What's Going On With PepsiCo Shares?

Earnings season has finally arrived. Investors are more than anxious for companies to pull the curtain back, unveiling what has transpired behind the scenes.

It’s been a tough year for stocks overall, with a hawkish Fed, geopolitical issues, and lingering COVID-19 uncertainties spoiling the fun all year long.

Earlier in the week, we received Q3 2022 results from a titan in the Zacks Consumer Staples sector, PepsiCo PEP.

PepsiCo is an American multinational beverage, food, and snack corporation headquartered in New York.

PepsiCo shares have displayed remarkable relative strength year-to-date, outperforming the S&P 500 by a wide margin.

Image Source: Zacks Investment Research

Currently, the company carries a Zacks Rank #3 (Hold) with an overall VGM Score of a B.

Let’s take a deeper dive into the quarterly results and see how a few other Consumer Staples titans, such as Coca-Cola KO and Altria Group MO, shape up heading into their respective prints.

PepsiCo Q3 2022

It was a strong quarter for PepsiCo, exceeding the Zacks Consensus EPS Estimate of $1.85 by a solid 6.5% and reporting quarterly earnings of $1.97 per share.

Impressively, it was the company’s ninth quarter of exceeding the Zacks Consensus EPS Estimate out of its last ten.

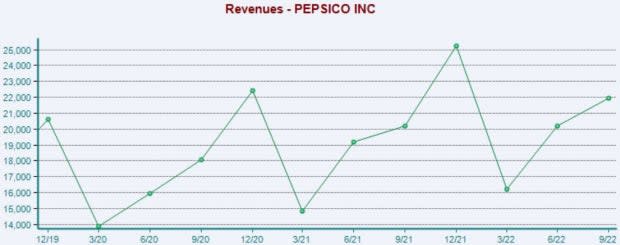

Revenue also exceeded expectations; sales of $21.9 billion easily surpassed the Zacks Consensus Sales Estimate of $20.8 billion by more than 5%. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Impressively, the company’s top-line performance was broad-based; its North America and International businesses both delivered 16% organic revenue growth.

Further, PEP’s operating profit climbed 11%, and the company’s core operating margin expanded by 30 bp, thanks to the company’s strong revenue growth and cost management initiatives.

The company also highlighted the strength of its diversified portfolio and consumer demand trends; PEP’s global beverages and convenience foods businesses delivered 12% and 20% organic revenue growth, respectively.

For the cherry on top, the company raised its FY22 guidance.

Ramon Laguarta, CEO and Chairman, said, “We are very pleased with our results for the third quarter as our global business momentum remains strong. Given our year-to-date performance, we now expect our full-year organic revenue to increase 12% (previously 10%) and core constant currency earnings per share to increase 10% (previously 8%).”

Coca-Cola

Coca-Cola is another titan in the Consumer Staples sector, one of PEP’s biggest rivals. As it stands, KO currently sports a Zacks Rank #3 (Hold).

For the company’s upcoming earnings release on October 25th, the Zacks Consensus EPS Estimate of $0.64 suggests a Y/Y decline of a marginal 1.5%. Over the last 60 days, the $0.64 per share estimate has remained unchanged.

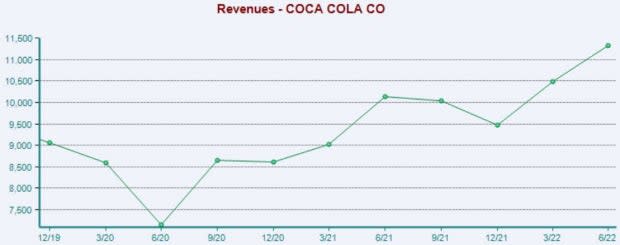

Like PEP, Coca-Cola has an impressive earnings track record; KO has exceeded revenue and earnings estimates in its last six quarters.

Just in its latest print, the company penciled in a 4.5% bottom-line beat paired with a 5.3% revenue beat.

Image Source: Zacks Investment Research

KO shares currently trade at a 22.7X forward earnings multiple, reflecting a 19% premium relative to its Zacks Consumer Staples sector.

While shares trade at a premium relative to their sector, the value is still well below its five-year median of 24.6X and highs of 26.2X in 2021.

Image Source: Zacks Investment Research

Heading into the quarterly print, KO carries an Earnings ESP Score of -0.3%.

Altria Group

Altria Group is a world-leading producer and marketer of cigarettes, tobacco, and other similarly related products. The company currently carries a Zacks Rank #4 (Sell) with an overall VGM Score of a C.

For the company’s upcoming quarterly print on October 27th, the Zacks Consensus EPS Estimate of $1.31 suggests Y/Y earnings growth of 7.4%.

Further, both earnings estimate revisions from analysts that have come in over the last several months have been downwards.

Altria has primarily exceeded bottom-line estimates, surpassing the Zacks Consensus EPS Estimate in seven of its last ten prints. In its latest earnings release, the company posted a marginal 0.8% EPS beat.

Top-line results have also been primarily strong, with Altria penciling in six top-line beats over its last ten quarters.

Image Source: Zacks Investment Research

MO’s valuation levels have declined dramatically; the company’s 9.5X forward earnings multiple is below its 10.9X five-year median and represents a sizable 50% discount relative to its Zacks sector.

Image Source: Zacks Investment Research

Heading into the upcoming print, MO carries an Earnings ESP Score of -1.5%.

Bottom Line

With PepsiCo posting strong Q3 results, it raises valid questions surrounding the upcoming earnings releases from Coca-Cola KO and Altria Group MO.

PEP experienced strong consumer demand, making it seem reasonable for other Consumer Staples stocks to have witnessed the same.

Still, it appears advantageous for investors to heed caution with MO shares currently, as its Zacks Rank #4 (Sell) indicates that its near-term earnings outlook is under pressure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company The (KO) : Free Stock Analysis Report

Altria Group, Inc. (MO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research