What's Driving PGT Innovations Inc's Surprising 17% Stock Rally?

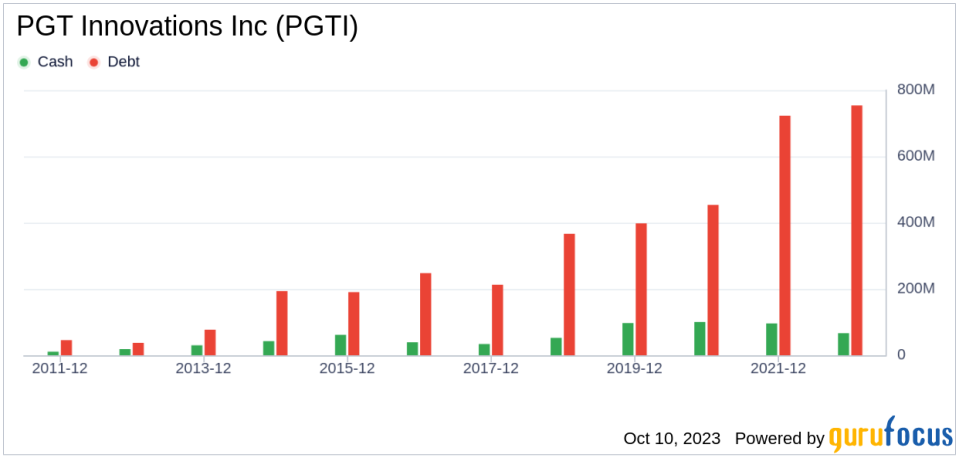

PGT Innovations Inc (NYSE:PGTI), a leading manufacturer in the construction industry, has seen a significant surge in its stock price over the past three months. The company's market cap currently stands at $1.89 billion, with its stock price at $32.36. Over the past week, the stock has seen a gain of 20.44%, and over the past three months, it has seen a gain of 17.09%. The company's GF Value, which calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, is currently at $29.3, down from its past GF Value of $30.48. Despite this, the stock's GF Valuation remains 'Fairly Valued', both currently and in the past.

Company Introduction

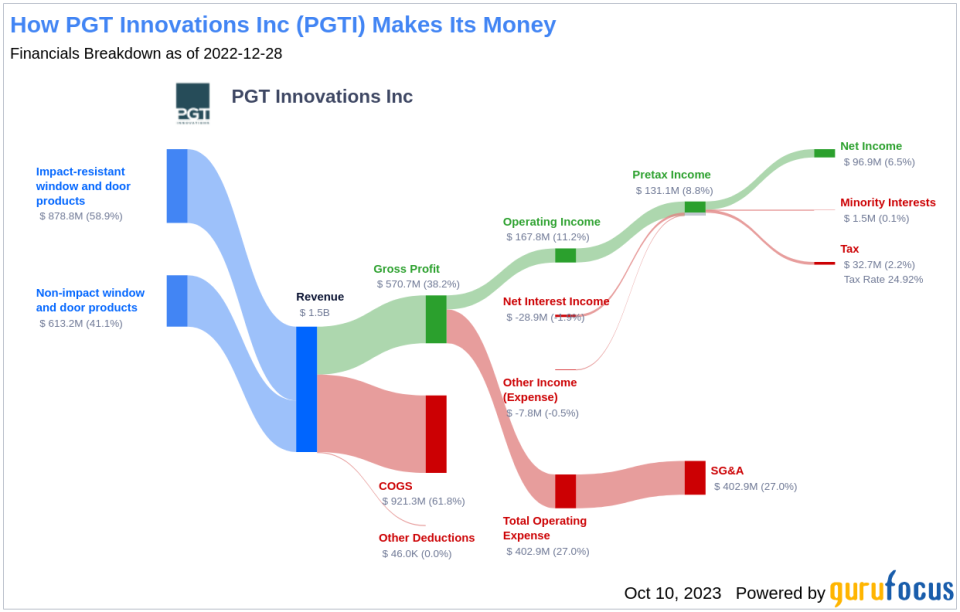

PGT Innovations Inc is a prominent player in the construction industry, specializing in the manufacture of impact-resistant aluminum and vinyl-framed windows and doors. The company offers a broad range of fully customizable window and door products, distributing them through multiple channels, including window distributors, building supply distributors, window replacement dealers, and enclosure contractors. While the company's products are sold through authorized dealers and distributor networks in the states of the Caribbean, Florida, Canada, and in South and Central America, the majority of its revenue is generated from Florida.

Profitability Analysis

PGT Innovations Inc boasts a high Profitability Rank of 10/10, indicating a high level of profitability. The company's Operating Margin stands at 12.14%, which is better than 80.6% of companies in the same industry. Furthermore, the company's ROE, ROA, and ROIC are all higher than the majority of companies in the industry, standing at 16.53%, 6.38%, and 9.98% respectively. The company has also demonstrated consistent profitability over the past 10 years, better than 99.94% of companies in the industry.

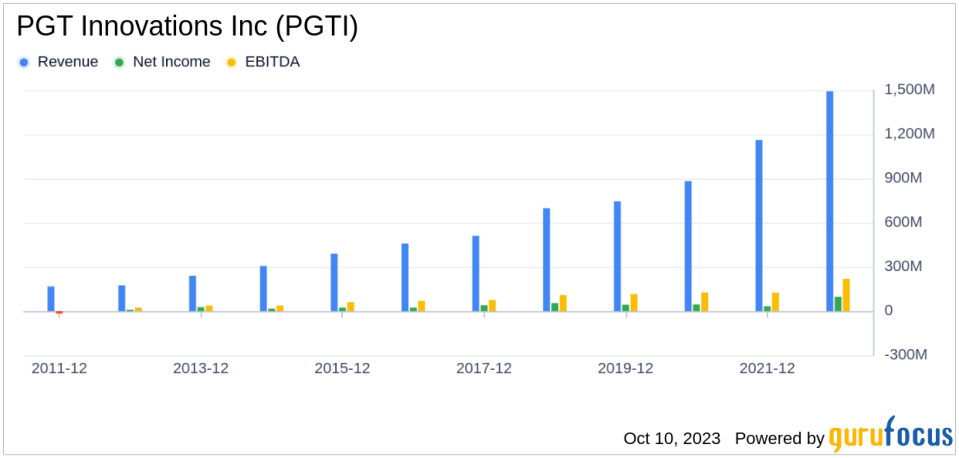

Growth Prospects

PGT Innovations Inc also has a high Growth Rank of 10/10, indicating a high level of growth. The company's 3-year and 5-year revenue growth rates per share are better than the majority of companies in the industry, standing at 25.20% and 18.60% respectively. Additionally, the company's 3-year and 5-year EPS without NRI growth rates are also higher than many companies in the industry, standing at 30.40% and 4.10% respectively.

Top Holders

The top three holders of PGT Innovations Inc's stock are Jim Simons (Trades, Portfolio), HOTCHKIS & WILEY, and First Eagle Investment (Trades, Portfolio). Jim Simons (Trades, Portfolio) holds the largest number of shares, with 775,397 shares, representing 1.33% of the company's stock. HOTCHKIS & WILEY holds 108,300 shares, representing 0.19% of the company's stock, while First Eagle Investment (Trades, Portfolio) holds 83,890 shares, representing 0.14% of the company's stock.

Competitors

PGT Innovations Inc faces competition from several companies in the construction industry, including Janus International Group Inc (NYSE:JBI), JELD-WEN Holding Inc (NYSE:JELD), and Masonite International Corp (NYSE:DOOR). Janus International Group Inc has a market cap of $1.59 billion, JELD-WEN Holding Inc has a market cap of $1.1 billion, and Masonite International Corp has a market cap of $1.93 billion.

Conclusion

In conclusion, PGT Innovations Inc's stock performance, profitability, growth, holders, and competitors all contribute to its current market position. The company's stock has seen significant gains over the past three months, and its profitability and growth ranks are both at the highest level. The company also has a strong market presence, with the majority of its revenue generated from Florida. Despite facing competition from several companies in the construction industry, PGT Innovations Inc continues to hold a strong position in the market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.