What's Driving Earthstone Energy Inc's Surprising 38% Stock Rally?

Earthstone Energy Inc (NYSE:ESTE), an independent oil and natural gas development and production company, has seen a significant surge in its stock price over the past three months. As of October 6, 2023, the company's stock price has risen by 38.45%, despite a slight dip of 6.22% over the past week. The company's market cap stands at $2.01 billion, with a current stock price of $18.92. According to GuruFocus.com's GF Value, which calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, Earthstone Energy Inc is currently fairly valued with a GF Value of $20.86. This is a slight decrease from the GF Value of $22.33 three months ago, when the company was significantly undervalued.

Company Overview

Earthstone Energy Inc operates in the oil and gas industry, focusing on the acquisition, development, exploration, and production of onshore, crude oil and natural gas reserves. The company is also active in corporate mergers and the acquisition of oil and natural gas properties. Its reserve portfolio consists of assets in the Midland Basin of West Texas, and the Eagle Ford Trend of South Texas. All of its operations are conducted onshore in the United States.

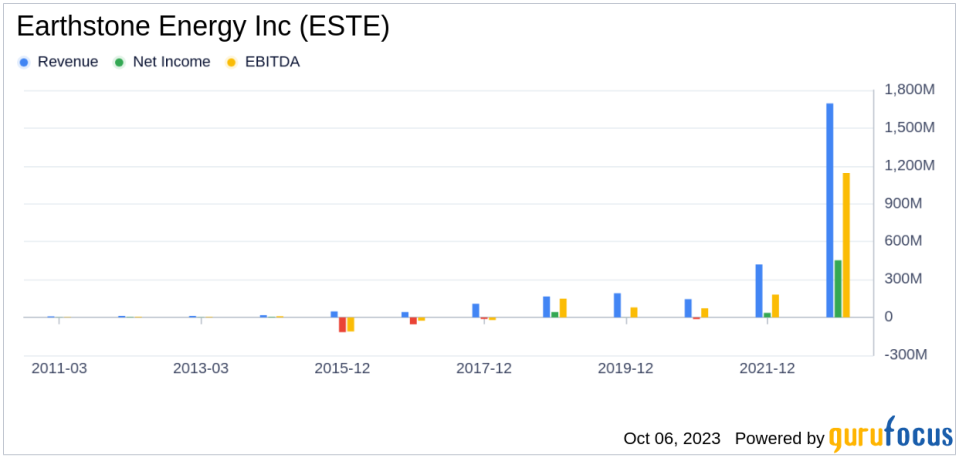

Profitability Analysis

Earthstone Energy Inc has a Profitability Rank of 7 out of 10, indicating a strong profitability performance. The company's operating margin of 45.11% is better than 87.16% of 981 companies in the same industry. Its ROE and ROA, standing at 29.03% and 11.96% respectively, are also impressive, outperforming a majority of its peers. The company's ROIC of 18.29% is better than 85.5% of 1083 companies, demonstrating its efficiency in generating cash flow relative to the capital it has invested in its business. Over the past 10 years, Earthstone Energy Inc has had 6 years of profitability, better than 59.18% of 953 companies.

Growth Prospects

Earthstone Energy Inc has a Growth Rank of 8 out of 10, indicating strong growth potential. The company's 3-year and 5-year revenue growth rate per share stand at 39.30% and 23.90% respectively, outperforming a majority of its peers. The company's total revenue growth rate for the future 3 to 5 years is estimated at 7.23%, better than 64.75% of 261 companies. Its 3-year EPS without NRI growth rate is an impressive 522.70%, better than 99.71% of 694 companies. The company's EPS growth rate for the future 3 to 5 years is estimated at 10.00%, better than 72.31% of 65 companies.

Major Stock Holders

Chuck Royce (Trades, Portfolio) is the largest holder of Earthstone Energy Inc's stock, holding 845,438 shares, which accounts for 0.8% of the company's shares. First Eagle Investment (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio) are the second and third largest holders, holding 383,029 and 352,647 shares respectively, accounting for 0.36% and 0.33% of the company's shares.

Competitive Landscape

Earthstone Energy Inc operates in a competitive industry, with Talos Energy Inc (NYSE:TALO), Gulfport Energy Corp (NYSE:GPOR), and Sitio Royalties Corp (NYSE:STR) being its main competitors. These companies have stock market caps of $1.86 billion, $2.22 billion, and $1.87 billion respectively.

Conclusion

In conclusion, Earthstone Energy Inc's impressive stock performance, strong profitability, and promising growth prospects make it a company to watch in the oil and gas industry. Despite facing stiff competition, the company's focus on oil and natural gas development and production, coupled with its strong financial performance, position it well for future success. However, investors should keep an eye on the company's stock price fluctuations and make informed decisions based on comprehensive analysis.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.