What's Driving ProPetro Holding Corp's Surprising 11% Stock Rally?

ProPetro Holding Corp (NYSE:PUMP) has experienced a significant shift in its stock performance recently. Over the past week, the stock has seen a decrease of 12.32%, but it has managed to rally with an 11.48% increase over the past three months. The company's GF Value, a measure of intrinsic value defined by GuruFocus.com, is currently at $12.14, suggesting that the stock is modestly undervalued. This is a notable change from the past GF Valuation, which categorized the stock as a possible value trap.

Unveiling ProPetro Holding Corp

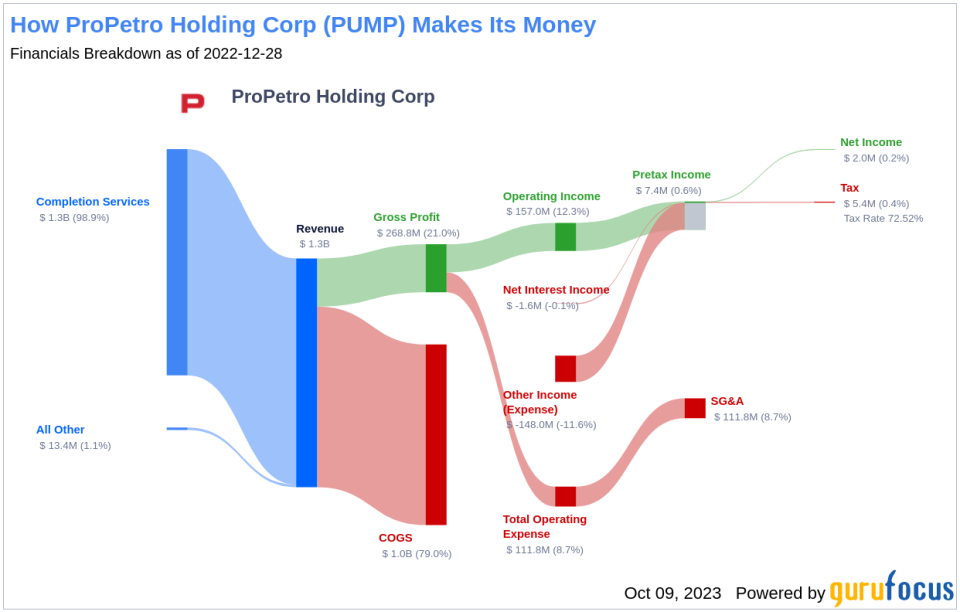

ProPetro Holding Corp is a Texas-based oilfield services company operating in the Oil & Gas industry. The company provides hydraulic fracturing, wireline, and other complementary services to oil and gas companies engaged in the exploration and production of North American unconventional oil and natural gas resources. ProPetro is primarily focused on the Permian Basin, offering services such as Hydraulic Fracturing, Cementing, Coiled Tubing, drilling, and flowback.

Profitability Analysis

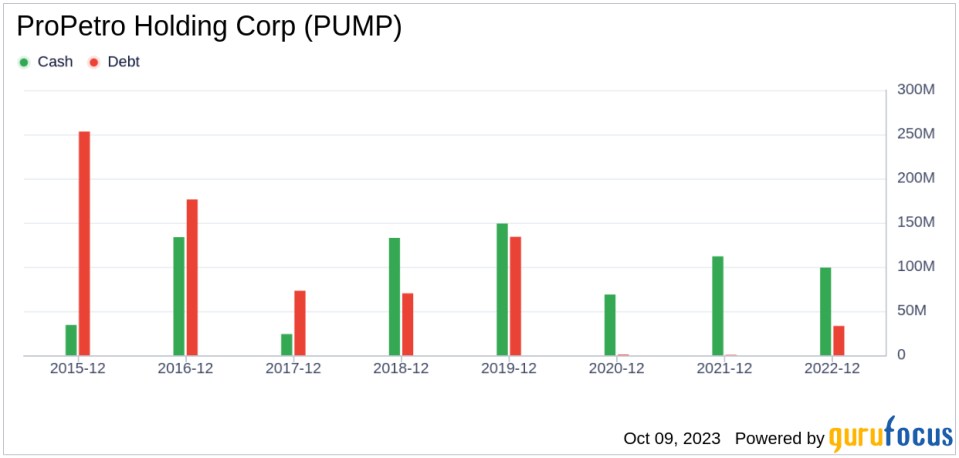

ProPetro's Profitability Rank stands at 5/10, indicating average profitability. The company's Operating Margin is 13.93%, better than 60.18% of companies in the same industry. The ROE and ROA are 9.91% and 7.14% respectively, both outperforming the majority of industry peers. The ROIC of 16.85% is better than 83.29% of companies in the industry. Over the past 10 years, ProPetro has had 4 years of profitability, better than 41.13% of companies.

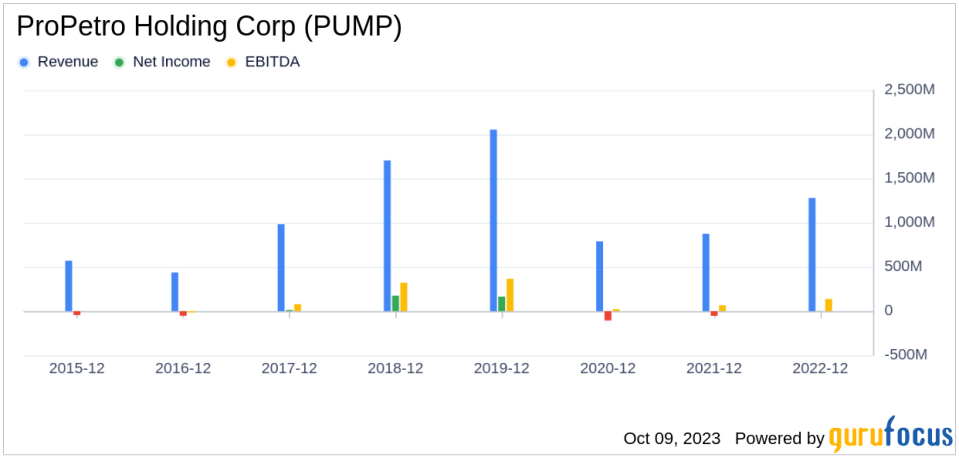

Growth Prospects

ProPetro's Growth Rank is 2/10, indicating low growth. The company's 3-year and 5-year revenue growth rates per share are -15.40% and -9.70% respectively, which are negative but still better than a small percentage of companies. The 3-year EPS without NRI growth rate is significantly negative at -76.60%, but it is still better than 2.46% of companies.

Major Stock Holders

The top three holders of ProPetro stock are Ken Fisher (Trades, Portfolio), HOTCHKIS & WILEY, and First Eagle Investment (Trades, Portfolio). Ken Fisher (Trades, Portfolio) holds 1,093,716 shares, accounting for 0.97% of the total shares. HOTCHKIS & WILEY holds 896,490 shares, making up 0.79% of the total shares. First Eagle Investment (Trades, Portfolio) holds 786,103 shares, representing 0.7% of the total shares.

Competitive Landscape

ProPetro faces competition from several companies within the same industry. US Silica Holdings Inc (NYSE:SLCA) has a market capitalization of $1.02 billion, Oceaneering International Inc (NYSE:OII) has a market cap of $2.44 billion, and Core Laboratories Inc (NYSE:CLB) has a market cap of $1.08 billion. These companies pose a significant challenge to ProPetro, which has a market cap of $1.1 billion.

Conclusion

In conclusion, ProPetro Holding Corp's stock performance has seen a significant rally over the past three months despite a recent dip. The company's profitability and growth metrics indicate a mixed performance, with average profitability and low growth. However, the company's operating margin, ROE, ROA, and ROIC are all better than the majority of companies in the same industry. The competitive landscape is intense, with several companies having similar market capitalizations. Investors should consider these factors when evaluating the potential value and risks associated with investing in ProPetro Holding Corp.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.