What's Driving RPC Inc's Surprising 15% Stock Rally?

RPC Inc (NYSE:RES), a prominent player in the Oil & Gas industry, has been making waves in the stock market with its impressive performance. The company's stock price has seen a significant surge of 6.80% over the past week and a remarkable 15.01% gain over the past three months. Currently priced at $8.92, the company boasts a market cap of $1.93 billion. According to GuruFocus.com's GF Value, which calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, RPC Inc is modestly undervalued with a GF Value of $10.49. This is a notable improvement from its past GF Value of $11.06, which indicated a possible value trap.

Unveiling RPC Inc

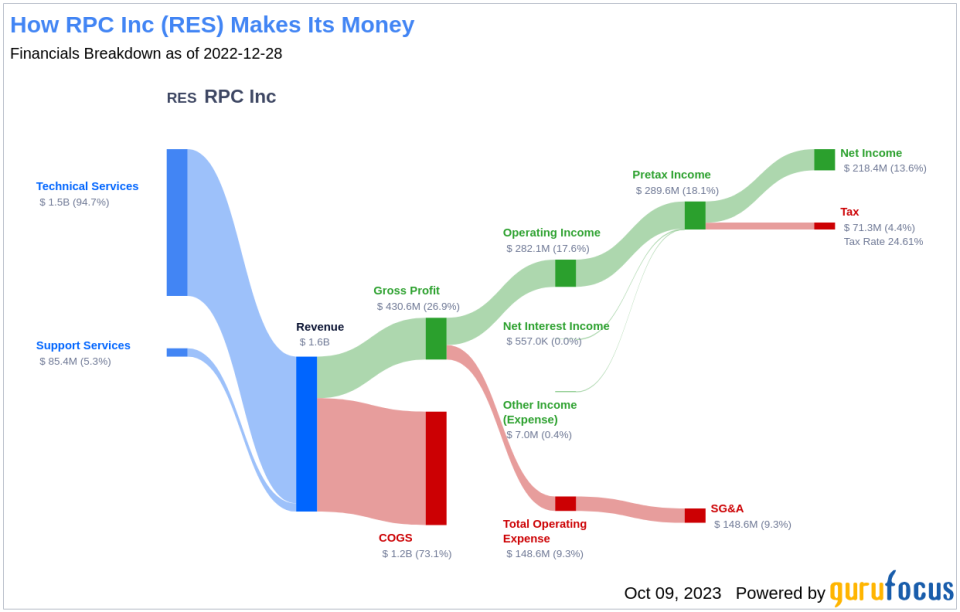

RPC Inc is a specialized oilfield services company that primarily serves independent and major oil and gas companies engaged in the exploration, production, and development of oil and gas properties throughout the United States. The company operates through two main segments: Technical Services and Support Services. The Technical Services segment, which generates the majority of the company's revenue, comprises pressure pumping, downhole tools, coiled tubing, snubbing, nitrogen, well control, wireline, and fishing. The Support Services segment includes drill pipe and related tools, pipe handling, pipe inspection and storage services, and oilfield training and consulting services.

Profitability Analysis of RPC Inc

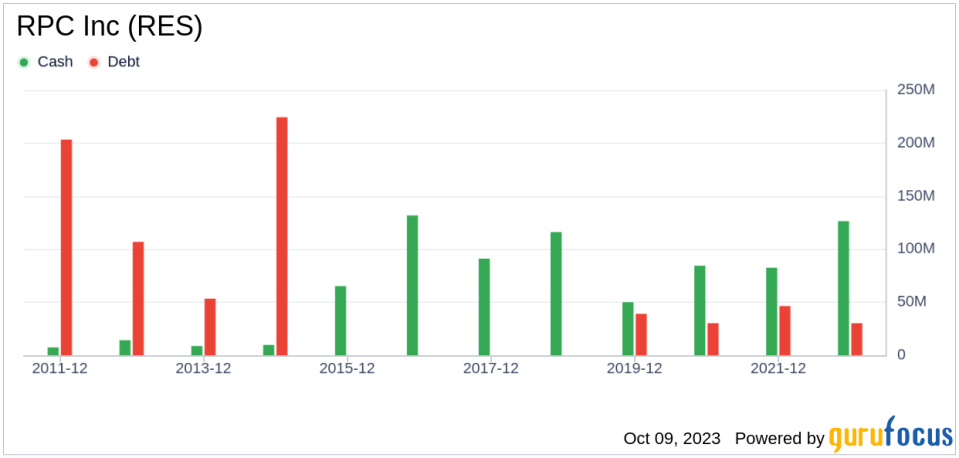

RPC Inc's profitability is commendable, with a Profitability Rank of 6/10, indicating its profitability and sustainability. The company's Operating Margin stands at 20.20%, better than 67.72% of 982 companies in the same industry. Its ROE is 34.43%, ROA is 26.31%, and ROIC is 32.88%, all of which are impressive compared to industry averages. Furthermore, the company has maintained profitability for 6 out of the past 10 years, better than 59.18% of 953 companies.

Growth Prospects of RPC Inc

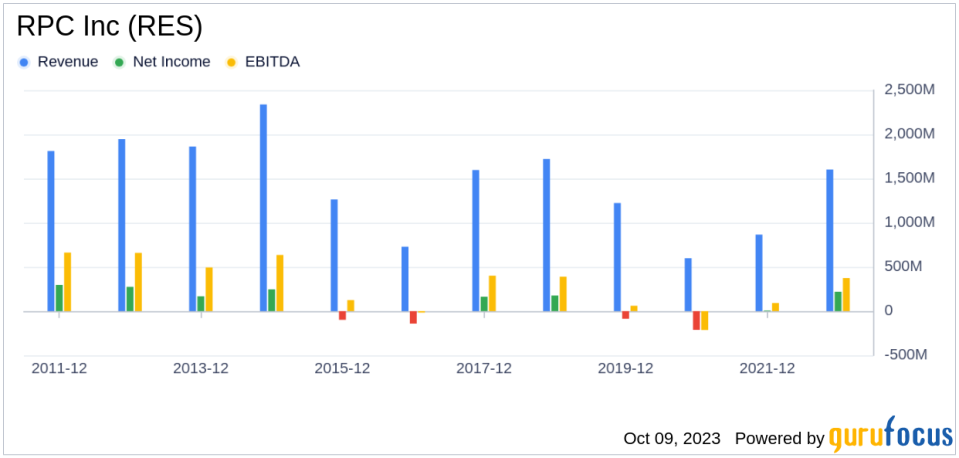

Despite its modest Growth Rank of 2/10, RPC Inc has shown promising signs of growth. The company's 3-Year Revenue Growth Rate per Share is 9.20%, better than 47.09% of 858 companies in the same industry. However, its 5-Year Revenue Growth Rate per Share is -7.50%, which is still better than 19.82% of 787 companies.

Major Holders of RPC Inc Stock

Among the top holders of RPC Inc's stock are renowned investors Mario Gabelli (Trades, Portfolio), who holds 1.42% of the shares, Chuck Royce (Trades, Portfolio), who holds 0.51%, and First Eagle Investment (Trades, Portfolio), which holds 0.13%.

Competitors in the Oil & Gas Industry

RPC Inc faces stiff competition from other companies in the Oil & Gas industry. Its main competitors include Archrock Inc(NYSE:AROC) with a market cap of $2.01 billion, Helix Energy Solutions Group Inc(NYSE:HLX) with a market cap of $1.57 billion, and ProFrac Holding Corp(NASDAQ:ACDC) with a market cap of $1.49 billion.

Conclusion

In conclusion, RPC Inc's stock performance, profitability, and growth prospects are impressive. The company's modest undervaluation, according to its GF Value, and its strong profitability and growth indicators, make it a potential investment opportunity. However, investors should also consider the competitive landscape and the company's growth rank before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.