What's Driving Telephone and Data Systems Inc's Surprising 135% Stock Rally?

Telephone and Data Systems Inc (NYSE:TDS), a diversified telecommunications operator, has seen a significant surge in its stock price over the past three months. The company's stock price has risen by a staggering 134.50%, despite a slight dip of 1.91% over the past week. As of October 24, 2023, the company's market cap stands at $2.15 billion, with its stock price at $19.06. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, the GF Value of TDS is $19.15, slightly above its current price, indicating that the stock is fairly valued. However, three months ago, the GF Value was $19.79, suggesting a possible value trap. This analysis aims to delve deeper into the factors contributing to TDS's stock performance, profitability, growth, and competition.

Introduction to Telephone and Data Systems Inc (NYSE:TDS)

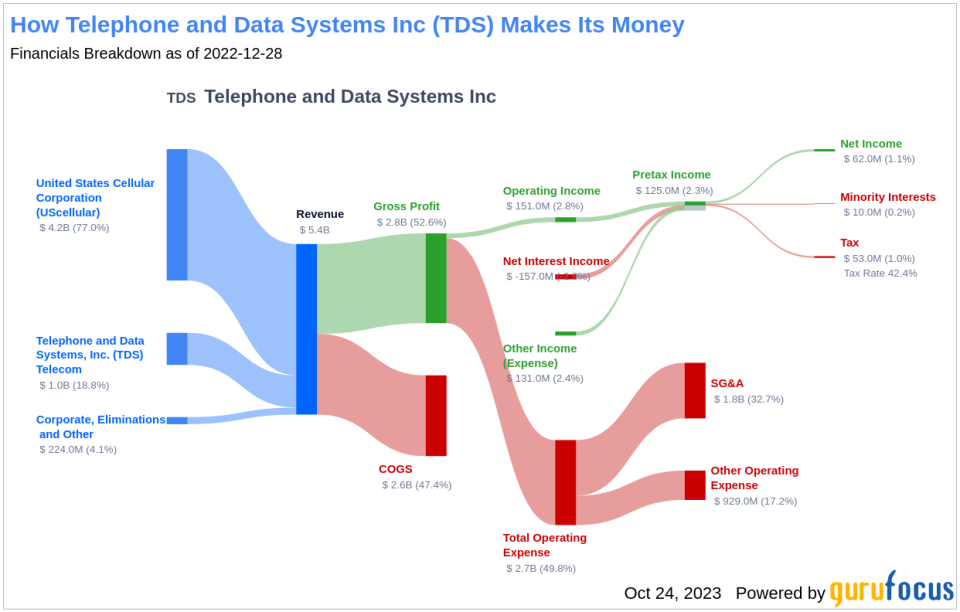

Telephone and Data Systems Inc operates in the telecommunication services industry, providing mobile, telephone, and broadband services. The company's business is divided into two segments: UScellular and TDS Telecom, with the former generating the majority of the revenue.

Profitability Analysis of TDS

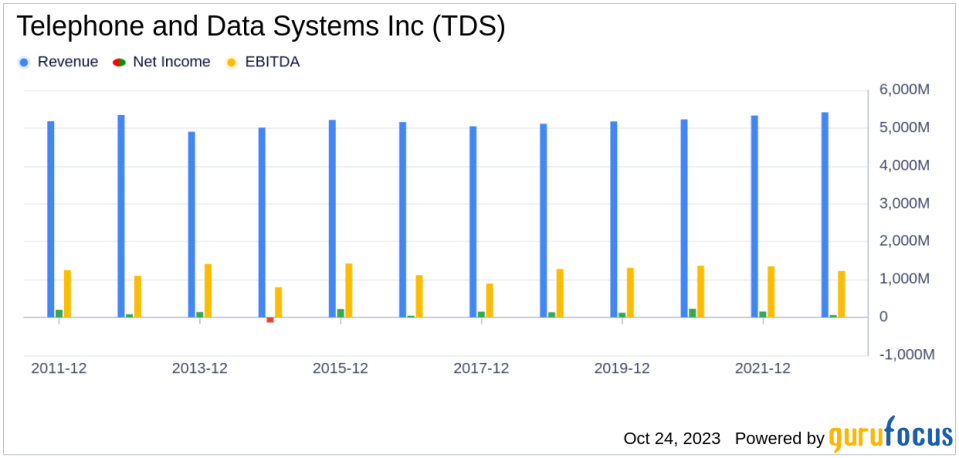

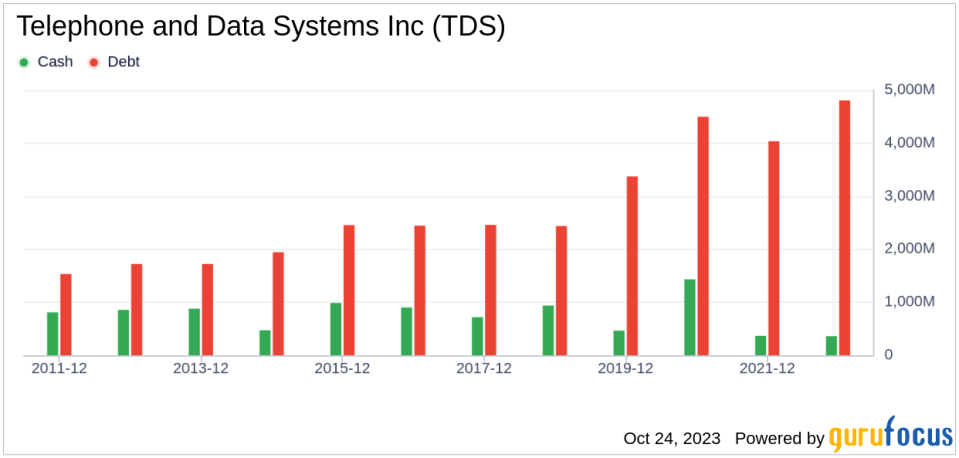

As of June 30, 2023, TDS's Profitability Rank stands at 6/10, indicating a moderate level of profitability. The company's Operating Margin is 1.13%, better than 23.33% of 390 companies in the same industry. However, the company's ROE and ROA are -0.46% and -0.19% respectively, which are better than 27.68% and 30.23% of companies in the industry. The ROIC of 1.08% is better than 30.98% of companies in the industry. Over the past decade, TDS has had 9 years of profitability, better than 66.05% of 377 companies.

Growth Analysis of TDS

TDS's Growth Rank is 4/10 as of today, indicating a moderate growth rate. The company's 3-Year Revenue Growth Rate per Share is 2.10%, better than 45.62% of 377 companies in the industry. The 5-Year Revenue Growth Rate per Share is 1.00%, better than 45.82% of 347 companies.

Overview of TDS's Stock Holders

The top three holders of TDS's stock are Mario Gabelli (Trades, Portfolio), Caxton Associates (Trades, Portfolio), and Barrow, Hanley, Mewhinney & Strauss, holding 1.86%, 0.03%, and less than 0.01% of the shares respectively.

Competitor Analysis

TDS faces competition from InterDigital Inc (NASDAQ:IDCC) with a market cap of $2.06 billion, Globalstar Inc (GSAT) with a market cap of $2.41 billion, and IHS Holding Ltd (NYSE:IHS) with a market cap of $1.59 billion.

Conclusion

In conclusion, TDS's stock performance has been impressive over the past three months, with a significant surge of 134.50%. The company's profitability and growth ranks indicate moderate profitability and growth. However, the company faces stiff competition from other players in the telecommunication services industry. Investors should keep a close eye on TDS's performance and make informed decisions based on comprehensive analysis.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.