Western Union (WU) Q4 Earnings Miss Estimates Despite Low Costs

The Western Union Company WU reported fourth-quarter 2022 adjusted earnings per share (EPS) of 32 cents, missing the Zacks Consensus Estimate of 34 cents. The bottom line plunged 50% year over year.

Total revenues fell 15% year over year on a reported basis or 6% on a constant currency basis to $1,091.9 million. However, the top line beat the Zacks Consensus Estimate of $1,074 million.

The weak quarterly earnings were due to a negative currency impact, discontinuation of operations across Russia and Belarus and higher adjusted effective tax rate. Weaker performance in the Consumer-to-Consumer (C2C) segment also affected results. Nevertheless, the downside was partly offset by a lower expense level and double-digit growth in U.S. outbound new digital customer acquisition (30%).

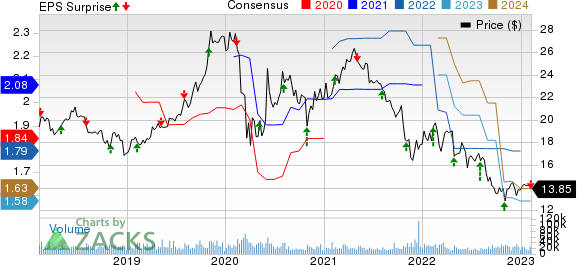

The Western Union Company Price, Consensus and EPS Surprise

The Western Union Company price-consensus-eps-surprise-chart | The Western Union Company Quote

Q4 Performance

Adjusted operating margin of 15.8% deteriorated from 24.9% a year ago due to lower revenues and increased technology and market-linked investments. Fourth-quarter adjusted effective tax rate of 14.7% was higher than 12.1% in the year-ago period.

Western Union’s total expenses came in at $940.3 million, down 3% year over year. Lower cost of services contributed to this decline in overall expenses in the fourth quarter, partially offset by higher SG&A expenses.

C2C Segment

The C2C segment reported revenues of $985.2 million, which tumbled 11% year over year on a reported basis or 9% on a constant currency basis in the quarter under review. The segment’s revenues fell short of the Zacks Consensus Estimate of $986.4 million. Operating income plunged 49% year over year to $138.6 million. The operating income margin of 14.1% fell from 24.2% a year ago.

Transactions within the C2C segment fell 12% year over year, affected by the suspension of operations in Russia and Belarus. Furthermore, lower transactions across Europe and CIS, North America, APAC and the Middle East, Africa and South Asia (MEASA).

Branded Digital revenues decreased 8% on a reported basis or 6% on a constant currency basis.

Business Solutions

The Business Solutions segment reported revenues of $29.5 million, which plunged 73% year over year but beat the Zacks Consensus Estimate by 16.8%. Operating income of $6.8 million fell 80% year over year. The operating income margin was at 23.1% in the fourth quarter, down from 30.8% a year ago.

Balance Sheet (as of Dec 31, 2022)

Western Union exited the fourth quarter with cash and cash equivalents of $1,285.9 million, increasing from the 2021-end level of $1,208.3 million. Total assets of $8,496.3 million declined from the $8,823.5 million figure in 2021 end.

Borrowings dropped from the $3,008.4 million figure at the 2021 end to $2,616.8 million.

Total stockholders' equity of $477.8 million surged from the $355.6 million level as of Dec 31, 2021.

In 2022, net cash provided by operating activities decreased from $1,045.3 million in 2021 to $581.6 million.

Capital Deployment

Western Union rewarded its shareholders with $263 million through $88 million in dividends and share buybacks worth $175 million during the fourth quarter.

The board approved a dividend of 23.5 cents per share for the first quarter of 2023.

2023 Guidance

Western Union expects adjusted revenues to decline 2-4% in 2023 from the 2022 level of $1,107.3 million. Adjusted EPS is anticipated within $1.55-$1.65 for 2023. The midpoint of the guidance indicates a decline from the 2022 reported figure of $1.76 per share.

Adjusted operating margin is expected between 19% and 21%. The metric stood at 20.4% in 2022.

Update on Business Solutions Sell-Off

Last year, Western Union inked a deal with Goldfinch Partners LLC and The Baupost Group LLC to divest its Business Solutions unit in two stages. The first closing took place on Mar 1, 2022.

However, in the third quarter, with the mutual consent of all the parties to the divestiture agreement, a decision was taken to divest Business Solutions in three stages. The second closing related to the sale of the United Kingdom operations was made in December 2022. In the third stage, the European Union operations included within the Business Solutions unit is expected to be divested in the second quarter of 2023.

Zacks Rank & Key Picks

Western Union currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Business Services space are Green Dot Corporation GDOT, Visa Inc. V and EVERTEC, Inc. EVTC, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Based in Austin, TX, Green Dot is a pro-consumer bank holding company and personal banking provider. The Zacks Consensus Estimate for GDOT’s 2022 earnings indicates an 11.3% year-over-year jump.

Headquartered in San Francisco, Visa is a global payments technology mammoth. The Zacks Consensus Estimate for V’s fiscal 2023 earnings indicates 12.1% year-over-year growth.

San Juan, Puerto Rico-based EVERTEC has a major transaction processing business. The Zacks Consensus Estimate for EVTC’s 2022 bottom line is pegged at $2.41 per share, which remained stable over the past week.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Visa Inc. (V) : Free Stock Analysis Report

The Western Union Company (WU) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Evertec, Inc. (EVTC) : Free Stock Analysis Report