What's Driving Hollysys Automation Technologies Ltd's Surprising 16% Stock Rally?

Hollysys Automation Technologies Ltd (NASDAQ:HOLI) has seen a significant surge in its stock price over the past three months, with a 15.62% increase. Despite a minor setback of 0.92% over the past week, the stock's overall performance remains robust. The company's GF Value, a measure of intrinsic value defined by GuruFocus.com, is currently at $19.17, indicating that the stock is fairly valued. This represents a slight increase from the past GF Value of $18.65, suggesting a steady growth trajectory for the company.

Unveiling Hollysys Automation Technologies Ltd

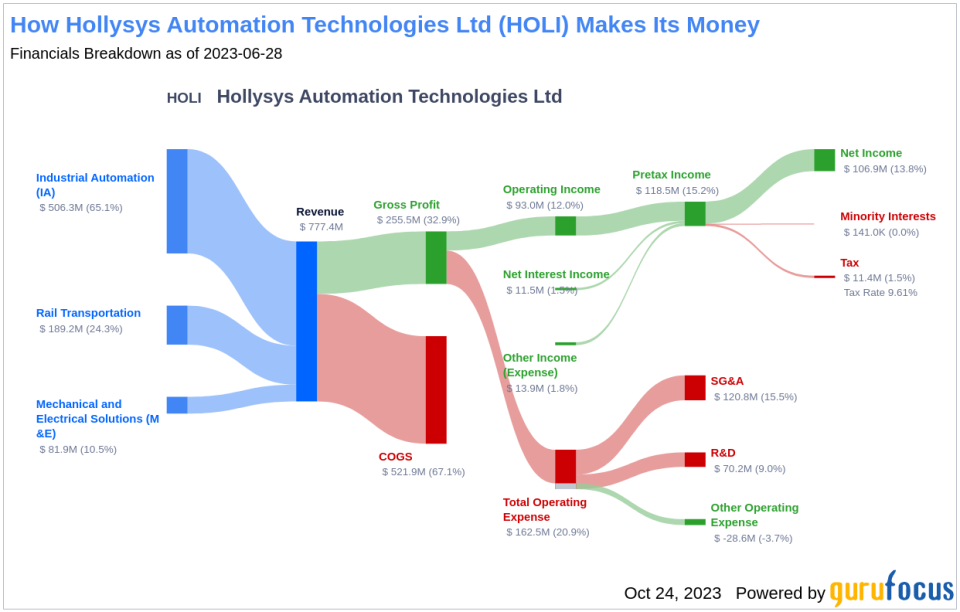

Hollysys Automation Technologies Ltd, a China-based company, operates in the Industrial Products industry, providing automation and control technologies and products. The company's business operations are divided into three segments: Industrial Automation (IA), Rail, and Mechanical & Electrical (M&E). The IA segment offers solutions including third-party hardware-centric products and proprietary software products. The Rail segment provides train control center and automation train protection to the rail and subway industries. The M&E segment, run by two Southeast Asia-based subsidiaries, offers mechanical and electrical solutions. The company primarily serves the Chinese domestic market, contributing significantly to its revenue.

Profitability Analysis of Hollysys Automation Technologies Ltd

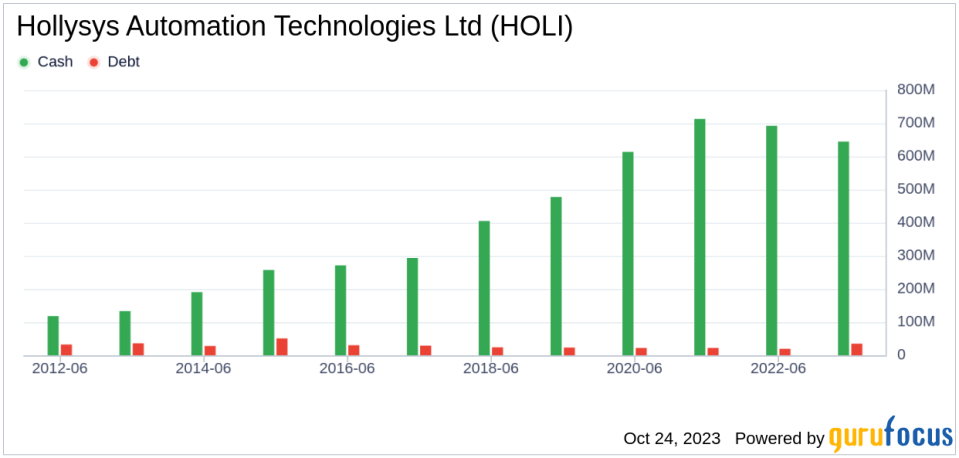

With a Profitability Rank of 8/10, Hollysys Automation Technologies Ltd demonstrates a high level of profitability. The company's Operating Margin stands at 11.97%, better than 73.85% of companies in the industry. Its ROE and ROA are 9.12% and 6.35% respectively, outperforming a majority of industry peers. The company's ROIC of 11.04% is also commendable, better than 72.49% of companies in the industry. Hollysys Automation Technologies Ltd has maintained consistent profitability over the past 10 years, a testament to its strong financial health.

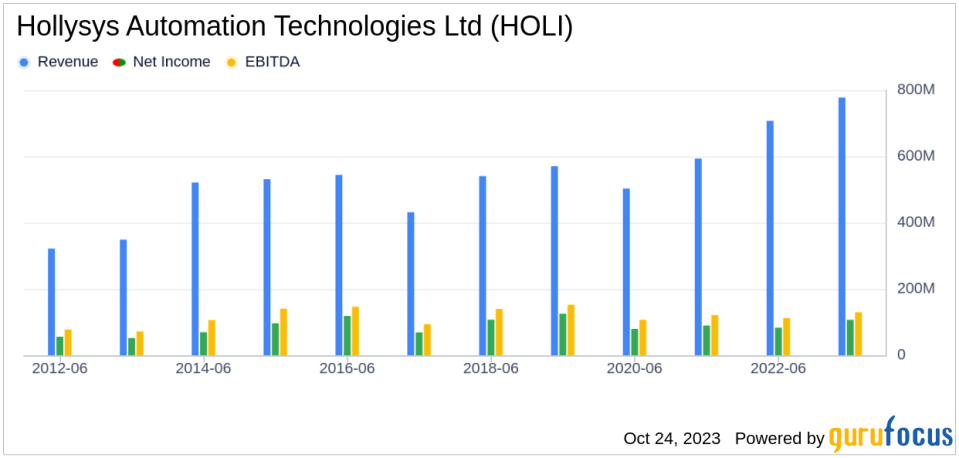

Growth Prospects of Hollysys Automation Technologies Ltd

The company's Growth Rank of 6/10 indicates moderate growth. Its 3-year and 5-year Revenue Growth Rates per Share are 14.70% and 7.50% respectively, outperforming a majority of industry peers. However, the company's 3-year and 5-year EPS without NRI Growth Rates present a mixed picture, with the former at 9.50% and the latter at -3.50%. Despite this, the company's growth prospects remain promising.

Top Holders of Hollysys Automation Technologies Ltd Stock

Chris Davis (Trades, Portfolio), Jim Simons (Trades, Portfolio), and Jeremy Grantham (Trades, Portfolio) are the top three holders of Hollysys Automation Technologies Ltd's stock. Chris Davis (Trades, Portfolio) holds the largest share with 5,428,153 shares, accounting for 8.75% of the company's stock. Jim Simons (Trades, Portfolio) and Jeremy Grantham (Trades, Portfolio) hold 896,570 and 559,392 shares respectively, representing 1.45% and 0.9% of the company's stock.

Competitors of Hollysys Automation Technologies Ltd

Hollysys Automation Technologies Ltd faces competition from GrafTech International Ltd (NYSE:EAF), Powell Industries Inc (NASDAQ:POWL), and Preformed Line Products Co (NASDAQ:PLPC). With market capitalizations of $852.602 million, $885.867 million, and $685.171 million respectively, these competitors pose a significant challenge to Hollysys Automation Technologies Ltd, which has a market cap of $1.26 billion.

Conclusion

In conclusion, Hollysys Automation Technologies Ltd has demonstrated strong performance, profitability, and growth, attracting significant interest from top stockholders. Despite facing competition from industry peers, the company's robust financial health and promising growth prospects make it a compelling choice for investors. As the company continues to navigate the dynamic market landscape, it will be interesting to see how its stock performance evolves in the future.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.