WEX Stock Rises 42% in a Year: Here's What You Should Know

WEX Inc. WEX shares have had an impressive run over the past year. The stock has rallied 42.1% compared with the 26.2% rise of the industry it belongs to and the 22.8% increase of the Zacks S&P 500 composite.

Reasons for the Upside

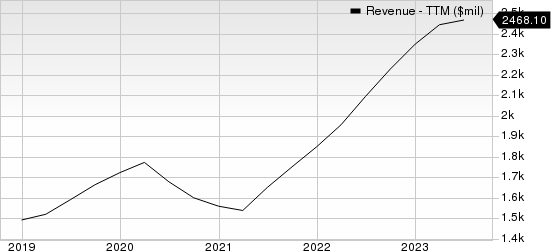

WEX’s top line continues to grow organically, driven by its extensive network of fuel and service providers, transaction volume growth, product excellence, marketing capabilities, sales force productivity and other strategic revenue generation efforts.

Robust demand for its payment processing, account servicing and transaction processing services, along with operational efficiency, has helped WEX achieve solid revenue growth. We expect the company’s revenues to increase 6.4% year over year in 2023 and 2.1% in 2024.

WEX Inc. Revenue (TTM)

WEX Inc. revenue-ttm | WEX Inc. Quote

The company’s strategic acquisitions complement its organic growth by contributing to revenues, adding differentiation to its products and service offerings and enhancing scalability. We remain optimistic about organic growth opportunities across each of its segments and expect revenue growth to be around 6.3% in 2023.

The 2021 acquisition of benefitexpress has expanded WEX’s offerings in benefits administration by bringing in a complementary suite of solutions to its Health offerings.

Favorable Estimate Revisions

The direction of estimate revisions serves as an important pointer when it comes to the price of a stock. Three estimates for 2023 have moved north over the past 60 days versus no southward revision, reflecting analysts’ confidence in the company. Over the same period, the Zacks Consensus Estimate for 2023 earnings has increased 0.2%.

Zacks Rank and Stocks to Consider

WEX currently carries a Zacks Rank #3 (Hold).

The following better-ranked stocks from the Business Services sector are worth consideration:

Verisk Analytics VRSK beat the Zacks Consensus Estimate in three of the last four quarters and matched on one instance, with an average surprise of 9.9%. The consensus mark for 2023 revenues is pegged at $2.66 billion, suggesting a decrease of 8.2% from the year-ago figure. The consensus estimate for 2023 earnings is pegged at $5.72 per share, indicating a 14% rise from the year-ago figure. VRSK currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Automatic Data ADP currently has a Zacks Rank of 2. It outpaced the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 3.1%. The consensus estimate for fiscal 2023 revenues and earnings implies growth of 6.3% and 11.1%, respectively.

Broadridge BR currently carries a Zacks Rank of 2. It surpassed the Zacks Consensus Estimate in two of the trailing four quarters, missed once and matched on one instance, the average surprise being 0.5%. The consensus estimate for fiscal 2024 revenues and earnings suggests growth of 7.2% and 8.8%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

WEX Inc. (WEX) : Free Stock Analysis Report