What's Driving Delek US Holdings Inc's Surprising 26% Stock Rally?

Delek US Holdings Inc (NYSE:DK), a prominent player in the Oil & Gas industry, has seen a significant surge in its stock price over the past three months. With a current market cap of $1.74 billion and a price of $26.9, the stock has experienced a 25.89% increase in the past quarter, despite a slight dip of 0.30% over the past week. According to the GF Value, which calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, the stock is currently modestly undervalued at $34.89, indicating potential for further growth. This is a significant improvement from three months ago when the stock was significantly undervalued at $39.14.

Company Overview: Delek US Holdings Inc

Delek US Holdings Inc is an integrated energy business with a focus on petroleum refining, transportation, and storage. The company also engages in the wholesale of crude oil, intermediate, and refined products, and operates a collection of retail fuel and convenience stores in the Southeast region of the United States. The company's refineries produce a variety of petroleum products for transportation and industrial markets in the United States. Its logistics segment generates revenue through gathering, transporting, and storing crude oil and intermediate products, as well as by marketing, storing, and distributing refined products.

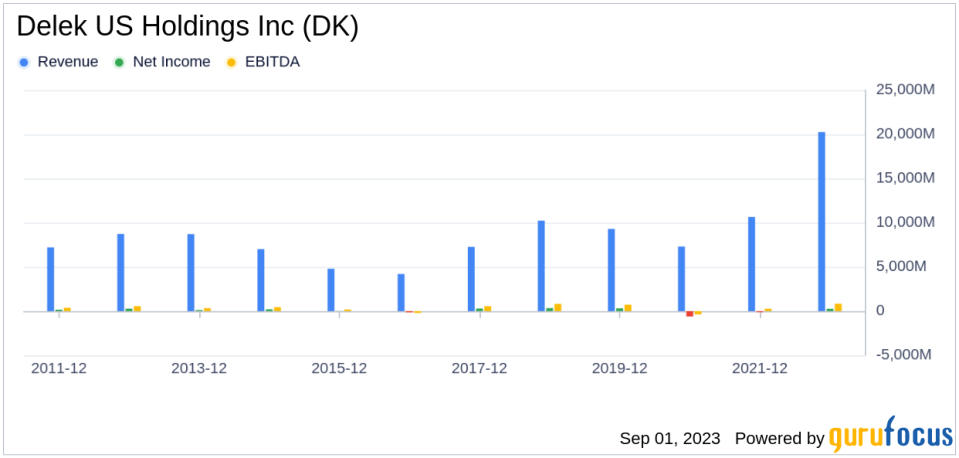

Profitability Analysis

Delek US Holdings Inc has a Profitability Rank of 7/10, indicating a relatively high level of profitability. The company's Operating Margin stands at 0.62%, which is better than 26.68% of 967 companies in the same industry. However, the company's ROE is -5.26%, and its ROA is -0.67%, both of which are lower than the industry average. Despite these figures, the company's ROIC of 0.93% is better than 38.33% of 1075 companies in the same industry. Over the past 10 years, the company has demonstrated profitability for 7 years, which is better than 68.99% of 948 companies.

Growth Prospects

Delek US Holdings Inc has a Growth Rank of 6/10, indicating moderate growth. The company's 3-year and 5-year revenue growth rates per share stand at 32.60% and 17.30% respectively, which are better than 85.09% and 80.57% of companies in the same industry. However, the company's future 3 to 5-year total revenue growth rate estimate is -11.90%, which is better than only 7.6% of 263 companies. The company's 3-year EPS without NRI growth rate is -3.50%, which is better than 26.67% of 690 companies.

Major Stock Holders

The top three holders of Delek US Holdings Inc's stock are Ken Fisher (Trades, Portfolio), who holds 1.99% of shares, Paul Tudor Jones (Trades, Portfolio), who holds 0.27% of shares, and Prem Watsa (Trades, Portfolio), who holds 0.05% of shares.

Competitive Landscape

Delek US Holdings Inc faces competition from several companies in the Oil & Gas industry. Its main competitors include Delek Logistics Partners LP, with a market cap of $1.85 billion, World Kinect Corp, with a market cap of $1.34 billion, and Par Pacific Holdings Inc, with a market cap of $2.19 billion.

Conclusion

In conclusion, Delek US Holdings Inc's stock has shown impressive performance over the past three months, with a 25.89% increase. The company's profitability and growth, as well as its position in the market relative to its competitors, suggest potential for further growth. However, investors should keep an eye on the company's future revenue growth rate estimate and its EPS without NRI growth rate, which are lower than the industry average. Despite these challenges, the company's stock remains modestly undervalued according to the GF Value, indicating potential for further growth.

This article first appeared on GuruFocus.