What's Driving Trina Solar Co Ltd's Surprising 19% Stock Rally?

Trina Solar Co Ltd (NYSE:TSL), a leading player in the semiconductors industry, has seen a significant surge in its stock price over the past three months. As of October 10, 2023, the company's market cap stands at $1.81 billion, with its stock price at $19.53. Over the past week, the stock price has seen a gain of 6.16%, and over the past three months, it has risen by an impressive 19.46%. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, the GF Value of Trina Solar is $23.24, indicating that the stock is modestly undervalued. This is consistent with the GF Valuation three months ago, which also suggested that the stock was modestly undervalued.

Company Overview

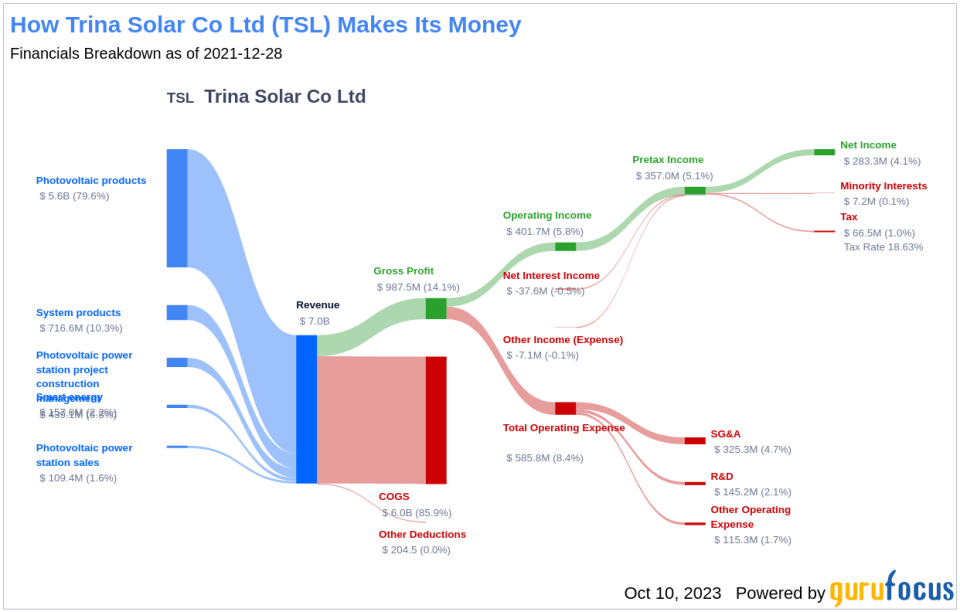

Trina Solar Co Ltd is a renowned manufacturer of photovoltaic products, photovoltaic systems, and smart energy solutions. The company's photovoltaic products business includes the research and development, manufacture, and sales of monocrystalline silicon-based photovoltaic modules. Its photovoltaic systems business encompasses power station business and the construction and management of photovoltaic power station projects. The smart energy business includes photovoltaic power generation, operation, and management of the photovoltaic power station, research and sales of the smart microgrid and multi-energy systems, and operation of the energy cloud platform, among others.

Profitability Analysis

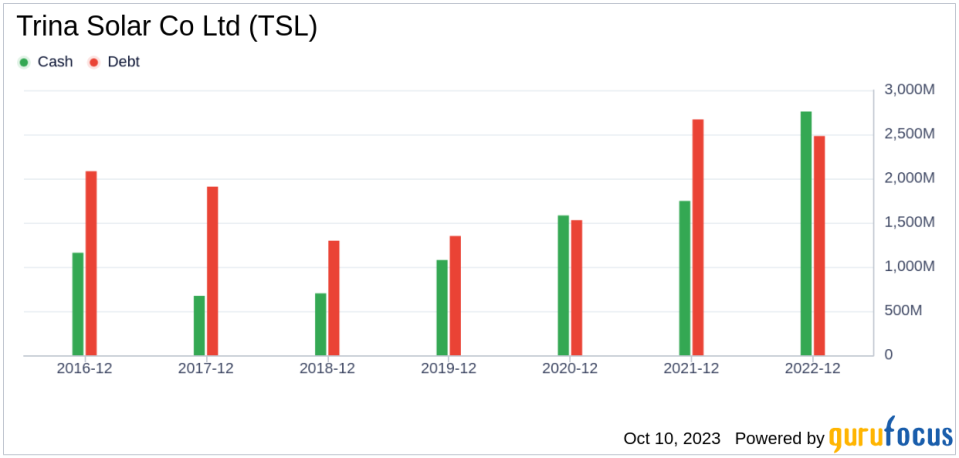

Trina Solar's Profitability Rank stands at 7 out of 10, indicating a strong profitability performance compared to other companies in the industry. The company's operating margin, calculated as Operating Income divided by its Revenue, is 7.93%, better than 53.88% of the companies in the industry. The ROE, ROA, and ROIC, which measure the company's profitability in relation to its equity, assets, and invested capital respectively, are also impressive. The company's ROE is 22.47%, ROA is 6.20%, and ROIC is 13.85%, each outperforming a significant percentage of companies in the industry. Over the past decade, Trina Solar has demonstrated profitability for seven years, better than 50.73% of the companies in the industry.

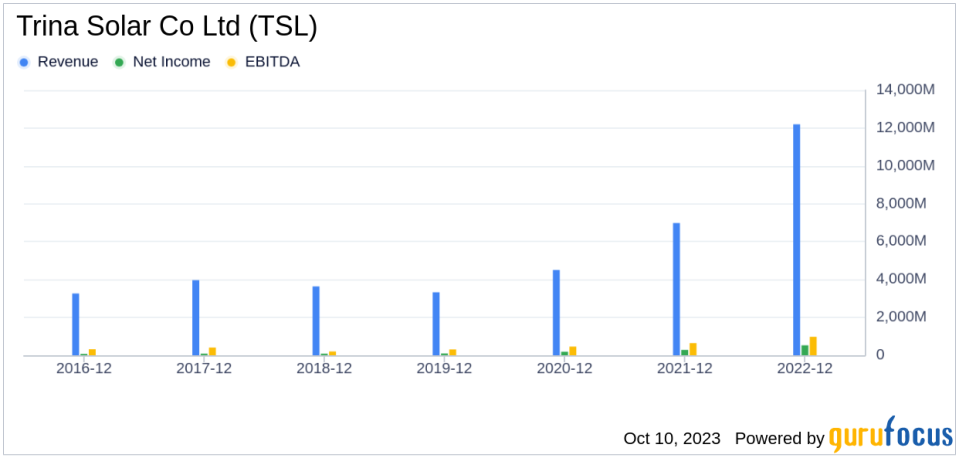

Growth Prospects

Trina Solar's Growth Rank is 9 out of 10, indicating robust growth prospects. The company's 3-year and 5-year revenue growth rate per share are 44.50% and 16.50% respectively, outperforming a significant percentage of companies in the industry. The 3-year and 5-year EPS without NRI growth rate, which measure the growth of the company's earnings per share excluding non-recurring items, are 68.10% and 37.90% respectively, also outperforming a significant percentage of companies in the industry.

Competitive Landscape

Trina Solar operates in a competitive industry, with key competitors including JA Solar Technology Co Ltd (SZSE:002459) with a market cap of $11.44 billion, CSI Solar Co Ltd (SHSE:688472) with a market cap of $7 billion, and Shanghai Aiko Solar Energy Co Ltd (SHSE:600732) with a market cap of $5.49 billion.

Conclusion

In conclusion, Trina Solar Co Ltd has demonstrated strong stock performance, profitability, and growth prospects. The company's stock price has seen a significant surge over the past three months, and its GF Value indicates that it is modestly undervalued. Trina Solar's profitability and growth ranks are impressive, and its operating margin, ROE, ROA, and ROIC outperform a significant percentage of companies in the industry. Despite operating in a competitive industry, Trina Solar's strong performance and growth prospects make it a compelling consideration for investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.