The Western Union Co's Dividend Analysis

Deciphering the Dividend Dynamics of The Western Union Co

The Western Union Co (NYSE:WU) recently announced a dividend of $0.24 per share, payable on December 29, 2023, with the ex-dividend date set for December 19, 2023. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into The Western Union Co's dividend performance and assess its sustainability.

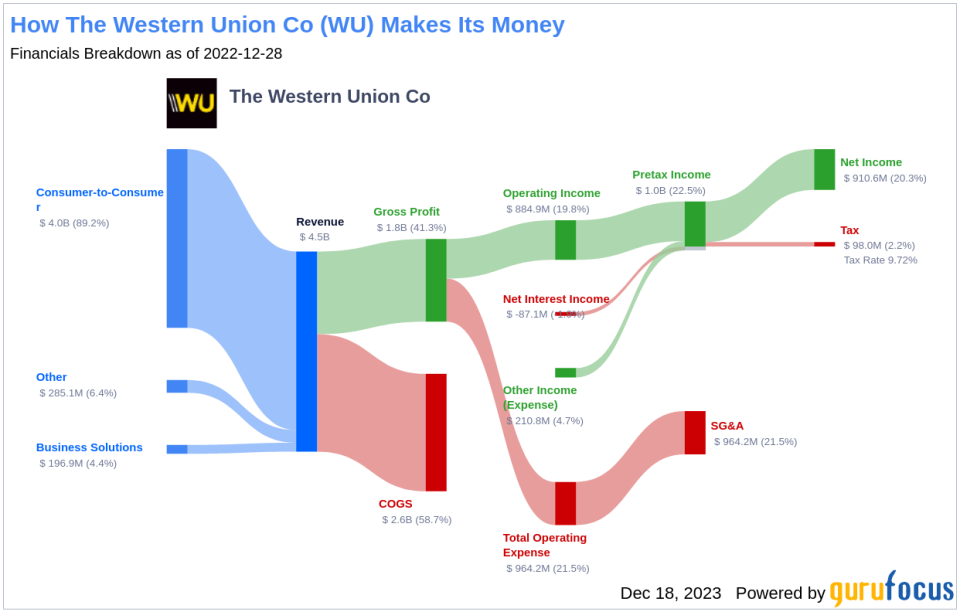

What Does The Western Union Co Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

The Western Union Co is a dominant player in the global money transfer industry, facilitating domestic and international transactions through a vast network of approximately 600,000 agents. In 2022 alone, the company processed over 270 million transactions, cementing its status as the world's leading money transfer company.

A Glimpse at The Western Union Co's Dividend History

The Western Union Co has maintained a consistent dividend payment record since 2006, distributing dividends quarterly. The company's commitment to increasing its dividend annually since 2006 has earned it the title of a dividend achievera prestigious recognition for companies that have achieved at least 17 consecutive years of dividend increases. Below is a chart showing annual Dividends Per Share to track historical trends.

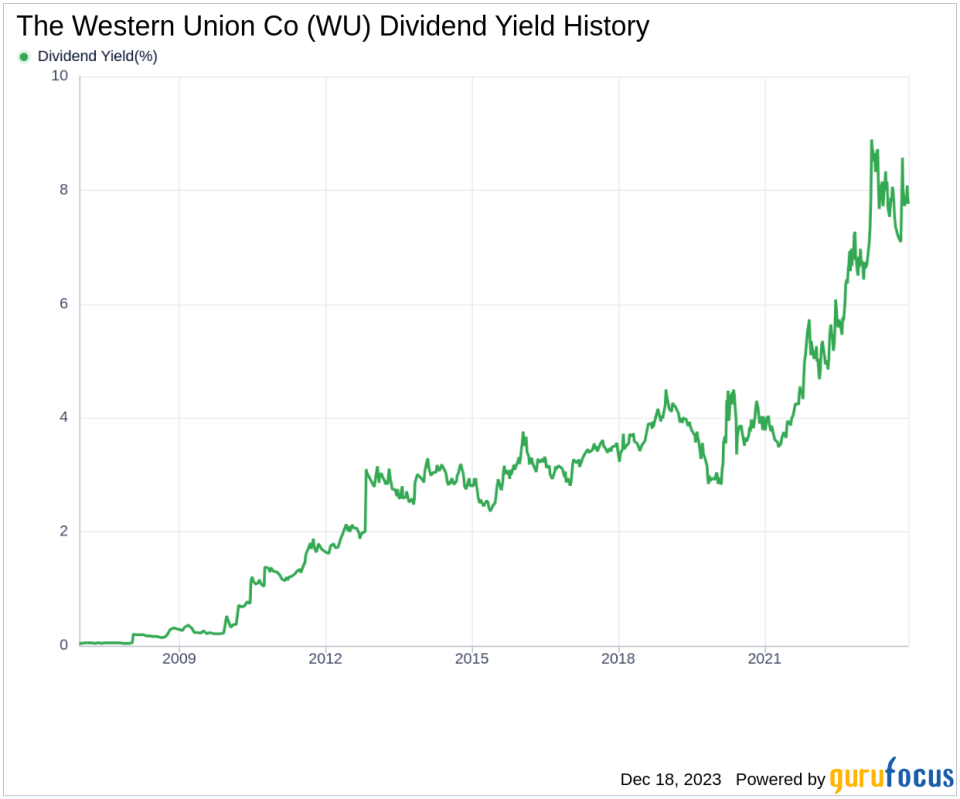

Breaking Down The Western Union Co's Dividend Yield and Growth

As of today, The Western Union Co boasts a 12-month trailing dividend yield of 7.86% and a forward dividend yield of 7.86%, indicating consistent dividend payments expected over the next year. The company's annual dividend growth rate over the past three years was 5.50%, which extends to 6.60% over a five-year period. Over the past decade, The Western Union Co's dividends per share have grown at an annual rate of 8.50%. Consequently, the 5-year yield on cost for The Western Union Co stock is approximately 10.82%.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio is a critical measure for evaluating the sustainability of dividends. The Western Union Co's dividend payout ratio stands at 0.48 as of September 30, 2023, suggesting a balanced approach to dividend distribution and earnings retention for future growth. The company's profitability rank is a strong 8 out of 10, indicating healthy profitability relative to its peers and consistent net profit over 9 of the past 10 years.

Growth Metrics: The Future Outlook

The Western Union Co's growth rank of 8 out of 10 signals a positive growth trajectory. However, the company's revenue per share and 3-year revenue growth rate indicate a -2.10% average yearly decrease, underperforming approximately 61.96% of global competitors. Despite this, The Western Union Co's 3-year EPS growth rate reflects an average annual increase of 5.90%, though it underperforms about 51.75% of global competitors.

Concluding Insights on The Western Union Co's Dividend Prospects

In summary, The Western Union Co has demonstrated a strong track record of dividend payments complemented by a respectable dividend growth rate. The company's prudent payout ratio and solid profitability rank suggest that its dividends are well-supported by its financials. Despite some challenges in revenue growth, The Western Union Co's earnings growth remains positive, which is essential for the long-term sustainability of its dividends. Investors considering high-dividend yield opportunities may find The Western Union Co an interesting prospect, and can further explore similar options using GuruFocus's High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.