What's in the Cards for Encompass Health (EHC) in Q3 Earnings?

Encompass Health Corporation EHC is slated to report third-quarter 2023 results on Oct 26, after market close.

Q3 Estimates

The Zacks Consensus Estimate for Encompass Health’s third-quarter earnings per share is pegged at 77 cents, which indicates an improvement of 14.9% from the prior-year quarter’s reported figure.

The consensus mark for revenues is pegged at $1.2 billion, suggesting 9.7% growth from the year-ago quarter’s reported number.

Earnings Surprise History

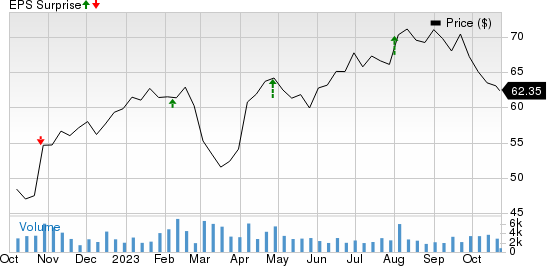

Encompass Health’s bottom line beat estimates in three of the trailing four quarters, missing once, the average surprise being 14%. This is depicted in the chart below:

Encompass Health Corporation Price and EPS Surprise

Encompass Health Corporation price-eps-surprise | Encompass Health Corporation Quote

Factors to Note

In the third quarter, the top line of Encompass Health is likely to have gained from growing volumes and year-over-year decrease in labor costs. Strong contributions from inpatient and outpatient services are expected to have provided an impetus to EHC’s quarterly performance.

Results of the Inpatient Rehabilitation unit are expected to have benefited on the back of sustained demand for its services, which, in turn, are likely to have attracted more customers and led to an increase in admissions. Growing demand for inpatient care and an improved patient conversion rate are expected to have benefited the results. The Zacks Consensus estimate and our estimate imply a growth of 12.6% and 11.9% year over year, respectively, in inpatient revenues in the third quarter of 2023.

The company’s continued efforts to add beds to its hospitals and open new de novo facilities are likely to have increased revenues in the third quarter. It aims to add two new de novos and 31 beds in the remainder of 2023. The Zacks Consensus Estimate and our estimate both suggest an increase of 4.7% year over year in the number of licensed beds for the third quarter of 2023.

Various collaborations in the third quarter are expected to have fueled the results. Moreover, as the company aims to expand its reach to Medicare Advantage customers, the patient mix is expected to have improved in the third quarter.

However, Encompass Health’s margins are expected to have taken a hit from higher operating expenses in the to-be-reported quarter. We expect total operating expenses to increase 7.7% year over year.

What Our Quantitative Model Predicts

Our proven model does not conclusively predict an earnings beat for Encompass Health this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, this is not the case here, as elaborated below.

Earnings ESP: Encompass Health has an Earnings ESP of -2.89%. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Zacks Rank: EHC currently carries a Zacks Rank of 3.

Stocks to Consider

While an earnings beat looks uncertain for Encompass Health, here are some companies from the broader Medical space that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around:

Apellis Pharmaceuticals, Inc. APLS has an Earnings ESP of +5.75% and is a Zacks #2 Ranked player. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Apellis’ earnings per share for the to-be-reported quarter indicates a 49.7% year-over-year improvement. APLS beat earnings estimates twice in the past four quarters and missed on two occasions, the average surprise being 1.4%.

AstraZeneca PLC AZN has an Earnings ESP of +5.13% and a Zacks Rank #3.

The Zacks Consensus Estimate for AstraZeneca’s bottom line for the to-be-reported quarter is pegged at 82 cents per share, which improved 3.8% in the past 30 days. AZN beat earnings estimates in all the past four quarters, the average surprise being 8.4%.

Jazz Pharmaceuticals plc JAZZ has an Earnings ESP of +1.31% and is a Zacks #2 Ranked player.

The Zacks Consensus Estimate for Jazz Pharmaceuticals’ bottom line for the to-be-reported quarter has improved 0.8% in the past 60 days. The consensus mark for JAZZ’s revenues is pegged at $970.5 million, signaling 3.2% year-over-year growth.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report