WestRock Co (WRK): Is the Stock Undervalued? A Comprehensive Analysis

WestRock Co (NYSE:WRK) saw a daily gain of 2.19%, and a significant 3-month gain of 24.94%. Despite a Loss Per Share of 5.54, the stock is considered modestly undervalued. This article aims to delve into the valuation analysis of WestRock Co, providing readers with an in-depth understanding of the company's current value and future prospects.

A Snapshot of WestRock Co

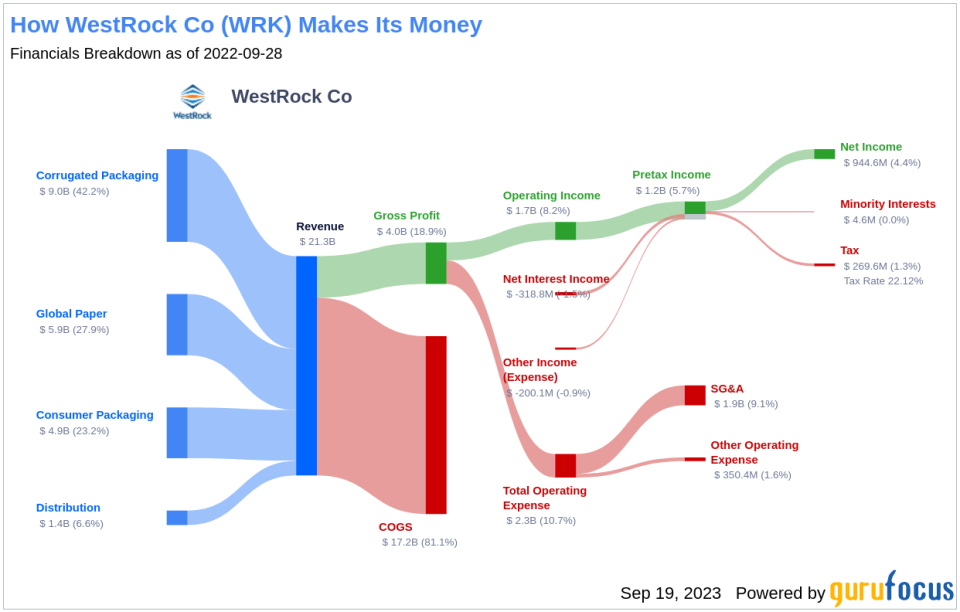

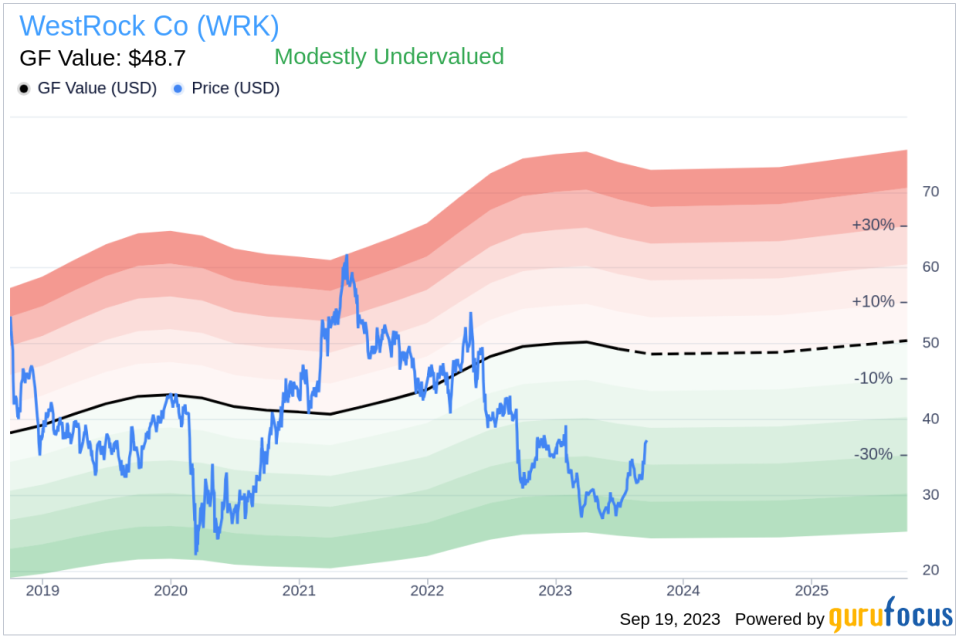

WestRock Co is a leading manufacturer of corrugated and consumer packaging, including folding cartons and paperboard. The company emerged as the largest North American producer of solid bleached sulfate and the second-largest producer of containerboard following the merger of RockTenn and MeadWestvaco in fall 2015. The current stock price stands at $37.34, while the GF Value, an estimation of fair value, is $48.7.

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line on our summary page provides an overview of the fair value at which the stock should ideally trade. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

WestRock Co (NYSE:WRK) stock is currently estimated to be modestly undervalued based on the GuruFocus Value calculation. The market cap of WestRock Co stands at $9.60 billion. Given its relatively undervalued status, the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliever higher future returns at reduced risk.

Financial Strength of WestRock Co

Investing in companies with poor financial strength carries a higher risk of permanent loss of capital. Thus, a careful review of a company's financial strength is crucial before deciding to buy its stock. WestRock Co has a cash-to-debt ratio of 0.04, worse than 88.74% of 373 companies in the Packaging & Containers industry. The overall financial strength of WestRock Co is ranked at 4 out of 10, indicating its poor financial condition.

Profitability and Growth of WestRock Co

Investing in profitable companies carries less risk. WestRock Co has been profitable 8 years over the past 10 years, with revenues of $20.70 billion and a Loss Per Share of $5.54 over the past 12 months. Its operating margin of 6.26% is better than 55.35% of 374 companies in the Packaging & Containers industry. Overall, GuruFocus ranks WestRock Co's profitability as fair.

Growth is a crucial factor in the valuation of a company. WestRock Co's 3-year average revenue growth rate is worse than 61.71% of 363 companies in the Packaging & Containers industry. Its 3-year average EBITDA growth rate is -1%, ranking worse than 64.74% of 346 companies in the same industry.

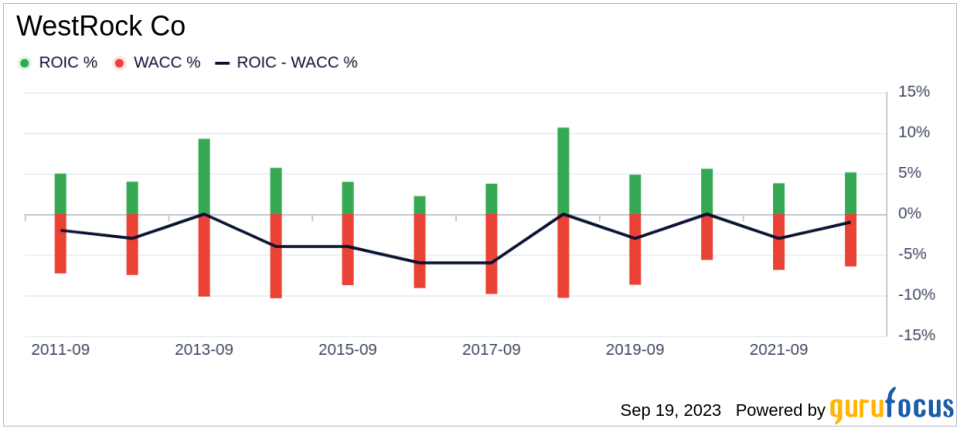

Return on invested capital (ROIC) measures how well a company generates cash flow relative to the capital it has invested in its business. The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. For the past 12 months, WestRock Co's return on invested capital is 5.07, and its cost of capital is 7.38.

Conclusion

In summary, the stock of WestRock Co (NYSE:WRK) is estimated to be modestly undervalued. The company's financial condition is poor, and its profitability is fair. Its growth ranks worse than 64.74% of 346 companies in the Packaging & Containers industry. For more information about WestRock Co stock, you can check out its 30-Year Financials here.

To find out the high quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.