well as games that require strategic thinking and planning.

Arena Gamers gamers enjoy MOBA (Multiplayer Online Battle Arena) games that emphasize fast pacing, teamwork, competition, and lots of weapons.

Fantasy Arena Gamers gamers enjoy fast-paced team-based arenas in high fantasy or abstract settings.

Competitive Arena Gamers These gamers are the most highly engaged and competitive, and enjoy a broad range of game mechanics. They are most likely found in fast-paced, skill-based team arenas.

Asian Gamers and Esports

The primary motivations of Asian gamers competition, completion, community and challenge are also These are also the most essential values of esports – which explains why China is the world’s largest (by far) market for esports, and GSEA is the fastest growing. More than 60% gamers in China and more than 60% of gamers in Greater Southeast Asia gamers are strongly drawn to esports. The vast majority of gamers across both regions engage with esports in some way.

In China, four of the seven segments, hardcore mobile gamers, hardcore pc gamers, core gamers, and super consumers, are key segments for esports. In Greater Southeast Asia, Arena Gamers, Fantasy Arena Gamers, and Competitive Arena Gamers are the key segments for esports. The highest spending gamer segment, Competitive Arena Gamers are also the most important segment for esports, and the largest segment in the survey.

Asia Represents Half The Global Market In Mobile and PC Games

In 2018, Chinese gamers spent $32 billion and those in Greater Southeast Asia spent $4.4 billion, primarily on mobile and PC games. Considering that this represents about half of the global market for mobile and PC games, it's important to consider how to appeal to their tastes beyond guesswork, no matter how educated. Refer to the 4 Cs (Competition, Completion, Community, and Challenge) whenever considering building a game -- whether it's a brand-new IP, a port, or otherwise -- for an Asian gamer.

Motivation matters and there's enough disparity between the East and the West that you can't rely on what you think you know. You have to look at the data, too.