What's Driving Laureate Education Inc's Surprising 18% Stock Rally?

Laureate Education Inc (NASDAQ:LAUR), a prominent player in the education industry, has seen a significant surge in its stock price over the past three months. Despite a minor setback of 0.99% over the past week, the stock has witnessed a robust 17.61% increase over the past quarter. This article aims to delve into the factors contributing to this impressive performance and provide a comprehensive analysis of the company's financial health and growth prospects.

Stock Performance and Valuation

Currently priced at $13.99, Laureate Education Inc's stock is modestly undervalued according to the GF Value, which stands at $18.38. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. This valuation is consistent with the company's past GF Value of $17.12 three months ago, indicating a persistent undervaluation of the stock. With a market capitalization of $2.2 billion, the company's stock presents a potentially lucrative investment opportunity.

Company Overview

Laureate Education Inc operates an international network of licensed universities and higher education institutions, providing higher education programs and services to students. The company's primary geographical segments include Peru and Mexico. With a unique business model and a strong foothold in the education industry, Laureate Education Inc continues to make strides in its sector.

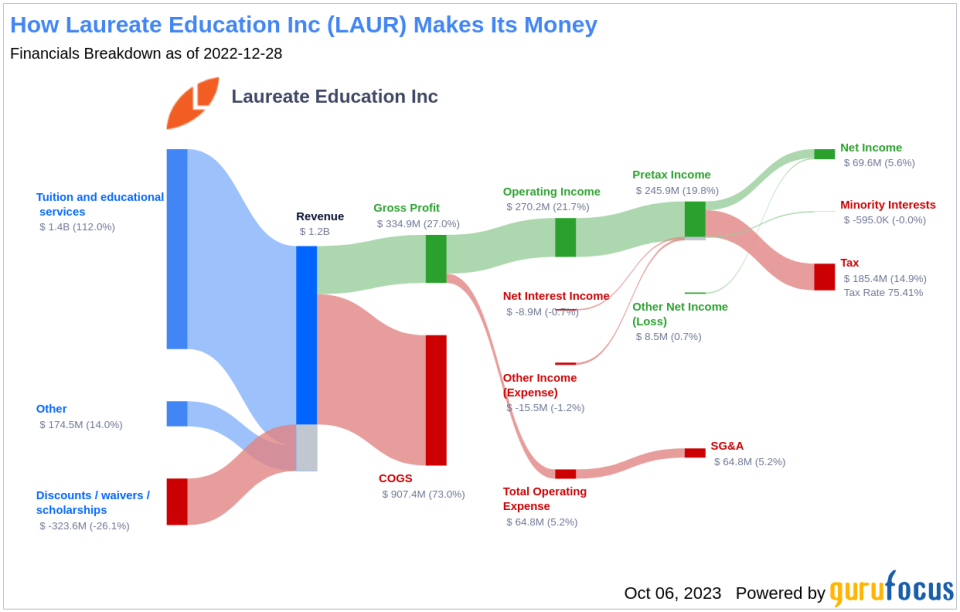

Profitability Analysis

Laureate Education Inc boasts a Profitability Rank of 5/10, indicating average profitability. The company's Operating Margin of 22.49% is better than 79.69% of companies in the same industry. Furthermore, the company's ROE (11.20%), ROA (4.79%), and ROIC (6.50%) are all above average compared to other companies in the industry. Over the past decade, the company has demonstrated profitability for six years, outperforming 52.72% of companies in the industry.

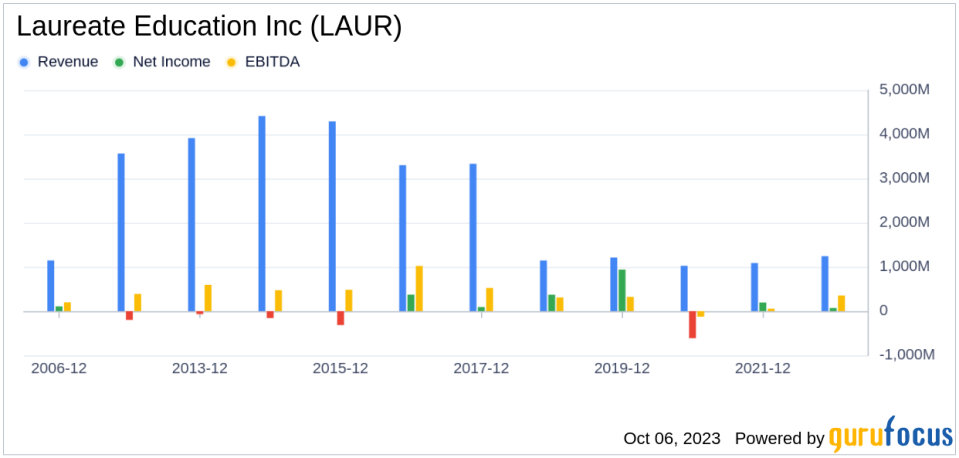

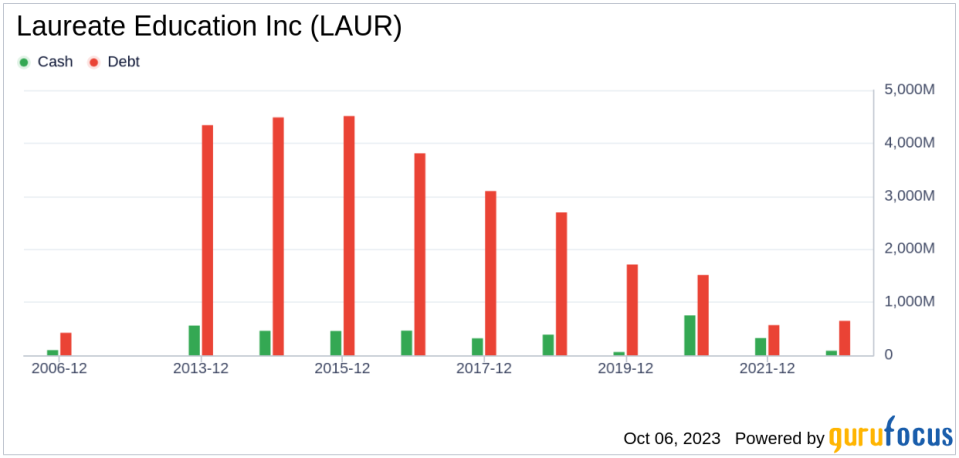

Growth Prospects

Despite a low Growth Rank of 2/10, Laureate Education Inc has shown promising signs of growth. The company's 3-year revenue growth rate per share stands at 10.60%, outperforming 63.68% of companies in the industry. However, the 5-year revenue growth rate per share is -12.70%, which is better than only 11.52% of companies in the industry.

Major Stockholders

First Pacific Advisors (Trades, Portfolio), Jim Simons (Trades, Portfolio), and Paul Tudor Jones (Trades, Portfolio) are the top three holders of Laureate Education Inc's stock. First Pacific Advisors (Trades, Portfolio) holds 561,210 shares (0.36%), Jim Simons (Trades, Portfolio) holds 206,400 shares (0.13%), and Paul Tudor Jones (Trades, Portfolio) holds 70,447 shares (0.04%).

Competitive Landscape

Laureate Education Inc faces stiff competition from Stride Inc (NYSE:LRN) with a market cap of $1.95 billion, Strategic Education Inc (NASDAQ:STRA) with a market cap of $1.9 billion, and Adtalem Global Education Inc (NYSE:ATGE) with a market cap of $1.82 billion.

Conclusion

In conclusion, Laureate Education Inc's stock has shown impressive performance over the past quarter, backed by its robust profitability and promising growth prospects. Despite facing stiff competition, the company's unique business model and strong foothold in the education industry make it a potentially lucrative investment opportunity. However, investors should conduct thorough research and consider the company's financial health and market conditions before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.