What's Driving Cathay General Bancorp's Surprising 24% Stock Rally?

Over the past week, Cathay General Bancorp's (NASDAQ:CATY) stock has seen a significant gain of 7.59%, and over the past three months, the stock has surged by an impressive 23.73%. Currently priced at $38, the stock's market cap stands at $2.76 billion. According to the GF Value, defined by GuruFocus.com, which calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, the stock is significantly undervalued with a GF Value of $54.57. This is a slight increase from the past GF Value of $53.11, indicating a potential opportunity for investors.

Understanding Cathay General Bancorp

Cathay General Bancorp is a regional bank primarily serving the Chinese-American community. With more than 45 branches and three international representative offices, the bank provides traditional loan and deposit products, as well as international trade-related services to individuals and small to midsize businesses. The Bank accepts checking, savings, and time deposits, and makes commercial, real estate, personal, home improvement, automobile, and other installment and term loans. The Bank also provides letters of credit, safe deposit, Social Security payment deposit, bank-by-mail, Internet banking services, and other customary banking services.

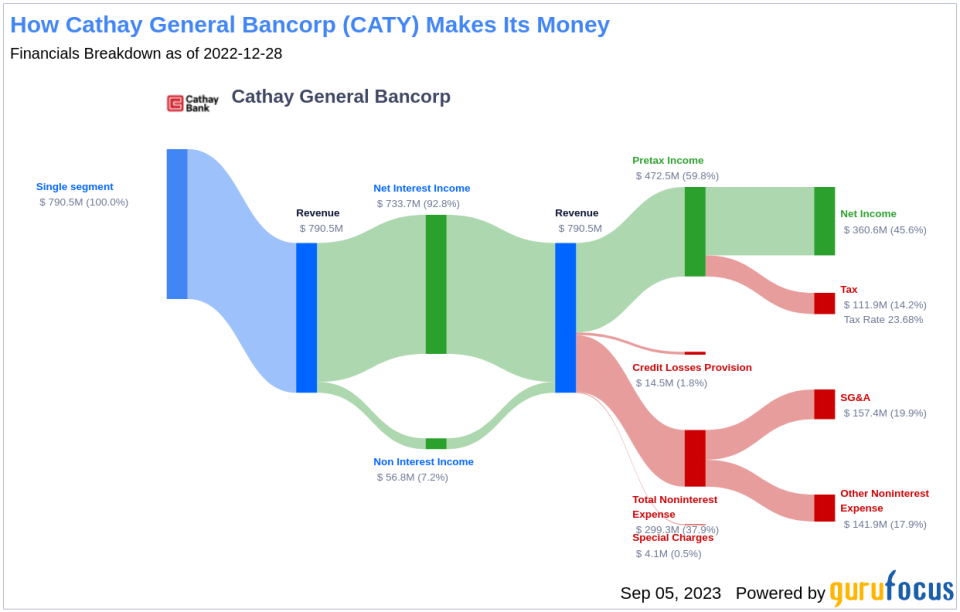

Profitability Analysis

Cathay General Bancorp's profitability is quite impressive, with a Profitability Rank of 7/10, indicating a high level of profitability. The company's ROE (Return on Equity) stands at 15.47%, which is better than 78.31% of the companies in the industry. The ROA (Return on Assets) is 1.75%, outperforming 84.3% of the companies in the Banks industry. Furthermore, the company has consistently shown profitability over the past 10 years, which is better than 99.93% of the companies in the industry.

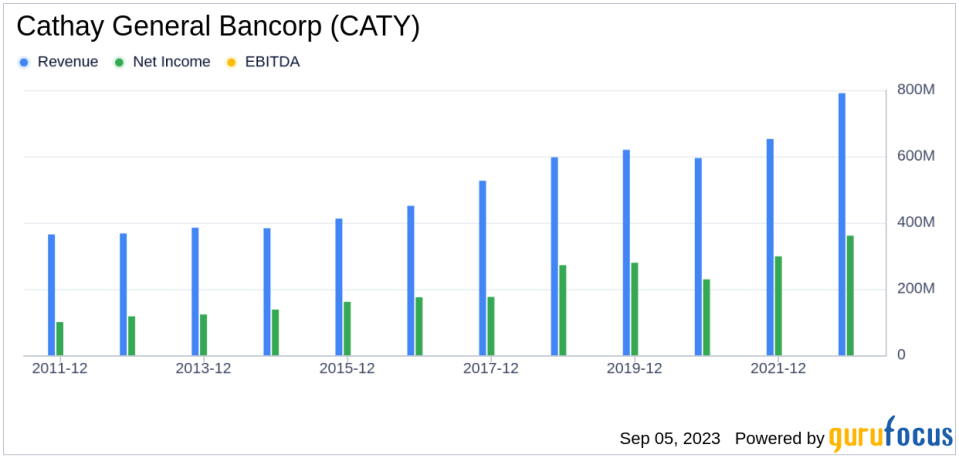

Growth Prospects

The company's growth prospects are also strong, with a Growth Rank of 9/10. This indicates strong growth in terms of revenue and profitability. The 3-Year Revenue Growth Rate per Share is 11.10%, better than 72.16% of the companies in the industry. The 5-Year Revenue Growth Rate per Share is 8.30%, outperforming 66.17% of the companies in the industry. The 3-Year EPS without NRI Growth Rate is 11.50%, better than 59.02% of the companies in the industry, and the 5-Year EPS without NRI Growth Rate is 12.80%, better than 64.65% of the companies in the industry.

Top Holders of the Stock

The top three holders of the stock are HOTCHKIS & WILEY with 328,535 shares (0.45%), Joel Greenblatt (Trades, Portfolio) with 6,884 shares (0.01%), and Ken Fisher (Trades, Portfolio) with 143 shares.

Competitive Landscape

Cathay General Bancorp faces competition from Community Bank System Inc (NYSE:CBU) with a market cap of $2.47 billion, Associated Banc-Corp (NYSE:ASB) with a market cap of $2.66 billion, and Axos Financial Inc (NYSE:AX) with a market cap of $2.64 billion.

Conclusion

In conclusion, Cathay General Bancorp's stock has shown impressive performance recently, with a significant gain over the past week and three months. The company's profitability and growth prospects are strong, and it is significantly undervalued according to the GF Value. Despite facing competition from other banks, Cathay General Bancorp's consistent profitability and strong growth make it a potential value for investors.

This article first appeared on GuruFocus.