What's Driving HNI Corp's Surprising 26% Stock Rally?

HNI Corp (NYSE:HNI), a leading provider of office furniture and hearth products, has seen a significant surge in its stock price over the past three months. As of September 27, 2023, the company's stock price stands at $34.1, with a market cap of $1.59 billion. Over the past week, the stock has gained 1.73%, and over the past three months, it has seen a remarkable 25.64% gain. According to the GF Value, which calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, HNI Corp is currently modestly undervalued with a GF Value of $39.39. This is a significant improvement from three months ago when it was significantly undervalued.

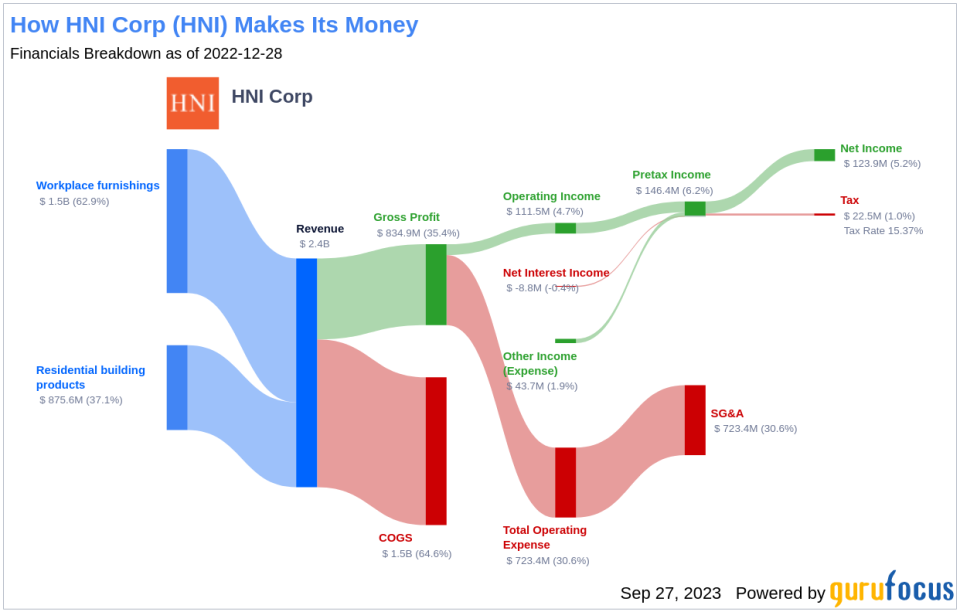

Unpacking HNI Corp's Business Model

HNI Corp operates in the industrial products industry, specializing in office furniture and hearth products. The company generates the majority of its revenue from its workplace furnishing segment, which includes panel-based and freestanding furniture systems, seating, storage, tables, and architectural products. These products are sold primarily through a national system of dealers, wholesalers, and office product distributors, as well as directly to end-user customers and federal, state, and local governments. HNI Corp also offers a range of residential building products, including gas, wood, electric, and pellet-fueled fireplaces, inserts, stoves, facings, and accessories. The company operates in multiple countries, including the United States, Canada, Mainland China, Hong Kong, India, Mexico, and Taiwan.

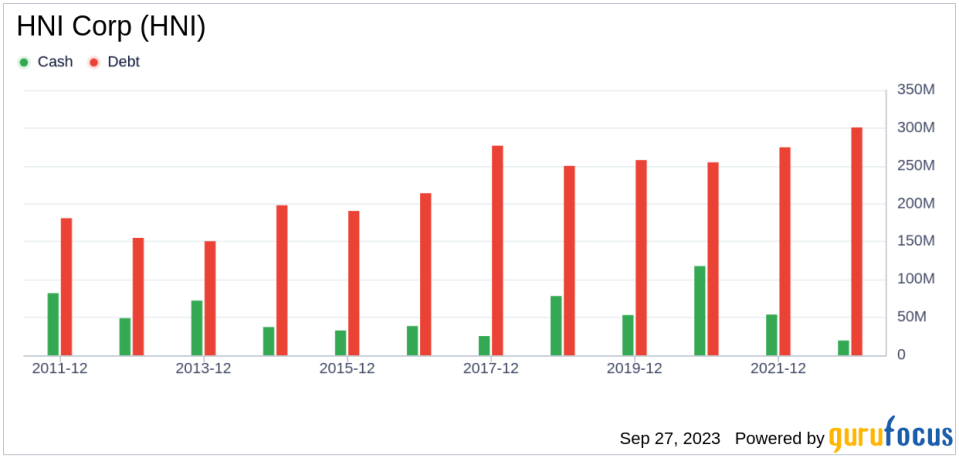

Profitability Analysis

With a Profitability Rank of 7/10, HNI Corp demonstrates a strong level of profitability, outperforming 66.3% of 2881 companies in terms of ROE and 53.88% of 2940 companies in terms of ROA. The company's operating margin stands at 3.21%, better than 31.64% of 2901 companies. Its ROE, ROA, and ROIC are 10.96%, 4.28%, and 4.31% respectively. Notably, HNI Corp has maintained consistent profitability over the past 10 years, a feat achieved by only 0.04% of 2775 companies.

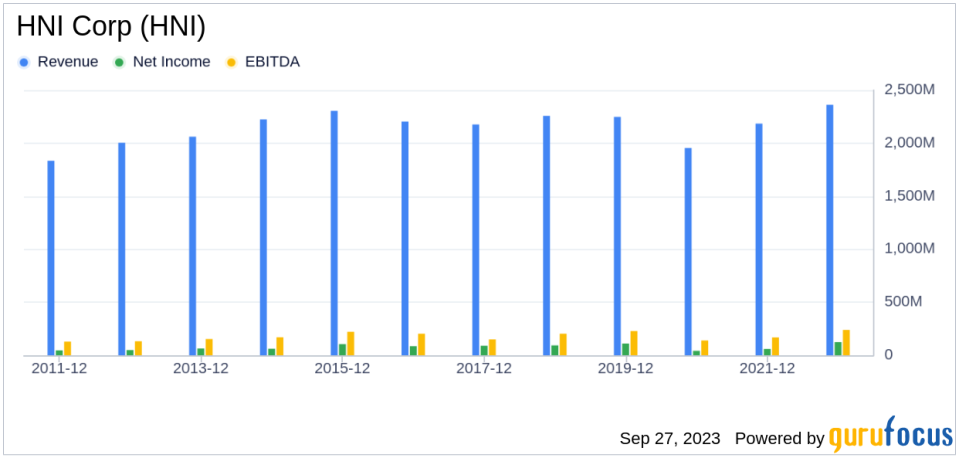

Growth Prospects

HNI Corp's Growth Rank of 6/10 indicates a moderate level of growth. The company's 3-year and 5-year revenue growth rates per share are 2.70% and 1.50% respectively, outperforming 36.17% of 2740 companies and 35.6% of 2497 companies. The future total revenue growth rate estimate stands at 5.34%, better than 40.3% of 268 companies. The 3-year and 5-year EPS without NRI growth rates are 5.00% and -1.00% respectively, outperforming 39.93% of 2259 companies and 27.75% of 1593 companies. The future EPS without NRI growth rate estimate is 8.00%, better than 17.72% of 79 companies.

Top Holders of HNI Corp Stock

The top three holders of HNI Corp stock are Jim Simons (Trades, Portfolio), holding 150,619 shares (0.32% share percentage), HOTCHKIS & WILEY, holding 52,354 shares (0.11% share percentage), and Jeremy Grantham (Trades, Portfolio), holding 32,795 shares (0.07% share percentage).

Competitive Landscape

HNI Corp operates in a competitive industrial products industry. Its main competitors include Steelcase Inc (NYSE:SCS) with a market cap of $1.25 billion, ACCO Brands Corp (NYSE:ACCO) with a market cap of $555.743 million, and Ennis Inc (NYSE:EBF) with a market cap of $558.941 million.

Conclusion

In conclusion, HNI Corp's stock has seen a significant surge over the past three months, driven by its strong profitability, moderate growth prospects, and robust business model. The company's stock is currently modestly undervalued, offering potential investment opportunities. However, investors should also consider the competitive landscape and the holdings of top investors when making investment decisions.

This article first appeared on GuruFocus.