Weyerhaeuser (WY) Partners With Lapis for Carbon Sequestration

Weyerhaeuser Company WY entered into an exclusive two-year agreement with Lapis Energy LP for subsurface carbon dioxide sequestration in Arkansas, Louisiana and Mississippi.

Per the agreement, Lapis will determine the carbon sequestration potential of five potential sites covering 187,500 acres of subsurface rights owned by Weyerhaeuser. Post the technical and commercial reckonings, Lapis will engage in moving the sites into full-scale development agreements. This will be followed by the completion of the required work to acquire permits and build and operate permanent carbon dioxide sequestration sites serving large-scale industrial sources.

Among the five potential sequestration sites, two were priorly identified by Weyerhaeuser as prospective opportunities for carbon capture and sequestration (CCS) development.

This exclusive carbon sequestration exploration agreement will provide a distinctive opportunity for WY to scale its CCS offerings and build its climate solutions portfolio more broadly.

Carbon Capture & Sequestration Business Bodes Well

Weyerhaeuser is benefiting from its engagement with high-quality developers for renewable energy and carbon capture, and storage opportunities across its acreage for the Natural Climate Solutions (NCS) business. The global efforts to minimize climate change and reduce greenhouse gas emissions to net zero by 2040 have proven beneficial for WY. It is because these sustainable initiatives require governments and companies around the globe to take major steps to modify operations, invest in low-carbon activities and purchase offsets to reduce environmental impacts.

Under the CCS business, the company expects solid progress on the projects announced with Oxy Low Carbon Ventures and Exxon, both expected to be online in late 2025/2026. The company aims to grow the NCS business to $100 million in EBITDA by 2025 end.

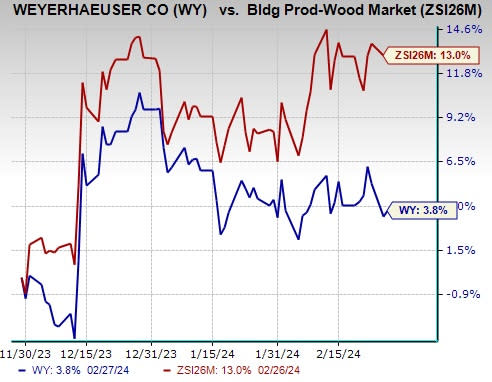

Image Source: Zacks Investment Research

Shares of this United States-based forest product company have increased 3.8% in the past three months compared with the Zacks Building Products - Wood industry’s 13% growth. Although shares of the company have underperformed its industry, improving the new-home market, high demand for carbon/ESG-related projects and a focus on operational excellence are likely to benefit it in gaining traction in the upcoming period.

Zacks Rank & Key Picks

Weyerhaeuser currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Construction sector.

NVR, Inc. NVR currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NVR delivered a trailing four-quarter earnings surprise of 8.1%, on average. The stock has gained 23.5% in the past three months. The Zacks Consensus Estimate for NVR’s 2024 sales and earnings per share (EPS) indicates growth of 7.7% and 4.6%, respectively, from the prior-year levels.

Summit Materials, Inc. SUM currently sports a Zacks Rank of 1. SUM delivered a trailing four-quarter earnings surprise of 18.2%, on average. The stock has gained 22% in the past three months.

The Zacks Consensus Estimate for SUM’s 2024 sales and EPS indicates growth of 78.9% and 34.2%, respectively, from a year ago.

Century Communities, Inc. CCS presently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 49.2%, on average. Shares of CCS have increased 15.9% in the past three months.

The Zacks Consensus Estimate for CCS’ 2024 sales and EPS indicates a rise of 11.1% and 24.4%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Weyerhaeuser Company (WY) : Free Stock Analysis Report

Century Communities, Inc. (CCS) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

Summit Materials, Inc. (SUM) : Free Stock Analysis Report