What's Driving CF Industries Holdings Inc's Surprising 18% Stock Rally?

CF Industries Holdings Inc (NYSE:CF), a leading player in the agriculture industry, has seen a significant surge in its stock price over the past three months. The company's stock price has risen by 18.27% since July 2023, marking a notable increase in its market value. As of October 9, 2023, the company's market cap stands at $16.33 billion, with its stock price at $84.62. Over the past week, the stock has seen a gain of 1.00%. This article aims to provide an in-depth analysis of CF Industries Holdings Inc's stock performance, profitability, growth, and its position in the market.

Understanding CF Industries Holdings Inc's Valuation

According to GuruFocus.com's GF Value, which calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, CF Industries Holdings Inc is currently fairly valued. The GF Value stands at $85.13, slightly above the current stock price. However, three months ago, the stock was significantly undervalued with a GF Value of $102.08. This indicates a positive shift in the company's valuation over the past quarter.

CF Industries Holdings Inc: A Leader in the Agriculture Industry

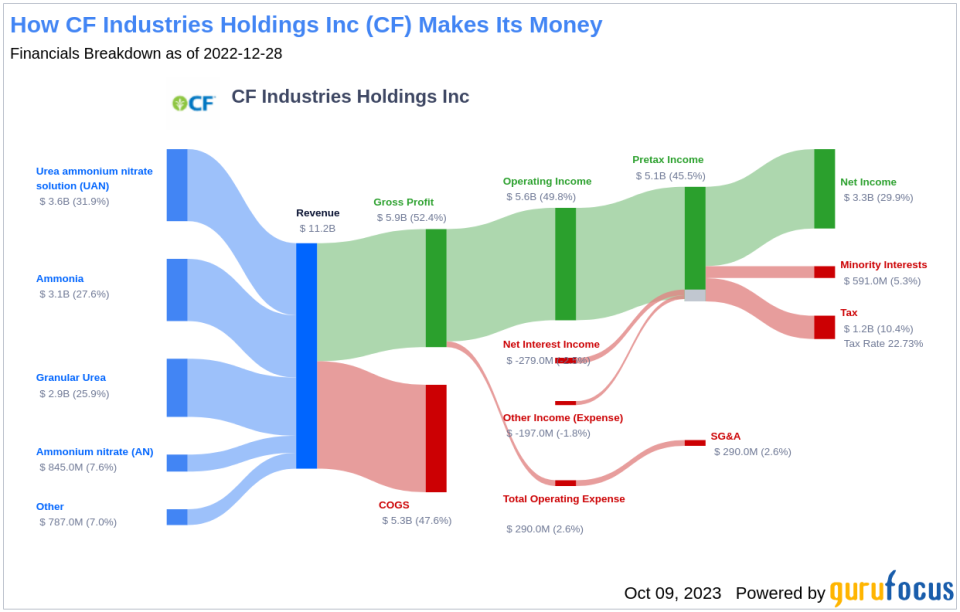

CF Industries Holdings Inc is a renowned producer and distributor of nitrogen fertilizers. The company operates seven nitrogen facilities in North America and holds joint venture interests in further production capacity in the United Kingdom and Trinidad and Tobago. CF primarily uses low-cost U.S. natural gas as its feedstock, making it one of the lowest-cost nitrogen producers globally. The company is also investing in carbon-free blue and green ammonia, which can be used as an alternative fuel to hydrogen or as a means to transport hydrogen.

Profitability Analysis of CF Industries Holdings Inc

CF Industries Holdings Inc has a Profitability Rank of 9 out of 10, indicating a high level of profitability compared to its industry peers. The company's Operating Margin stands at 41.09%, better than 95.45% of the companies in the industry. The company's ROE and ROA are 47.06% and 17.81% respectively, both of which are higher than the majority of its peers. The company's ROIC is 28.16%, better than 92.49% of the companies in the industry. Over the past 10 years, the company has been profitable for 9 years, better than 57.89% of the companies in the industry.

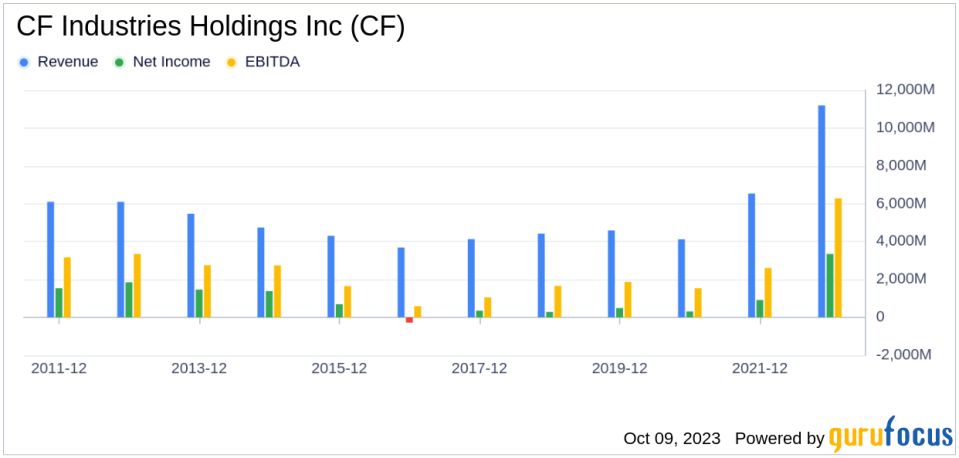

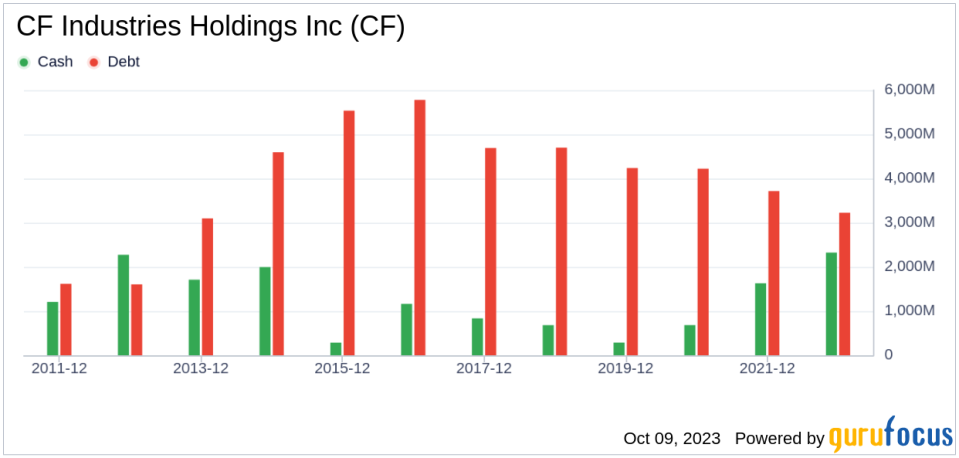

Growth Prospects of CF Industries Holdings Inc

CF Industries Holdings Inc has a Growth Rank of 9 out of 10, indicating strong growth potential. The company's 3-Year and 5-Year Revenue Growth Rates per share are 38.30% and 22.10% respectively, both of which are higher than the majority of its peers. However, the company's future total revenue growth rate estimate is -18.19%, which is better than 0% of the companies in the industry. The company's 3-Year and 5-Year EPS without NRI Growth Rates are 94.40% and 54.10% respectively, both of which are higher than the majority of its peers. However, the company's future EPS without NRI growth rate estimate is -13.68%, which is better than 20% of the companies in the industry.

Top Holders of CF Industries Holdings Inc's Stock

The top three holders of CF Industries Holdings Inc's stock are T Rowe Price Equity Income Fund (Trades, Portfolio), Jim Simons (Trades, Portfolio), and Ray Dalio (Trades, Portfolio). T Rowe Price Equity Income Fund (Trades, Portfolio) holds 3,980,000 shares, accounting for 2.04% of the company's stock. Jim Simons (Trades, Portfolio) holds 1,585,150 shares, accounting for 0.82% of the company's stock. Ray Dalio (Trades, Portfolio) holds 334,814 shares, accounting for 0.17% of the company's stock.

CF Industries Holdings Inc's Competitors

CF Industries Holdings Inc's top three competitors in the agriculture industry are The Mosaic Co(NYSE:MOS) with a market cap of $11.52 billion, FMC Corp(NYSE:FMC) with a market cap of $7.82 billion, and The Scotts Miracle Gro Co(NYSE:SMG) with a market cap of $2.64 billion.

Conclusion

In conclusion, CF Industries Holdings Inc's stock performance, profitability, and growth prospects indicate a strong position in the market. The company's high profitability and growth ranks, along with its fair valuation, make it a potential candidate for value investors. However, investors should also consider the company's future revenue and EPS growth rate estimates, which are lower than the majority of its peers. Despite the competition in the agriculture industry, CF Industries Holdings Inc's strong market position and strategic investments in alternative fuels suggest promising future performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.