Westwood Holdings Group Inc Reports Robust Q4 and Full Year 2023 Results

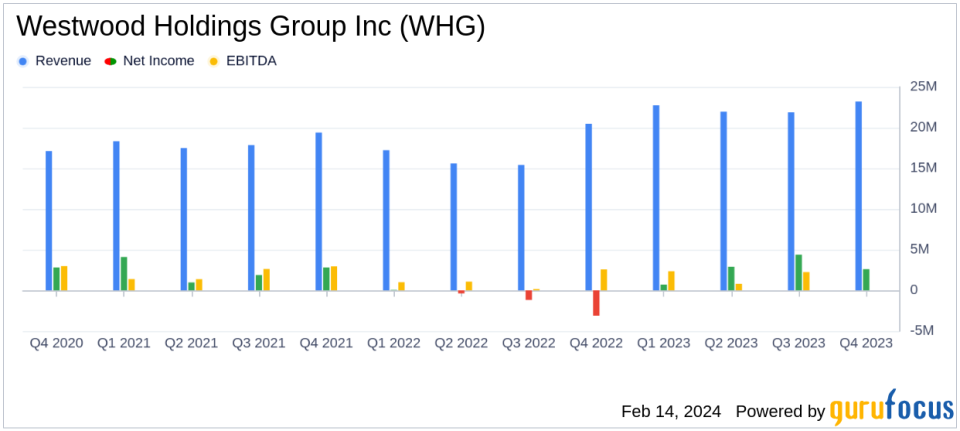

Revenue Growth: Q4 revenues increased to $23.2 million, up from $20.5 million in the same quarter last year.

Comprehensive Income: Q4 comprehensive income reached $2.6 million, a significant improvement from a net loss of $3.1 million in Q4 2022.

Non-GAAP Economic Earnings: Q4 economic earnings stood at $5.2 million compared to a loss of $0.7 million in the prior year's quarter.

Annual Performance: Full-year net income totaled $10.6 million, reversing the previous year's net loss of $4.6 million.

Dividend Declaration: A cash dividend of $0.15 per common share has been declared, payable on April 3, 2024.

Assets Under Management: Firmwide assets under management and advisement totaled $16.6 billion at year-end.

Strategic Acquisitions: The acquisitions of Salient Partners' asset management business and Broadmark Asset Management contributed to revenue growth.

On February 14, 2024, Westwood Holdings Group Inc (NYSE:WHG) released its 8-K filing, revealing a strong finish to the year with solid fourth-quarter earnings and a significant turnaround from the previous year's losses. The company, which operates through its Advisory and Trust segments and is primarily focused on the United States market, has shown resilience and strategic growth through its recent acquisitions.

Financial Highlights and Performance Metrics

WHG's fourth-quarter revenue of $23.2 million represents a year-over-year increase from $20.5 million, driven by higher average assets under management due to strategic acquisitions. The comprehensive income for the quarter was $2.6 million, a stark contrast to the net loss of $3.1 million in the same quarter of the previous year. This improvement reflects the company's strong investment performance and successful integration of new business lines.

For the full year, WHG reported a net income of $10.6 million, recovering from a net loss of $4.6 million in the previous year. This positive outcome was influenced by higher revenues, life insurance proceeds, and favorable changes in the fair value of contingent consideration, despite increased costs associated with employee compensation and IT investments following the acquisition of Salient Partners' asset management business.

Strategic Developments and Management Commentary

WHG's CEO, Brian Casey, highlighted the company's excellent investment performance, with several strategies delivering top quartile results. He also noted the promising new business pipeline and the recent addition of the Managed Investment Solutions team, which is expected to enhance WHG's offerings by combining active asset allocation with passive investment solutions.

Several of our strategies produced excellent results for our clients in the fourth quarter by delivering top quartile performance. Several SmidCap Value wins in the fourth quarter will be funded shortly and our new business pipeline is growing nicely. Advisors in the intermediary space are definitely taking more meetings and they had a very busy January. Our wealth business has made several key hires and is showing continuous progress in improving efficiency and generating better margins. We are excited for the year ahead and look forward to offering clients a new set of capabilities, combining active asset allocation with passive investment solutions, delivered by the creative and highly experienced Managed Investment Solutions team that has just joined Westwood."

Financial Position and Dividend Announcement

WHG's financial position remains robust, with $53.1 million in cash and short-term investments and no debt as of December 31, 2023. The company's stockholders' equity totaled $120.4 million. Additionally, WHG declared a cash dividend of $0.15 per common share, demonstrating its commitment to returning value to shareholders.

WHG's performance in the fourth quarter and throughout 2023 reflects the company's strategic focus and ability to navigate market challenges effectively. The company's strong financial achievements and the successful integration of recent acquisitions position it well for continued growth and success in the asset management industry.

For detailed financial tables and further information, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Westwood Holdings Group Inc for further details.

This article first appeared on GuruFocus.