What's Driving MakeMyTrip Ltd's Surprising 49% Stock Rally?

MakeMyTrip Ltd (NASDAQ:MMYT), an online travel company operating in the Travel & Leisure industry, has seen a significant surge in its stock price over the past three months. The company's stock price has risen by 49.19%, from $41.76 to a market cap of $4.43 billion. This article will delve into the factors contributing to this impressive performance and provide an in-depth analysis of the company's profitability, growth, and competitive landscape.

Stock Performance: A Closer Look

Over the past week, MakeMyTrip's stock price has seen a modest gain of 0.67%. However, the past three months have witnessed a remarkable 49.19% surge in the company's stock price. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, the GF Value of MakeMyTrip stands at $55.8, up from $51.3 three months ago. This indicates that the stock is modestly undervalued, a significant shift from three months ago when it was considered a possible value trap.

Company Introduction: MakeMyTrip Ltd (NASDAQ:MMYT)

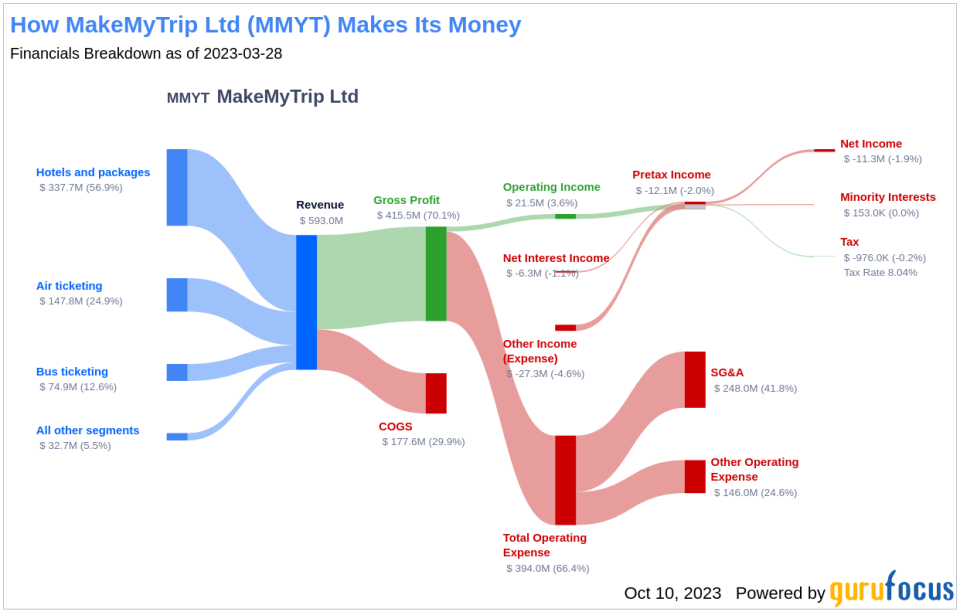

MakeMyTrip Ltd is an online travel company that provides online booking solutions for day-to-day travel needs. The company operates through various segments, including Air ticketing, Hotels and packages, Bus ticketing, and Others. The majority of its revenue is generated from the Hotels and packages segment, which includes internet-based platforms, call-centers, and branch offices that provide holiday packages and hotel reservations. The company primarily operates in India but also has a presence in the United States, South East Asia, Europe, and other countries.

Profitability Analysis

MakeMyTrip's Profitability Rank stands at 2/10, indicating that it is less profitable than many of its peers. The company's Operating Margin is 5.61%, which is better than 45.99% of companies in the same industry. In terms of return on equity (ROE), return on assets (ROA), and return on invested capital (ROIC), the company has posted figures of 1.99%, 1.28%, and 4.13% respectively.

Growth Prospects

The company's Growth Rank is 2/10, indicating lower growth than many of its peers. However, the company's 3-year and 5-year revenue growth rates per share are 3.60% and -10.20% respectively. The company's 3-year and 5-year EPS without NRI growth rates are 71.40% and 46.00% respectively, indicating a strong growth trajectory.

Top Holders of MakeMyTrip Stock

The top three holders of MakeMyTrip's stock are Baillie Gifford (Trades, Portfolio) with a 2.13% share, Sarah Ketterer (Trades, Portfolio) with a 0.21% share, and Paul Tudor Jones (Trades, Portfolio) with a 0.09% share.

Competitive Landscape

MakeMyTrip operates in a competitive industry, with major players such as TripAdvisor Inc (NASDAQ:TRIP) with a market cap of $2.18 billion, Sabre Corp (NASDAQ:SABR) with a market cap of $1.3 billion, and Travel+Leisure Co (NYSE:TNL) with a market cap of $2.55 billion.

Conclusion

In conclusion, MakeMyTrip's impressive stock performance can be attributed to its strong growth prospects and modest undervaluation. Despite facing stiff competition and having a lower profitability rank, the company has managed to maintain a positive growth trajectory. However, investors should keep a close eye on the company's profitability and growth metrics to make informed investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.