What to expect from commercial real estate in 2021

If offices, hotels and other commercial properties survive, their luck should change by the end of next year, according to industry experts.

Hotels, offices and retail storefronts are expected to trail a broader economic recovery next year; so investors are pinning their hopes on a COVID-19 vaccine in 2021. More commercial properties will go belly-up during the first half of 2021 before commercial real estate begins to stabilize in the second half of the year, experts say. Meanwhile, warehouses and distribution centers, the one bright spot in the industry, is expected to become even more valuable.

“As monumental as 2020 has been, 2021 could be even more influential, as the critical decisions and investment leaders make now could bear fruit over the next 12 months,” said Kathy Feucht, global real estate leader at Deloitte, a London-based professional services network.

To weather the tail end of the pandemic, commercial real estate investors plan to reduce costs by 25% on average in 2021, according to Deloitte. But cutting costs might be short-sighted — to keep up with new demand for ventilation, health-related amenities and digital proptech, operating costs could actually increase $19.40 per square foot in 2021, according to Deloitte.

Emergence of ‘dark stores’

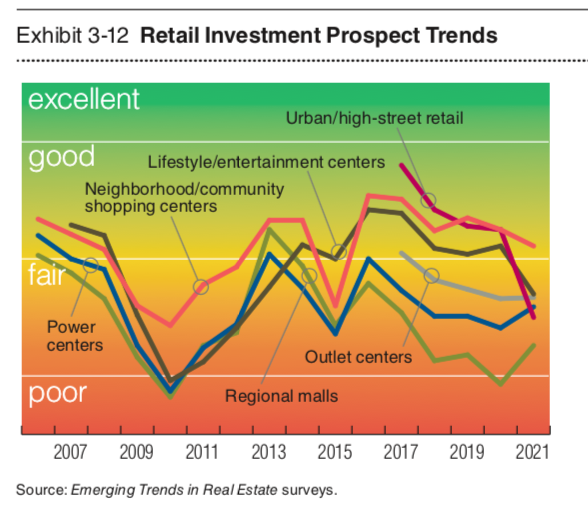

More retailers went bankrupt in 2020 than during the Great Recession — especially department stores and apparel retailers. As brick-and-mortar retailers burn through cash reserves and consumers shop online, even more retail properties will go empty and landlords will default on their loans in the first half of 2021. Experts predict there will be 20% less retail real estate by 2025, according to the CBRE Group, a Los Angeles-based commercial real estate services and investment firm.

But once the coronavirus vaccine is distributed in the U.S., shoppers are expected to leave their couches and return to experience brick-and-mortar stores.

“As we look to 2021 and beyond the pandemic, we believe people will desperately want to connect and gather and experiential retail will once again thrive,” said Terry Montesi, CEO of Texas-based Trademark Property Company.

Malls and urban retail in places like New York City and San Francisco have the worst outlook. Vacant storefronts will be replaced by health care and wellness centers, grocery stores and other alternative stores, and some retailers have pivoted to help meet demand for e-commerce.

“We are seeing a demand for 'dark stores,' where retail sales aren't fueled by pedestrian traffic, but by curbside pick-up and same-day delivery,” said Claudio Mekler, CEO of Miami Manager, a private investment firm based in South Florida that owns community shopping centers in Miami-Dade, Broward and Palm Beach Counties.

Office spaces face extra hurtle from shift to remote work

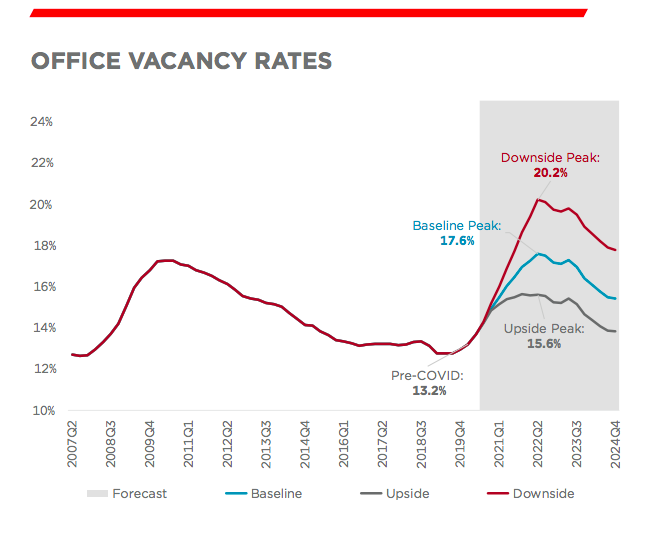

Most office spaces stood empty in 2020. Investors expect workers to slowly re-enter offices after the pandemic subsides. But companies have adjusted to work-from-home policies, and office demand could be permanently cut by 15% because of the shift to remote work, according to CBRE.

But the office market should reach bottom and begin stabilizing during 2021. By halfway through next year, 85.7% of companies plan to return to the office, according to CBRE. The expansion of the economy and the population should create a full recovery by 2025, according to Cushman & Wakefield, a Chicago-based commercial real estate services company.

“We anticipate greater pressure on office real estate, as some tenants look to tighten their footprint to respond to greater numbers of employees who are likely to work from home and/or hybrid models even after the pandemic recedes,” said Darin Buelow, global location strategy leader at Deloitte Consulting.

Office supply is only getting more plentiful, as sublease opportunities and new construction hit the market. Vacancies will hurt landlords’ ability to negotiate, driving down rent prices and creating more competition for upgrades in air quality, digital technology and flexible lease options.

“Hopefully the drop mirrors the financial crisis of 2009, when it took us 13 months to reach the bottom — meaning we all know the market direction at the moment, so the quicker we reach the bottom, the quicker we can get to recovery,” said Eric Cagner, executive managing director at Newmark Knight Frank, a U.S.-based commercial real estate services company.

Southern markets like Raleigh, Nashville, Tampa, Charlotte, Phoenix, and Dallas are expected to perform better, while tech-heavy cities like San Francisco, San Jose, Austin and Seattle will have a stronger uphill battle but may see lots of growth, according to CBRE.

“Most firms recognize there is always going to be a need for office space. Maybe it will be less dense, maybe it will be more flexible to work a couple days a week from home. There may be a hybrid situation where firms will continue to use office space and more flexibility,” said Ariel Bentata, founding and managing partner, investments at Florida-based investment company Accesso Partners LLC.

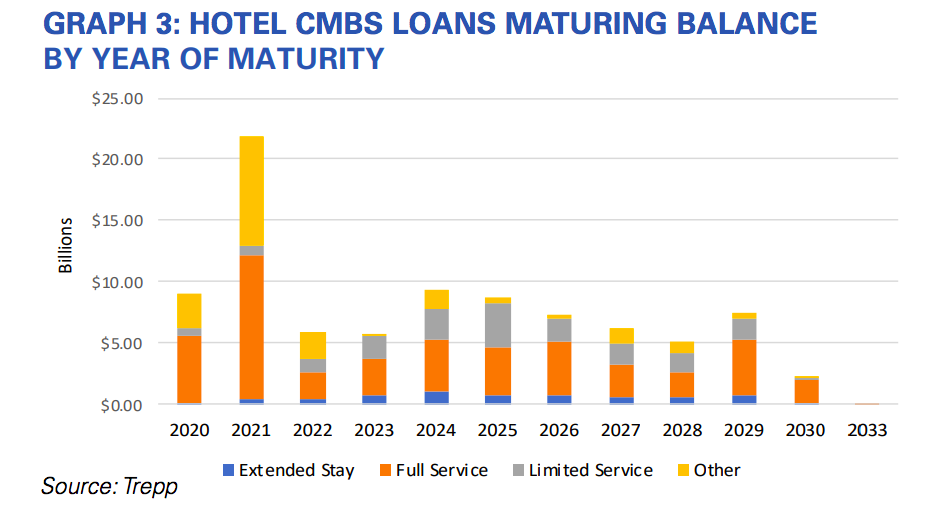

Hotels are still in trouble

Hotels are in for a tough year in 2021. While hospitality companies are expected to recover over 50% of revenue in 2021, the industry isn’t expected to recover until 2023 — and the most upscale hotels, which often cater to business and group travel, will take even longer, till 2024 or 2025, according to CBRE.

The slow recovery may not be enough to help hoteliers pay their mortgages — $30.9 billion in outstanding hospitality loans will come due in 2021, which could cause record numbers of hotels to go under — though many have been granted forbearance, according to New York-based data, analytics and tech company Trepp.

In the worst markets, big cities like San Francisco, Boston, Chicago and New York, 40%-50% of pre-COVID-19 revenue is expected in 2021. But drive-to destinations like Jacksonville, Virginia Beach, San Bernardino, Memphis and Oklahoma City could see up to 75% recovery in 2021, according to CBRE.

“We’re noticing that travelers want to be far away from dense populations, but also don’t want to travel too far to make that happen. The pandemic has increased travelers’ preferences for socially distant destinations over busy, major cities,” said Gavin Royster, Director of Development, Charlestowne Hotels.

Warehouses are the unexpected champion

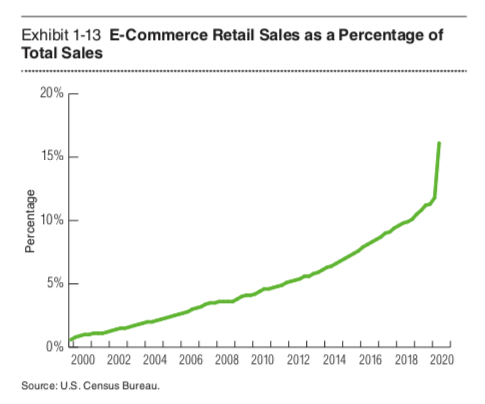

Warehouses were the unexpected champion of commercial real estate this year, and their success is expected to continue next year as logistics companies try to catch up with demand for e-commerce orders. Experts expect 250 million square feet of additional demand for warehouse space in 2021, compared to only 211 million square feet annually over the past five years, according to CBRE.

“Industrial should continue to be active as customers demand rapid delivery of more products and manufacturing activity picks up with on-shoring deployments in 2021,” said Buelow.

Eager investors will have a hard time finding deals on industrial real estate opportunities, but for investors fortunate enough to already own warehouses, high rent prices and low vacancy rates will be a lucrative opportunity — especially in the south, where U.S. population growth will drive demand in those areas, especially in Texas with a forecast of 9% population growth in the next five years.

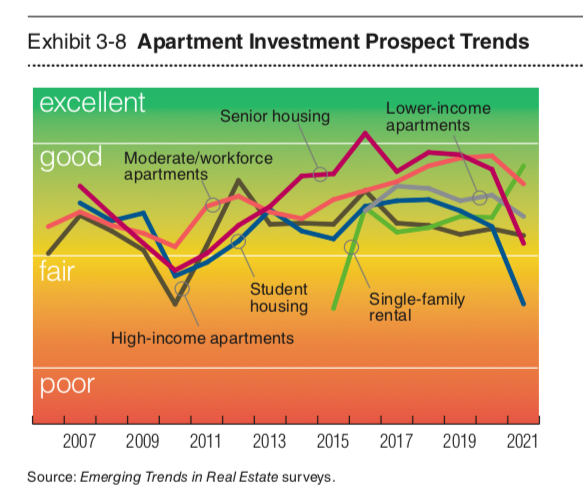

Apartment buildings will be solid performers

Though initial reports suggested that apartment owners would struggle to collect rent during the pandemic, multifamily properties like apartment buildings held up well amid the coronavirus pandemic, compared to previous recessions. And these property types are expected to continue with solid demand in 2021.

“Housing is a fundamental need, so there’s always demand, especially at more attainable price points – and take advantage of historically low interest rates,” said Jon Morgan, co-founder and managing principal of Interra.

While rent prices in urban areas like New York City dropped causing an overall stagnation in U.S. rent prices in 2020, rent prices have already stabilized in most of the U.S and are expected to rebound in 2021, according to Yardi Matrix, an Arizona-based commercial real estate data company.

Sarah Paynter is a reporter at Yahoo Finance.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

More from Sarah:

San Francisco rent hits historic lows but city still most expensive in US

Santa Claus goes virtual: Retailers seek loyalty as COVID-19 keeps shoppers away from stores

Coronavirus battered the co-working industry, now it is making a comeback