What's Driving CVB Financial Corp's Surprising 48% Stock Rally?

CVB Financial Corp (NASDAQ:CVBF), a prominent player in the banking industry, has been making waves in the stock market with its impressive performance. The company's market cap stands at $2.53 billion, with its stock price currently at $18.17. Over the past week, the stock has seen a gain of 4.61%, and over the past three months, it has surged by a remarkable 48.08%. According to the GF Value, which calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, the stock is modestly undervalued at $25.6. This is a significant improvement from three months ago when the stock was significantly undervalued at a GF Value of $25.59.

Company Overview

CVB Financial Corp is the holding company for Citizens Business Bank, which offers banking, lending, and investing services. The bank operates through approximately 58 banking centers and three trust office locations, serving various regions in California, including the Inland Empire, Los Angeles County, Orange County, San Diego County, Ventura County, Santa Barbara County, and the Central Valley area. As a key player in the Banks industry, CVB Financial Corp has demonstrated consistent growth and profitability, contributing to its strong stock performance.

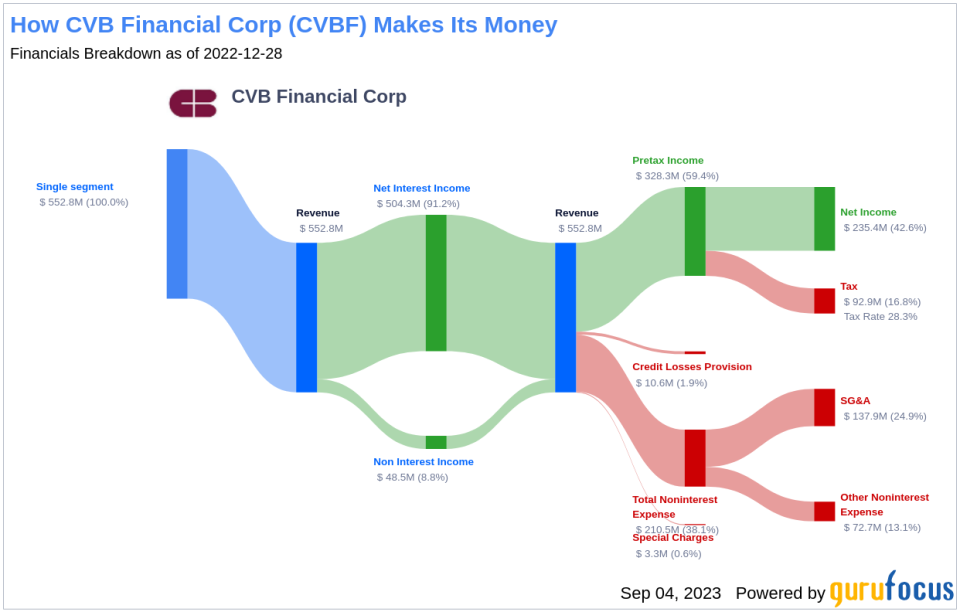

Profitability Analysis

CVB Financial Corp's profitability is impressive, with a Profitability Rank of 7/10, indicating strong profitability compared to other companies. The company's ROE stands at 12.54%, outperforming 63.26% of 1448 companies in the industry. Its ROA is 1.49%, better than 77.89% of 1452 companies. Furthermore, CVB Financial Corp has maintained consistent profitability over the past 10 years, outperforming 99.93% of 1462 companies.

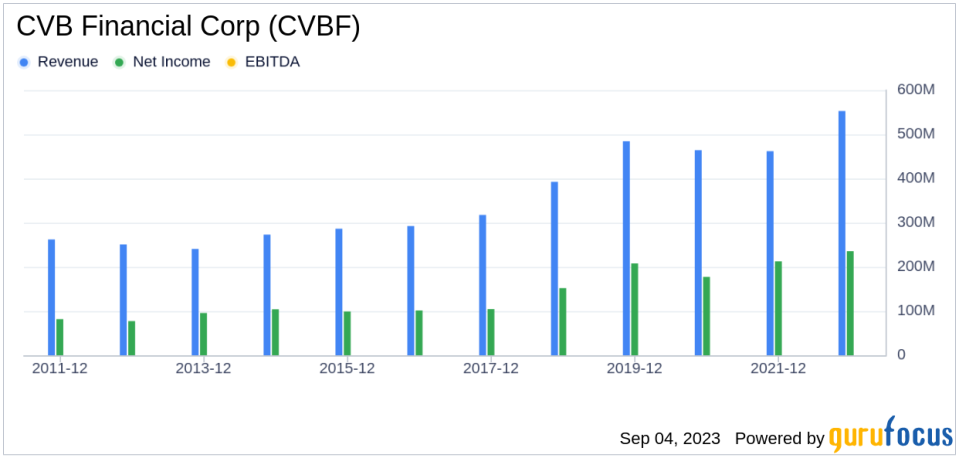

Growth Prospects

CVB Financial Corp also boasts strong growth potential, with a Growth Rank of 8/10. The company's 3-year and 5-year revenue growth rates per share stand at 4.50% and 5.00% respectively, outperforming a significant portion of companies in the industry. Additionally, the company's 3-year and 5-year EPS without NRI growth rates are 4.10% and 10.10% respectively, indicating a strong growth in earnings.

Major Stock Holders

The top two holders of CVB Financial Corp's stock are Jim Simons (Trades, Portfolio), who holds a 0.54% share, and Paul Tudor Jones (Trades, Portfolio), who holds a 0.12% share. Their investment in the company further validates its strong performance and growth potential.

Competitive Landscape

CVB Financial Corp operates in a competitive industry, with major competitors including First BanCorp (market cap: $2.57 billion), Axos Financial Inc (market cap: $2.65 billion), and First Hawaiian Inc (market cap: $2.46 billion). Despite the competition, CVB Financial Corp's strong profitability and growth potential position it favorably in the industry.

Conclusion

In conclusion, CVB Financial Corp's impressive stock performance, strong profitability, and robust growth potential make it a compelling investment. The company's consistent profitability over the past 10 years and its strong growth rates further enhance its appeal. With major stockholders like Jim Simons (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio) backing the company, and despite the competition in the banking industry, CVB Financial Corp is well-positioned for continued success.

This article first appeared on GuruFocus.