Weyco Group Inc (WEYS) Navigates Market Challenges with Record Annual Earnings in 2023

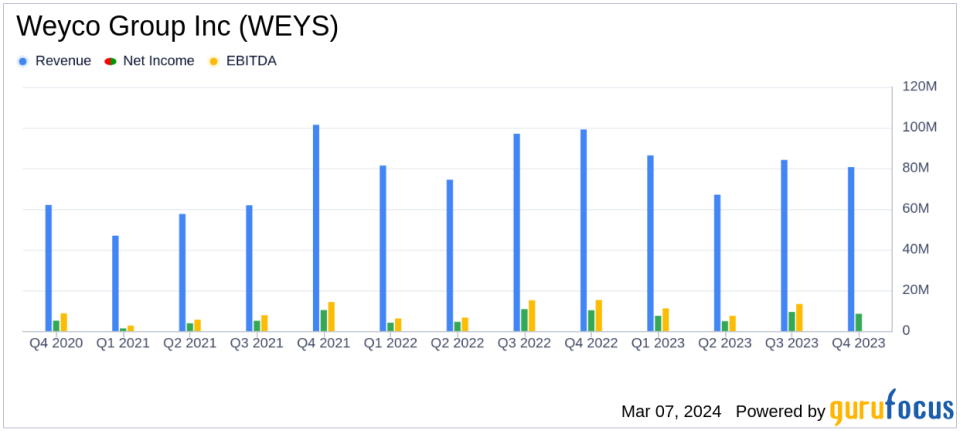

Consolidated Net Sales: Decreased by 10% year-over-year to $318.0 million in 2023.

Gross Earnings: Improved to 44.9% of net sales in 2023 from 41.1% in 2022.

Operating Earnings: Reached a record $41.0 million in 2023, a 2% increase over the previous year.

Net Earnings: Set a new record at $30.2 million, or $3.17 per diluted share, up 2% from 2022.

Dividend: A cash dividend of $0.25 per share declared, payable on March 29, 2024.

On March 5, 2024, Weyco Group Inc (NASDAQ:WEYS) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year of 2023. The company, known for its design, manufacture, and distribution of quality footwear under various brand names, faced a challenging market environment yet managed to report record earnings for the year.

Year 2023 in Review

For the full year, Weyco Group's consolidated net sales saw a 10% decrease compared to the previous year, totaling $318.0 million. This decline was attributed to a 31% drop in BOGS brand sales due to market saturation and a general reduction in orders. Despite the sales downturn, the company achieved record operating earnings of $41.0 million, a 2% increase from 2022, and net earnings reached a new high of $30.2 million, or $3.17 per diluted share.

The company's North American Wholesale Segment experienced a 12% decline in sales, while the North American Retail Segment reported a 4% increase, setting a new sales record. Florsheim Australia faced a 7% decrease in net sales, primarily due to the loss of a significant wholesale customer and the wind-down of operations in the Asia Pacific region.

Fourth Quarter Highlights

The fourth quarter of 2023 saw consolidated net sales of $80.6 million, a 19% decrease from the same period in the previous year. However, consolidated gross earnings improved to 50.3% of net sales, up from 46.6%. Quarterly earnings from operations and net earnings fell by 24% and 17%, respectively, with net earnings totaling $8.5 million, or $0.90 per diluted share.

In the North American Wholesale Segment, net sales decreased by 21%, with the BOGS brand experiencing the most significant decline. The Retail Segment's net sales were down by 3%, but retail operating earnings reached a record $3.5 million, a 6% increase over the previous year.

Management's Perspective

Thomas W. Florsheim, Jr., Chairman and CEO of Weyco Group, commented on the results:

"We generated record annual earnings in 2023 as a result of stronger gross margins and efforts to contain costs. We are particularly pleased with these results despite the lower sales volumes. Looking ahead, we expect to face headwinds in the first half of 2024, but continue to focus on building our backlogs and are optimistic that demand will improve in the back half of the year."

Financial Health and Future Outlook

Weyco Group's balance sheet reflects a strong financial position, with cash and cash equivalents of $69.3 million at the end of 2023, a significant increase from $16.9 million the previous year. The company's efforts to optimize inventory levels and control costs have contributed to its robust financial health.

While the company anticipates challenges in the first half of 2024, the focus on building backlogs and a positive outlook for the latter half of the year suggest a strategic approach to navigating the current market dynamics. The declared dividend also underscores the company's commitment to delivering shareholder value.

For a more detailed discussion of Weyco Group's fourth quarter and full year 2023 financial results, interested parties can join the conference call scheduled for March 6, 2024.

Weyco Group's performance in a challenging market environment demonstrates resilience and strategic cost management, positioning the company to potentially capitalize on future market improvements. For value investors, Weyco Group's ability to maintain profitability and declare dividends in spite of sales headwinds may present an attractive opportunity.

Explore the complete 8-K earnings release (here) from Weyco Group Inc for further details.

This article first appeared on GuruFocus.