WestRock Co (WRK): A Hidden Gem or a Risky Bet? An In-Depth Look at Its Valuation

WestRock Co (NYSE:WRK) has been making headlines with its daily gain of 1.85% and a remarkable 3-month gain of 22.36%. However, the company also reported a Loss Per Share of 5.54, raising questions about its valuation. Is the stock modestly undervalued or is there more than meets the eye? This article aims to provide a comprehensive valuation analysis of WestRock Co (NYSE:WRK).

An Overview of WestRock Co

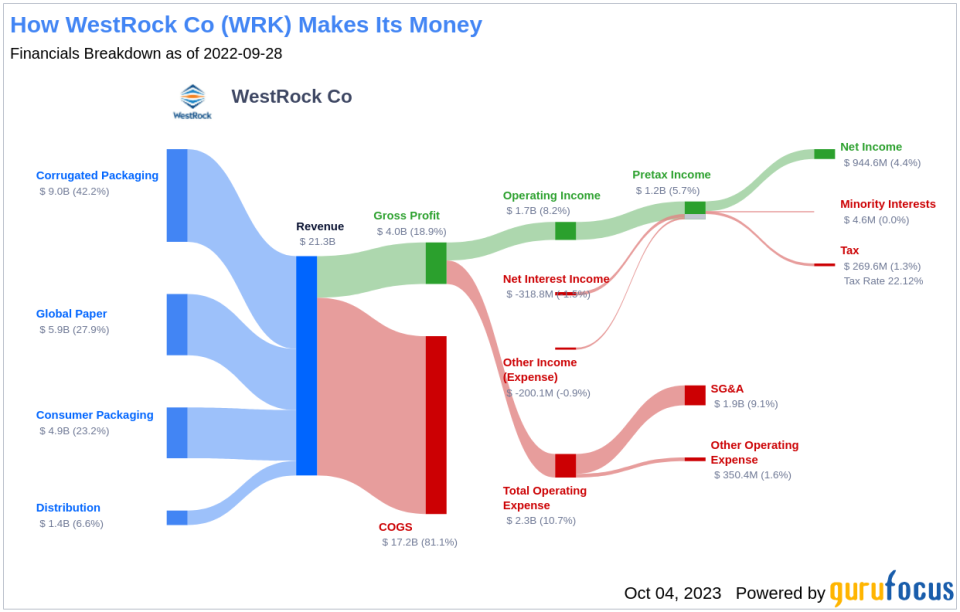

WestRock Co, a prominent manufacturer of corrugated and consumer packaging, became the largest North American producer of solid bleached sulfate following the merger of RockTenn and MeadWestvaco in 2015. The company also holds the position of the second-largest producer of containerboard, a key component in the production of shipping containers. With a current stock price of $36.24 and a market cap of $9.30 billion, the fair value of WestRock Co, as estimated by the GF Value, stands at $48.62.

Decoding the GF Value

The GF Value is a unique metric that represents the intrinsic value of a stock. It is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides an overview of the fair value that the stock should ideally be traded at.

According to our analysis, WestRock Co (NYSE:WRK) appears to be modestly undervalued. This implies that the long-term return of its stock is likely to be higher than its business growth. However, investors should tread carefully and consider other factors before making a decision.

Link: These companies may deliver higher future returns at reduced risk.

Assessing the Financial Strength of WestRock Co

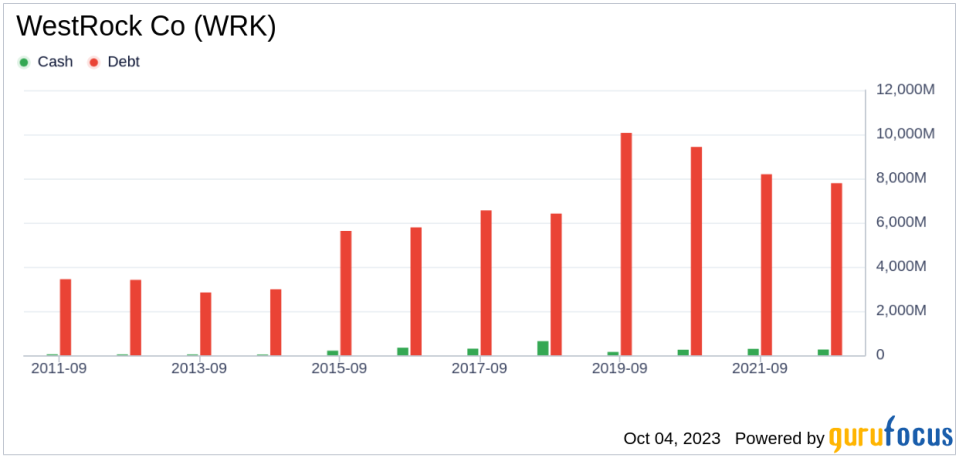

Investing in a company with poor financial strength can result in a higher risk of permanent loss. Hence, it is crucial to assess the financial strength of a company before investing in its stock. A look at WestRock Co's cash-to-debt ratio and interest coverage can provide valuable insights into its financial health.

WestRock Co has a cash-to-debt ratio of 0.04, which is lower than 88.5% of 374 companies in the Packaging & Containers industry. This indicates that the company's financial strength is relatively poor.

Profitability and Growth of WestRock Co

Investing in profitable companies, especially those with consistent profitability over the long term, is generally less risky. WestRock Co has been profitable 8 out of the past 10 years, with a revenue of $20.70 billion and a Loss Per Share of $5.54 over the past twelve months. The company's operating margin is 6.26%, ranking better than 54.21% of 380 companies in the Packaging & Containers industry. However, the company's 3-year average revenue growth rate is worse than 61.88% of 362 companies in the same industry. This indicates that the company's growth and profitability are fair but could be improved.

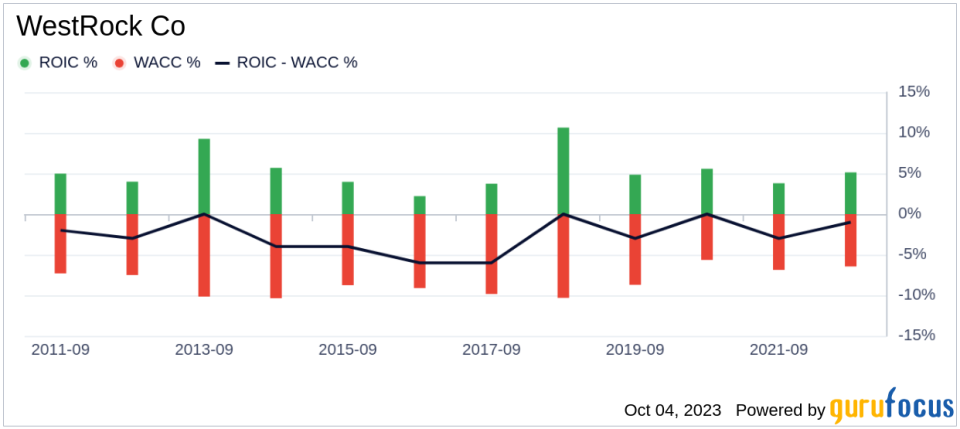

Return on Invested Capital vs. Weighted Average Cost of Capital

A comparison of a company's return on invested capital (ROIC) with its weighted average cost of capital (WACC) can offer insights into its profitability. WestRock Co's ROIC stands at 5.07, while its WACC is 7.48, indicating that the company is not creating value for shareholders.

Conclusion

In conclusion, WestRock Co (NYSE:WRK) appears to be modestly undervalued. However, the company's financial condition is poor, and its profitability and growth could be improved. Therefore, investors should conduct thorough research and consider various factors before investing in the stock. For more detailed financial information about WestRock Co, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.