Western Union (WU) Q3 Earnings Beat on High C2C Transactions

The Western Union Company WU reported third-quarter 2023 adjusted earnings per share (EPS) of 43 cents, beating the Zacks Consensus Estimate by 13.2%. The bottom line rose 2.4% year over year.

Total revenues rose 1% year over year on a reported basis or 7% on a constant-currency basis to $1,097.8 million. Moreover, the top line beat the Zacks Consensus Estimate by 6.3%.

The strong quarterly earnings were due to strength in the Middle East business, Evolve 2025’s momentum, and transaction growth. However, the discontinuation of operations across Russia and Belarus, promotional pricing activities and higher expenses affected the results.

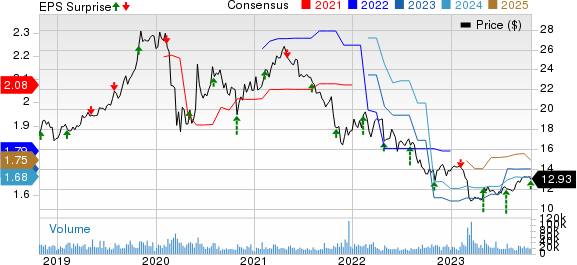

The Western Union Company Price, Consensus and EPS Surprise

The Western Union Company price-consensus-eps-surprise-chart | The Western Union Company Quote

Q3 Performance

Adjusted operating margin of 19.6% deteriorated 100 basis points year over year due to higher technology and variable costs. Third-quarter adjusted effective tax rate of 16.6% was higher than 15.5% in the year-ago period.

Western Union’s total expenses were $886.9 million, up 3% year over year. Higher cost of services contributed to this upside in overall expenses in the third quarter.

C2C Segment

The C2C segment reported revenues of $1,019 million, which grew 4% year over year on a reported basis or 3% on a constant-currency basis in the quarter under review. The segment’s revenues beat our estimate by 6.9%. Operating income fell 0.2% year over year to $193.4 million.The operating income margin of 19% fell from 19.7% a year ago.

Transactions within the C2C segment increased 5% year over year on the back of strong Latin American and Caribbean Region and the Middle East, Africa and South Asia.

Branded Digital revenues increased 3% on a reported and constant-currency basis.

Business Solutions

The company completed the divestment (third closing) of the Business Solutions unit on Jul 1, 2023. In this final stage, the European Union operations of the unit were included. The sale of this unit resulted in a gain of $18 million.

Other

This segment reported revenues of $78.8 million, which grew 22% year over year on a reported basis. The segment’s revenues beat our estimate by 15.7%. Operating income stood flat year over year to $21.6 million. The operating income margin of 27.5% fell from 33.4% a year ago.

Balance Sheet (as of Sep 30, 2023)

Western Union exited the third quarter with cash and cash equivalents of $1,138.2 million, decreasing from the 2022-end level of $1,285.9 million. Total assets of $7,913.7 million declined from $8,496.3 million at 2022-end.

Borrowings dropped from $2,616.8 million at 2022-end to $2,309.1 million.

Total stockholders' equity of $613.6 million increased from $477.8 million as of Dec 31, 2022.

In the third quarter, net cash provided by operating activities decreased from $522.4 million in the third quarter of 2022 to $518.6 million.

Dividend Update

Western Union rewarded its shareholders with $88 million in dividends in the third quarter.

2023 Guidance

The company revised its guidance upward and expects adjusted revenues to decline 1% or rise 1% in 2023 from the 2022 level of $1,107.3 million.

Adjusted EPS is anticipated to be in the range of $1.65-$1.75 for 2023. The midpoint of the guidance indicates a decline from the 2022 reported figure of $1.76 per share.

Adjusted operating margin is expected to be between 19% and 21%. The metric stood at 20.4% in 2022.

Zacks Rank

Western Union currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Financial Transaction Services Players

Fiserv, Inc. FI reported impressive third-quarter 2023 results, wherein earnings and revenues surpassed the Zacks Consensus Estimate.

Adjusted EPS (excluding 40 cents from non-recurring items) of $1.96 exceeded the consensus mark by 1% and increased 20% year over year. Adjusted revenues of $4.62 billion surpassed the consensus estimate by 0.53% and rose 8.2% year over year.

Visa Inc. V reported solid fourth-quarter fiscal 2023 results, driven by increased payments, cross-border volumes and processed transactions. Steady cross-border travel growth, resilient consumer spending and higher-than-expected data processing aided the results, partially offset by increased costs and client incentives.

The company reported fourth-quarter fiscal 2023 EPS of $2.33, which beat the Zacks Consensus Estimate of $2.23 by 4.5%. The bottom line improved 21% year over year.

Mastercard Incorporated MA reported third-quarter 2023 adjusted earnings of $3.39 per share, which beat the Zacks Consensus Estimate by 5.6%. The bottom line improved 26% year over year.

The leading technology company in the global payments industry reported net revenues of $6,533 million, which rose 14% year over year in the quarter under review. The top line outpaced the consensus mark by a whisker.

Cross-border volumes (a key measure that tracks spending on cards beyond the issuing country) improved 21% on a local-currency basis. Value-added services and solutions net revenues rose 17% year over year to $2,323 million. MA’s clients issued 3.3 billion Mastercard and Maestro-branded cards as of Sep 30, 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

The Western Union Company (WU) : Free Stock Analysis Report

Fiserv, Inc. (FI) : Free Stock Analysis Report