What's Driving Shenandoah Telecommunications Co's Surprising 24% Stock Rally?

Shenandoah Telecommunications Co (NASDAQ:SHEN) has been making waves in the stock market with a significant 24.20% surge in its stock price over the past three months. As of October 25, 2023, the company's market cap stands at $1.18 billion, with its stock price at $23.51. Over the past week, the stock has seen a gain of 3.92%, indicating a positive trend. However, the company's GF Value, a measure of intrinsic value defined by GuruFocus.com, is currently at $27.15, suggesting that the stock is modestly undervalued. This is a shift from three months ago when the GF Value was $31.89, indicating a possible value trap.

Company Overview: Shenandoah Telecommunications Co

Shenandoah Telecommunications Co, operating in the Telecommunication Services industry, provides a range of broadband communication products and services. The company's operations span across wireless, cable, fiber optic, and fixed wireless networks, catering to customers in the Mid-Atlantic United States. Shenandoah Telecommunications Co operates through two business units: tower and broadband. The tower segment leases company-owned cell tower spaces to other wireless communication providers, while the broadband segment provides broadband Internet, video, and voice services to residential and commercial customers. The broadband segment is the primary revenue generator for the company, with the majority of sales coming from residential and small to medium businesses within the broadband unit.

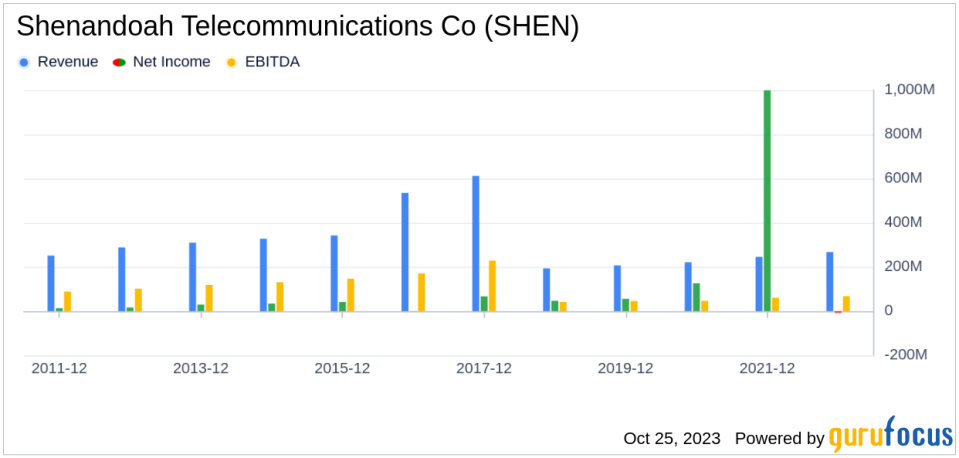

Profitability Analysis

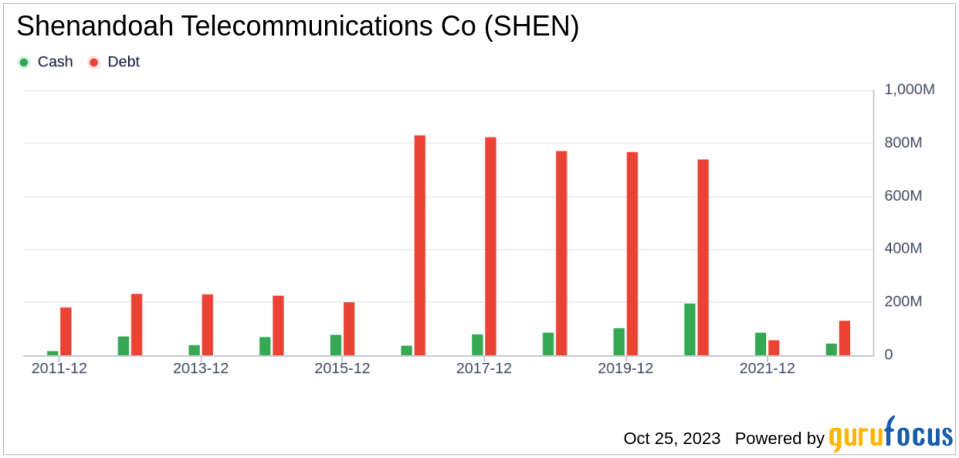

Shenandoah Telecommunications Co's Profitability Rank stands at 5/10 as of June 30, 2023. The company's Operating Margin is 1.14%, better than 23.59% of 390 companies in the same industry. However, the company's ROE and ROA are -0.11% and -0.07% respectively, indicating a need for improvement. The company's ROIC is -0.18%, better than 23.43% of 397 companies in the industry. Over the past decade, the company has had 8 years of profitability, better than 55.44% of 377 companies.

Growth Prospects

The company's Growth Rank is 3/10, indicating moderate growth potential. The 3-Year Revenue Growth Rate per Share is 8.90%, better than 71.09% of 377 companies in the industry. However, the 5-Year Revenue Growth Rate per Share is -9.20%, only better than 15.56% of 347 companies, suggesting a need for strategic growth initiatives.

Major Stock Holders

Jim Simons (Trades, Portfolio) and Mario Gabelli (Trades, Portfolio) are the top two holders of Shenandoah Telecommunications Co's stock. Jim Simons (Trades, Portfolio) holds 420,571 shares, accounting for 0.84% of the company's stock, while Mario Gabelli (Trades, Portfolio) holds 114,336 shares, accounting for 0.23% of the company's stock.

Competitive Landscape

Shenandoah Telecommunications Co faces competition from WideOpenWest Inc(NYSE:WOW) with a stock market cap of $573.721 million, Anterix Inc(NASDAQ:ATEX) with a stock market cap of $579.891 million, and IDT Corp(NYSE:IDT) with a stock market cap of $695.087 million.

Conclusion

In conclusion, Shenandoah Telecommunications Co's stock has seen a significant surge over the past three months. However, the company's profitability and growth ranks suggest a need for strategic initiatives to improve performance. The company's stock is held by major investors, indicating confidence in its potential. Despite facing competition, Shenandoah Telecommunications Co's unique offerings and market position make it a stock to watch.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.