Western Standard LLC Boosts Stake in Merrimack Pharmaceuticals Inc

Western Standard LLC, a Los Angeles-based investment firm, recently increased its holdings in Merrimack Pharmaceuticals Inc (NASDAQ:MACK), a leading biotechnology company. This article provides an in-depth analysis of the transaction, the profiles of both the guru and the traded company, and the potential implications for investors.

Details of the Transaction

On December 29, 2022, Western Standard LLC added 818,645 shares of Merrimack Pharmaceuticals Inc to its portfolio at a trade price of $11.11 per share. This transaction increased the firm's total holdings in the company to 1,991,108 shares, representing 24.06% of its portfolio and 13.90% of Merrimack's outstanding shares. The trade had a 9.89% impact on the guru's portfolio and resulted in a 69.82% change in its shareholdings.

Profile of Western Standard LLC

Western Standard LLC is an investment firm located at 5900 Wilshire Blvd, Los Angeles, CA. The firm manages a portfolio of 35 stocks, with a total equity of $116 million. Its top holdings include Merrimack Pharmaceuticals Inc(NASDAQ:MACK), Douglas Dynamics Inc(NYSE:PLOW), Ecovyst Inc(NYSE:ECVT), Bristow Group Inc(NYSE:VTOL), and Dole PLC(NYSE:DOLE). The firm's primary investment sectors are healthcare and energy.

Overview of Merrimack Pharmaceuticals Inc

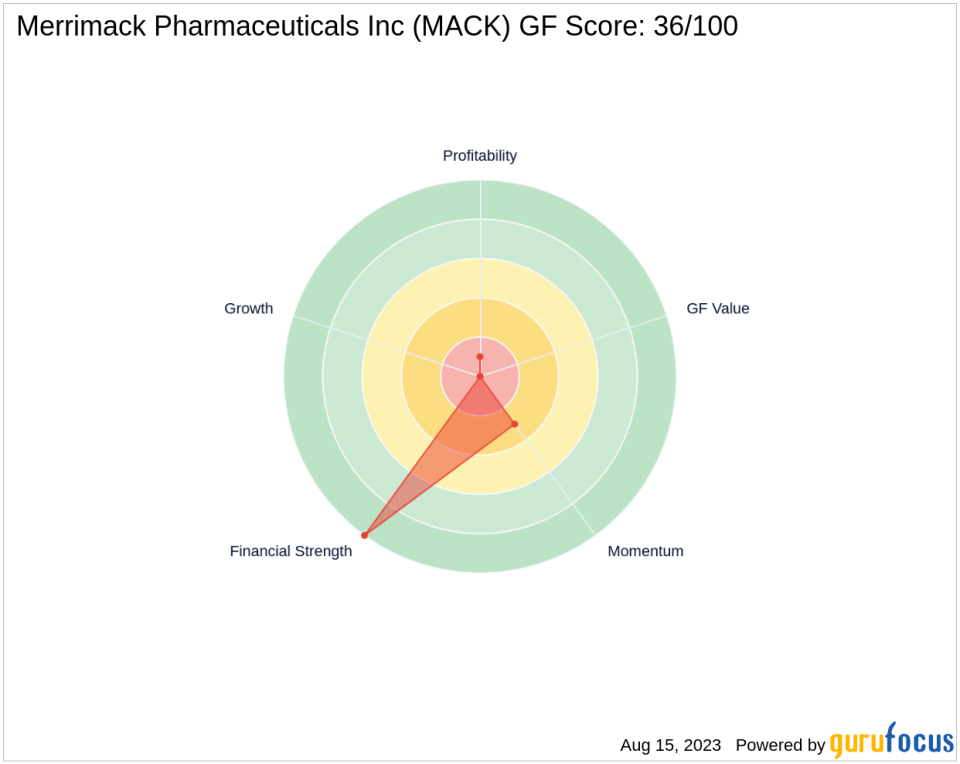

Merrimack Pharmaceuticals Inc, a US-based biotechnology company, specializes in the discovery, development, and commercialization of innovative cancer treatments. The company's approach to systems biology involves applying multidisciplinary capabilities to build functional and predictive computational models of biological systems. As of August 15, 2023, the company's market capitalization stands at $176.005 million, with a stock price of $12.29. However, the company's GF Value and PE Percentage are not available due to insufficient data. The company's GF Score is 36/100, indicating a poor future performance potential.

Analysis of Merrimack Pharmaceuticals Inc's Financial Health

Merrimack Pharmaceuticals Inc's financial strength is ranked 10/10, indicating a strong balance sheet. However, its profitability rank is 1/10, and its growth rank is 0/10, suggesting low profitability and growth. The company's Piotroski F-Score is 3, indicating poor business operations. Its Altman Z score is not available due to insufficient data, and its cash to debt rank is 3, indicating a high level of debt.

Merrimack Pharmaceuticals Inc's Industry Position

In the biotechnology industry, Merrimack Pharmaceuticals Inc's return on equity (ROE) is -9.47, and its return on assets (ROA) is -9.21. These figures place the company at ranks 330 and 363, respectively, indicating below-average profitability. The company's interest coverage is not applicable due to insufficient data.

Merrimack Pharmaceuticals Inc's Growth and Momentum

Over the past three years, Merrimack Pharmaceuticals Inc has seen a 51.60% growth in EBITDA and a 58.90% growth in earnings. However, the company's RSI 14 Day Rank is 1381, and its Momentum Index 6 - 1 Month Rank is 465, indicating weak momentum.

Conclusion

Western Standard LLC's recent acquisition of Merrimack Pharmaceuticals Inc shares reflects the firm's confidence in the biotechnology company's potential. However, Merrimack's low profitability and growth ranks, coupled with its high debt level, suggest that the company faces significant challenges. Investors should carefully consider these factors before making investment decisions.

This article first appeared on GuruFocus.