What's Driving Comstock Resources Inc's Surprising 39% Stock Rally?

Comstock Resources Inc (NYSE:CRK), an independent energy company operating in the Haynesville shale, has seen a significant surge in its stock price over the past three months. The company's stock price has gained 39.41% over the past quarter, outperforming many of its peers in the Oil & Gas industry. This article will delve into the factors behind this impressive performance and provide an in-depth analysis of the company's financial health and growth prospects.

Stock Performance of Comstock Resources Inc

Comstock Resources Inc, with a current market cap of $3.54 billion, has seen its stock price rise from $9.11 to $12.7 over the past three months, representing a gain of 39.41%. Over the past week alone, the stock has gained 12.45%. According to the GF Value, a measure defined by GuruFocus.com that calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, the stock is currently fairly valued with a GF Value of $11.97. However, three months ago, the stock was significantly undervalued with a GF Value of $15.41.

Introduction to Comstock Resources Inc

Comstock Resources Inc is a key player in the Oil & Gas industry, with a strategic focus on the acquisition, development, production, and exploration of oil and natural gas. The company's operations are concentrated in the Haynesville shale, a natural gas basin located in East Texas and North Louisiana. This geographical focus provides Comstock with superior economics and proximity to the Gulf Coast markets, offering a strategic advantage over many of its competitors.

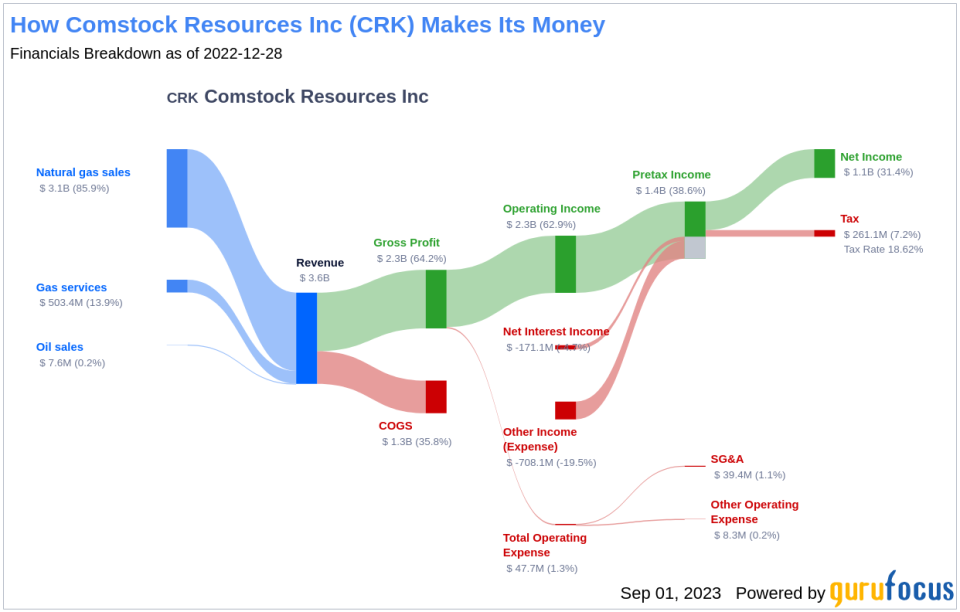

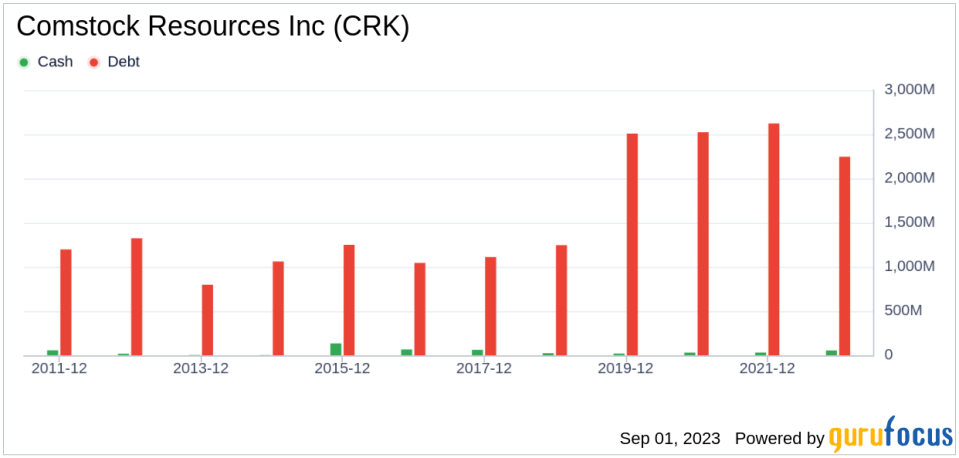

Profitability of Comstock Resources Inc

Comstock Resources Inc has a Profitability Rank of 5/10, indicating its relative profitability within its industry. The company's Operating Margin of 49.13% is better than 89.87% of companies in the industry. Additionally, its ROE of 47.27%, ROA of 17.15%, and ROIC of 22.09% are all superior to a majority of companies in the industry. Over the past decade, Comstock has been profitable for 3 years, which is better than 33.23% of companies.

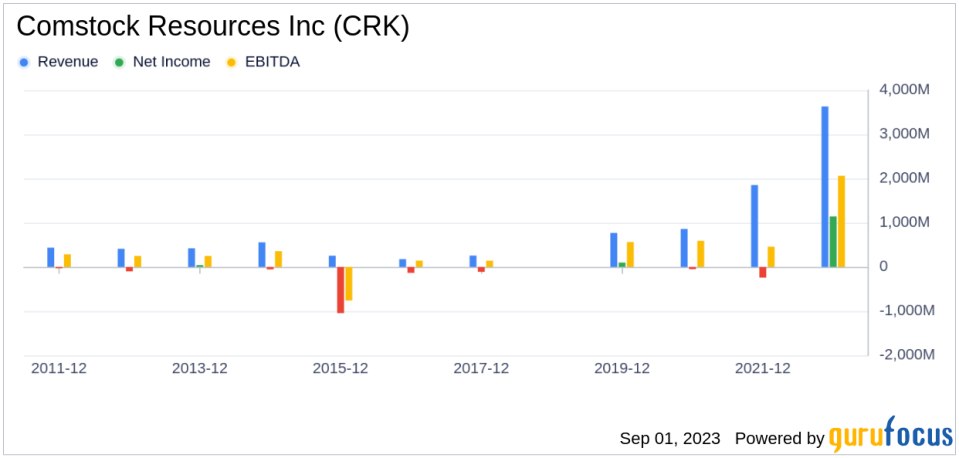

Growth of Comstock Resources Inc

Comstock Resources Inc has demonstrated robust growth over the past three years. The company's 3-Year Revenue Growth Rate per Share stands at 47.20%, which is better than 91.78% of companies in the industry. Furthermore, its 3-Year EPS without NRI Growth Rate is 99.20%, outperforming 91.16% of companies.

Holders of Comstock Resources Inc Stock

The top three holders of Comstock Resources Inc's stock are Michael Burry (Trades, Portfolio) (200,000 shares, 0.07%), Arnold Van Den Berg (Trades, Portfolio) (128,117 shares, 0.05%), and Joel Greenblatt (Trades, Portfolio) (82,573 shares, 0.03%). Their significant investments in the company reflect their confidence in its growth prospects and financial health.

Competitors of Comstock Resources Inc

Comstock Resources Inc operates in a competitive industry, with key competitors including Kosmos Energy Ltd (market cap: $3.48 billion), CNX Resources Corp (market cap: $3.65 billion), and Black Stone Minerals LP (market cap: $3.69 billion). Despite the intense competition, Comstock's strategic focus and robust financial performance have enabled it to maintain a strong position in the industry.

Conclusion

In conclusion, Comstock Resources Inc's impressive stock performance over the past three months can be attributed to its strong profitability, robust growth, and strategic advantages. The company's financial health and growth prospects make it a compelling investment opportunity in the Oil & Gas industry. However, investors should continue to monitor the company's performance and the competitive dynamics of the industry to make informed investment decisions.

This article first appeared on GuruFocus.