WestRock Co (WRK) Reports Fiscal Q1 2024 Results Amidst Market Challenges

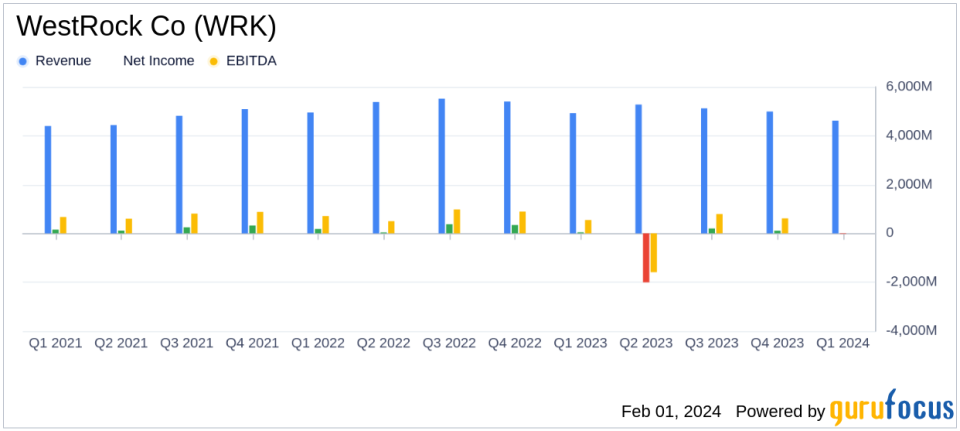

Net Sales: Decreased to $4.6 billion from $4.9 billion in the prior year quarter.

Net Loss: Reported a net loss of $22 million, including $66 million of restructuring and other costs.

Adjusted EBITDA: Consolidated Adjusted EBITDA stood at $571 million, down 12.5% year-over-year.

Cost Savings: Achieved over $200 million, with expectations to exceed the fiscal 2024 target of $300 to $400 million.

Corrugated Packaging: Segment sales increased by 3.5%, with Adjusted EBITDA margin at 13.5%.

Consumer Packaging: Adjusted EBITDA margin improved by 60 basis points to 15.7%.

Global Paper: Segment faced a decrease in sales and Adjusted EBITDA margin, reflecting lower demand and selling price/mix.

On February 1, 2024, WestRock Co (NYSE:WRK), a leader in sustainable paper and packaging solutions, released its 8-K filing, detailing the financial outcomes for the first quarter of fiscal year 2024, which ended on December 31, 2023. The company, known for its extensive range of corrugated and consumer packaging products, faced a challenging quarter with net sales falling to $4.6 billion, a decrease from the $4.9 billion reported in the same quarter of the previous year.

WestRock's net loss of $22 million for the quarter included significant restructuring and other costs, netting $66 million. Despite the net loss, the company reported an Adjusted Net Income of $51 million. The loss per diluted share (EPS) was $0.09, while the Adjusted EPS was $0.20. The company's Consolidated Adjusted EBITDA was $571 million, a 12.5% decrease from the prior year's quarter, primarily due to lower Global Paper and Consumer Packaging segment Adjusted EBITDA, as well as higher corporate non-allocated expenses.

WestRock's Corrugated Packaging segment saw a sales increase of 3.5% compared to the prior year quarter, attributed to the Mexico Acquisition and cost savings initiatives. However, the segment's Adjusted EBITDA margin decreased slightly to 13.5% from 14.1%. The Consumer Packaging segment improved its Adjusted EBITDA margin to 15.7%, up from 15.1%, despite a decrease in sales primarily due to lower volumes and the divestiture of interior partition operations.

The Global Paper segment experienced a decrease in sales and Adjusted EBITDA margin, reflecting the impact of lower selling price/mix, lower volumes, and the effect of previously divested mill operations. The Distribution segment also faced a decrease in sales and Adjusted EBITDA, mainly due to lower volumes.

CEO David B. Sewell commented on the quarter's performance, stating,

During the quarter, we grew external containerboard shipments, while we felt the impact of lower paperboard market demand. We continue to expect significantly improved demand in the second half of our fiscal year. We are continuing to deliver on, and we expect to significantly exceed, our cost savings targets. Our transformation initiatives have strengthened our portfolio, are increasing vertical integration and created significant operational efficiencies. With our broad portfolio of packaging solutions and self-help initiatives, we are well positioned to capitalize on the opportunities ahead."

WestRock's cash flow activities remained robust, with net cash provided by operating activities at $275 million. The company's total debt stood at $8.7 billion, with Adjusted Net Debt at $8.1 billion. During the quarter, WestRock invested $247 million in capital expenditures and returned $78 million to stockholders through dividend payments.

Due to the proposed business combination with Smurfit Kappa Group plc, WestRock did not host a conference call for its fiscal first quarter results and will not provide financial guidance for subsequent periods to avoid delays in the anticipated Transaction timeline.

For more detailed financial information and the full earnings report, please refer to WestRock's 8-K filing.

Investors and stakeholders can look forward to potential improvements in demand in the latter half of the fiscal year, as well as the benefits from the company's ongoing cost savings initiatives and strategic transformation efforts.

For further inquiries, please contact WestRock's Investor Relations Vice President, Robert Quartaro, or Corporate Communications Manager, Robby Johnson.

Explore the complete 8-K earnings release (here) from WestRock Co for further details.

This article first appeared on GuruFocus.