What's Driving WR Berkley Corp's Surprising 10% Stock Rally?

WR Berkley Corp (NYSE:WRB), a leading player in the insurance industry, has seen a significant surge in its stock price over the past three months. The company's market cap stands at $17.58 billion, with its stock price currently at $68.26. Over the past week, the stock price has seen a gain of 2.24%, and over the past three months, it has risen by an impressive 10.38%. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The current GF Value of WRB is $72.44, compared to $69.06 three months ago. This indicates that the stock is fairly valued, a significant improvement from being modestly undervalued three months ago.

Introduction to WR Berkley Corp (NYSE:WRB)

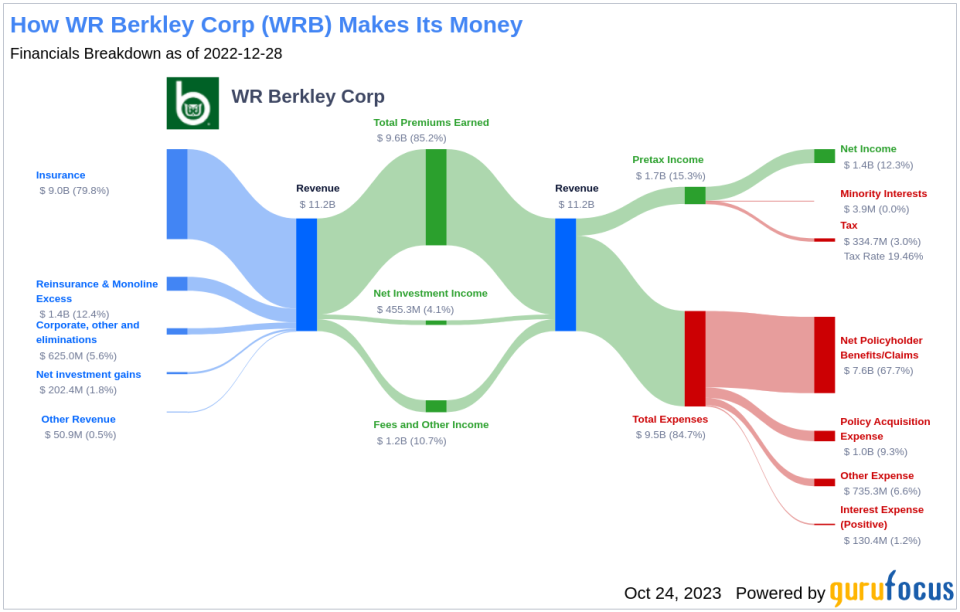

WR Berkley Corp is an insurance holding company with a host of subsidiaries that primarily underwrite commercial casualty insurance. The firm specializes in niche products that include various excess and surplus lines, workers' compensation insurance, self-insurance consulting, reinsurance, and regional commercial lines for small and midsize businesses. The company operates in the insurance industry, which is known for its resilience and steady growth.

Profitability Analysis of WR Berkley Corp (NYSE:WRB)

WR Berkley Corp has a Profitability Rank of 7/10, indicating a strong profitability compared to other companies in the industry. The company's Return on Equity (ROE) is 18.86%, better than 83.84% of the companies in the industry. The Return on Assets (ROA) stands at 3.73%, outperforming 74.24% of the companies in the industry. The Return on Invested Capital (ROIC) is 4.26%, better than 73.09% of the companies in the industry. WR Berkley Corp has maintained profitability for the past 10 years, which is better than 99.79% of the companies in the industry.

Growth Prospects of WR Berkley Corp (NYSE:WRB)

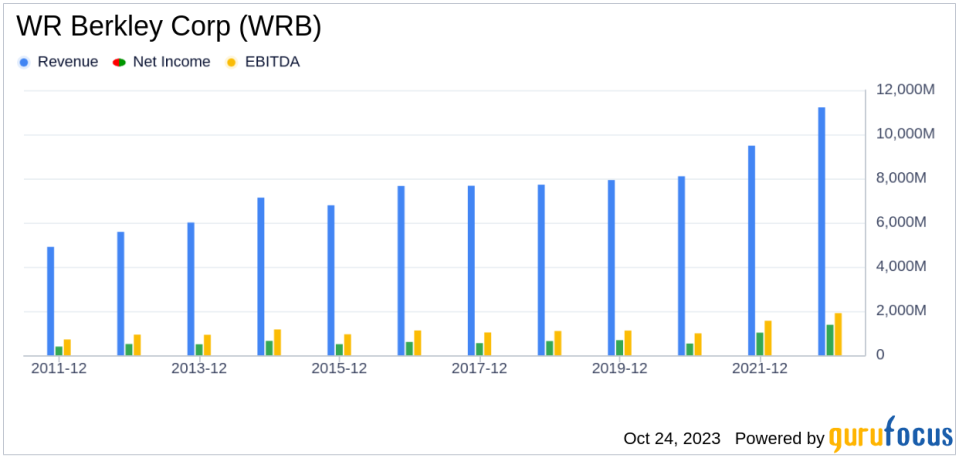

WR Berkley Corp has a Growth Rank of 10/10, indicating strong growth prospects. The company's 3-Year Revenue Growth Rate per Share is 13.70%, better than 80.96% of the companies in the industry. The 5-Year Revenue Growth Rate per Share is 8.50%, outperforming 66.97% of the companies in the industry. The company's future total revenue growth rate is estimated to be 6.73%, better than 66.36% of the companies in the industry. The 3-Year EPS without NRI Growth Rate is 28.20%, better than 83.38% of the companies in the industry. The 5-Year EPS without NRI Growth Rate is 18.90%, outperforming 82.7% of the companies in the industry. The future EPS without NRI growth rate is estimated to be 5.70%, better than 31.82% of the companies in the industry.

Top Holders of WR Berkley Corp (NYSE:WRB) Stock

Steven Cohen (Trades, Portfolio) is the top holder of WR Berkley Corp stock, holding 642,986 shares, which represents 0.25% of the company's shares. Jim Simons (Trades, Portfolio) is the second-largest holder with 489,820 shares, representing 0.19% of the company's shares. Charles Brandes (Trades, Portfolio) holds 409,372 shares, representing 0.16% of the company's shares.

Competitors of WR Berkley Corp (NYSE:WRB)

WR Berkley Corp faces competition from Cincinnati Financial Corp(NASDAQ:CINF) with a market cap of $15.62 billion, Loews Corp(NYSE:L) with a market cap of $14.27 billion, and Markel Group Inc(NYSE:MKL) with a market cap of $19.41 billion.

Conclusion

In conclusion, WR Berkley Corp has shown impressive stock performance, profitability, and growth. The company's stock is fairly valued, and it has strong profitability and growth prospects. The company's stock is held by top investors, and it faces competition from companies with similar market caps. Despite the competition, WR Berkley Corp's strong fundamentals make it a compelling choice for investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.