What's Driving Telephone and Data Systems Inc's Surprising 129% Stock Rally?

Telephone and Data Systems Inc (NYSE:TDS) has been making headlines in the stock market with a significant surge in its stock price. Over the past week, the company's stock price has seen a gain of 1.78%, and over the past three months, it has skyrocketed by an impressive 128.74%. The current stock price stands at $18.33, with a market cap of $2.07 billion. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The GF Value of TDS is $19.12, indicating that the stock is fairly valued. However, three months ago, the GF Value was $19.76, suggesting a possible value trap, which required investors to think twice before investing.

Introduction to Telephone and Data Systems Inc (NYSE:TDS)

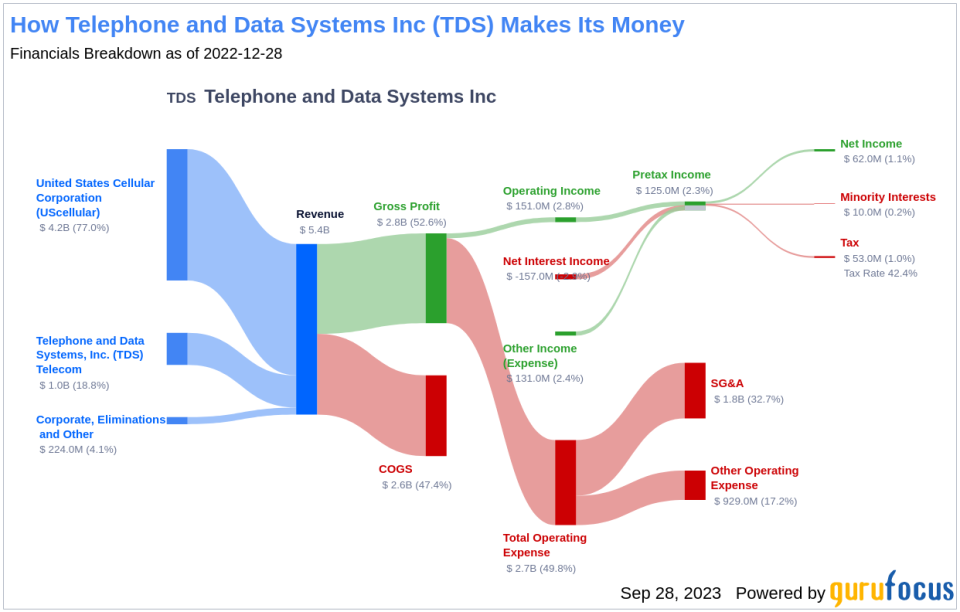

Telephone and Data Systems Inc is a diversified telecommunications operator that provides mobile, telephone, and broadband services. The company operates in the Telecommunication Services industry and generates maximum revenue from its UScellular segment.

Profitability Analysis of TDS

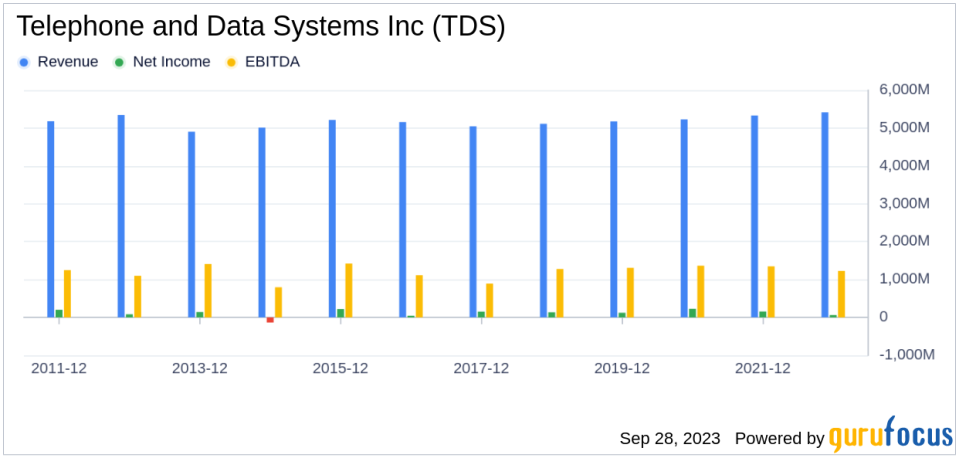

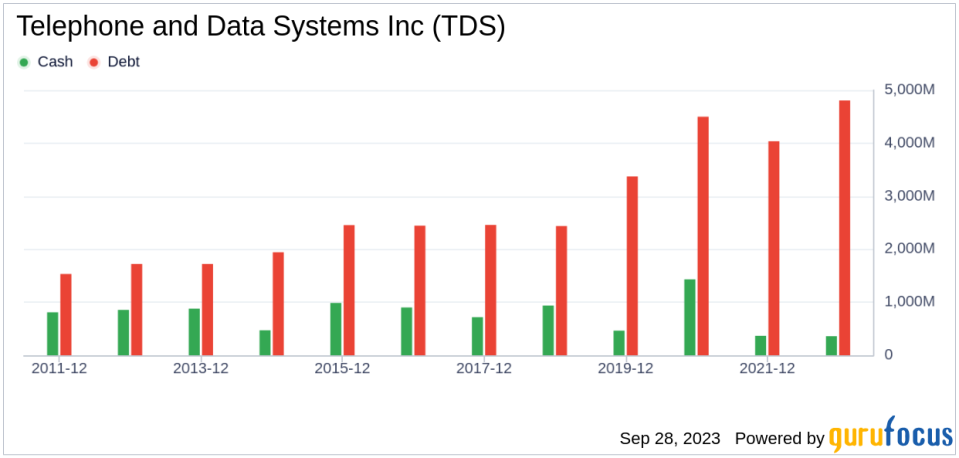

When it comes to profitability, TDS has a Profitability Rank of 6/10, indicating a decent level of profitability. The company's operating margin is 1.13%, which is better than 24.81% of the companies in the industry. The ROE, ROA, and ROIC, which stand at -0.46%, -0.19%, and 1.08% respectively, are better than a significant percentage of companies in the industry. Furthermore, TDS has shown consistent profitability over the past decade, with 9 years of profitability, which is better than 66.22% of the companies.

Growth Analysis of TDS

TDS has a Growth Rank of 5/10, indicating a moderate level of growth. The company's 3-year and 5-year revenue growth rate per share are 2.10% and 1.00% respectively, which are better than a significant percentage of companies in the industry.

Overview of TDS's Stock Holders

The top three holders of TDS's stock are Mario Gabelli (Trades, Portfolio), Caxton Associates (Trades, Portfolio), and Barrow, Hanley, Mewhinney & Strauss, holding 1.86%, 0.03%, and 0% of the shares respectively.

Competitor Analysis

TDS operates in a competitive industry with companies like InterDigital Inc (NASDAQ:IDCC) with a market cap of $2.13 billion, Globalstar Inc (GSAT) with a market cap of $2.25 billion, and IHS Holding Ltd (NYSE:IHS) with a market cap of $1.96 billion.

Conclusion

In conclusion, Telephone and Data Systems Inc has shown impressive growth in its stock price over the past three months. The company's profitability and growth ranks indicate a decent level of profitability and growth. However, investors should be cautious due to the past GF Valuation suggesting a possible value trap. The company operates in a competitive industry, and it is essential to keep an eye on the performance of its competitors. Despite the challenges, TDS has managed to maintain a consistent level of profitability over the past decade, which is a positive sign for potential investors.

This article first appeared on GuruFocus.