What's Driving MakeMyTrip Ltd's Surprising 44% Stock Rally?

MakeMyTrip Ltd (NASDAQ:MMYT), an online travel company operating in the Travel & Leisure industry, has seen a significant surge in its stock price over the past three months. The company's market cap currently stands at $4.34 billion, with its stock price at $40.94. Over the past week, the stock has gained 3.95%, and over the past three months, it has seen a remarkable 44.37% gain. This article aims to unpack the factors behind this meteoric rise and provide an in-depth analysis of the company's performance, profitability, growth, and competition.

Understanding the Stock's Valuation

One of the key metrics to understand the stock's performance is the GF Value. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, MakeMyTrip's GF Value stands at $55.64, up from $51.14 three months ago. This suggests that the stock is modestly undervalued, offering potential for further growth. This is a significant shift from three months ago when the stock was considered a possible value trap, warranting caution from investors.

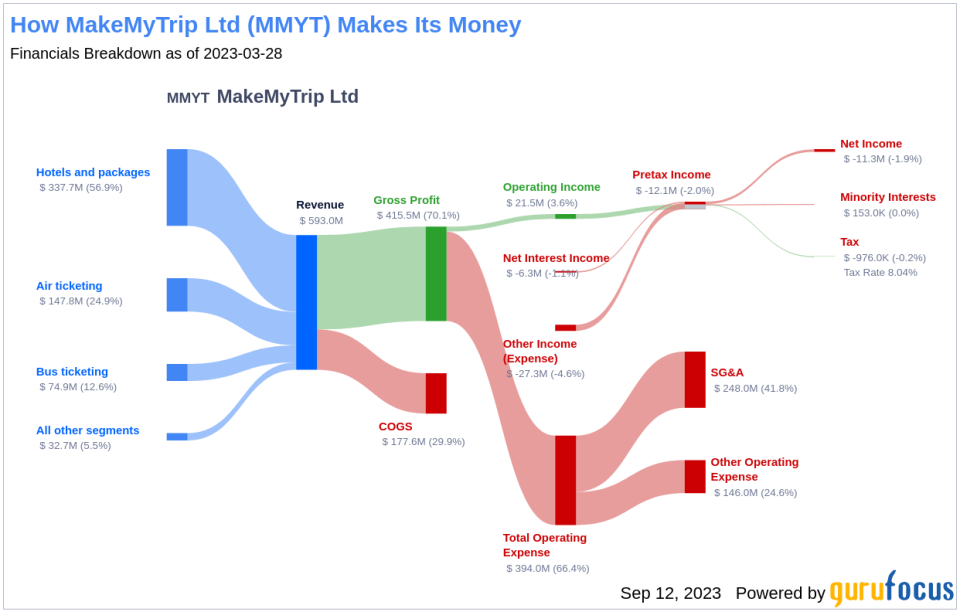

Profitability Analysis

MakeMyTrip's profitability rank is 2/10, indicating that the company's profitability is relatively low compared to other companies in the industry. However, the company's operating margin of 5.61% is better than 46.83% of the companies in the industry. Similarly, its ROE of 1.99%, ROA of 1.28%, and ROIC of 4.13% are better than 42.88%, 48.75%, and 59.93% of the companies in the industry, respectively. These figures suggest that while the company's profitability is not high, it is performing better than a significant portion of its competitors.

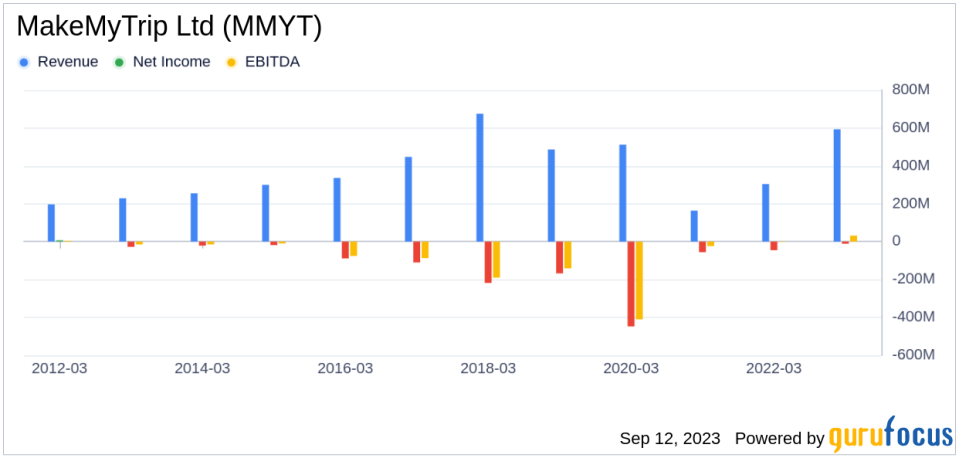

Growth Prospects

The company's growth rank is 2/10, suggesting that its growth prospects are relatively low. However, the company's 3-year revenue growth rate per share of 3.60% is better than 63.32% of the companies in the industry. Despite a negative 5-year revenue growth rate per share of -10.20%, the company's 3-year and 5-year EPS without NRI growth rates of 71.40% and 46.00% respectively, are better than 92.04% and 91.36% of the companies in the industry. This indicates that while the company's revenue growth has been negative, its earnings growth has been strong, suggesting potential for future growth.

Top Holders and Competitors

The top three holders of MakeMyTrip's stock are Baillie Gifford (Trades, Portfolio) with a 2.13% share, Sarah Ketterer (Trades, Portfolio) with a 0.21% share, and Paul Tudor Jones (Trades, Portfolio) with a 0.09% share. The company's main competitors in the Travel & Leisure industry are TripAdvisor Inc (NASDAQ:TRIP) with a market cap of $2.11 billion, Sabre Corp (NASDAQ:SABR) with a market cap of $1.55 billion, and Travel+Leisure Co (NYSE:TNL) with a market cap of $2.83 billion.

Conclusion

In conclusion, MakeMyTrip Ltd's stock has seen a significant surge over the past three months, driven by its strong earnings growth and modest undervaluation. While the company's profitability and growth ranks are relatively low, it is performing better than a significant portion of its competitors in terms of operating margin, ROE, ROA, and ROIC. The company's strong earnings growth, despite negative revenue growth, suggests potential for future growth. However, investors should be cautious given the company's low profitability and growth ranks and consider the potential risks before investing.

This article first appeared on GuruFocus.