What's in the Offing for Host Hotels (HST) in Q4 Earnings?

Host Hotels & Resorts, Inc. HST is scheduled to release fourth-quarter and full-year 2023 earnings results on Feb 21 after market close. While the quarterly results are likely to display year-over-year growth in revenues, funds from operations (FFO) per share might remain unchanged.

In the previous quarter, the Bethesda, MD-based lodging real estate investment trust (REIT) delivered a surprise of 17.14% in terms of adjusted FFO per share. The quarterly results reflected better-than-anticipated revenues.

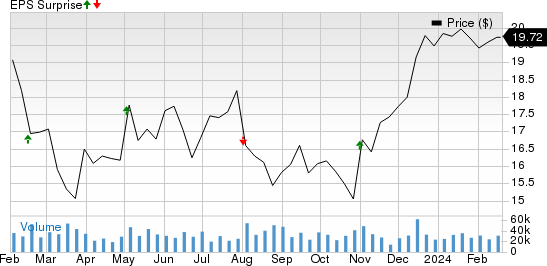

Over the trailing four quarters, Host Hotels’ adjusted FFO per share surpassed estimates on three occasions and missed in the remaining period, the average beat being 7.17%. The graph below depicts this surprise history:

Host Hotels & Resorts, Inc. Price and EPS Surprise

Host Hotels & Resorts, Inc. price-eps-surprise | Host Hotels & Resorts, Inc. Quote

Factors at Play

Host Hotels enjoys a portfolio of luxury and upper-scale hotels across the top 20 lucrative U.S. markets, with a strong presence in the attractive Sunbelt region. These properties are strategically located in central business districts of major cities with proximity to airports and resort/conference destinations, driving demand.

The improvement in group travel demand and business transient demand — led by the healthy demand from small and medium-sized businesses — have aided occupancy and hotel revenue per available (RevPAR) growth over the past few quarters. This trend is likely to have continued in the fourth quarter.

The Zacks Consensus Estimate for quarterly RevPAR stands at $200.41, indicating an increase of 1.8% from the year-ago quarter.

The consensus mark for the average occupancy rate is pegged at 68.87%, suggesting an improvement from the prior-year quarter’s reported figure of 65.70%.

The Zacks Consensus Estimate for HST’s quarterly revenues is presently pegged at $1.30 billion, implying growth of 2.83% from the prior-year period’s reported figure.

Host Hotels’ strategic capital allocations to improve its portfolio quality and strengthen its position in the United States, where it has a greater scale and competitive advantage, are likely to have given it an edge and driven margin expansion.

However, moderating leisure travel demand and rates at the company’s resorts and a slower-than-anticipated return of group and business travel are anticipated to have cast a pall on the company’s quarterly performance to some extent. Also, lower inbound international travel might have been a concern for Host Hotels.

Further, higher interest expenses are expected to have been a spoilsport. We expect fourth-quarter 2023 interest expenses to rise 9.2% year over year.

The company’s activities during the to-be-reported quarter were inadequate to garner analysts’ confidence. The Zacks Consensus Estimate for the FFO per share has been unchanged at 44 cents over the past two months. Moreover, the figure implies no change from the year-ago reported number.

For 2023, Host Hotels expected AFFO per share in the range of $1.90-$1.95. This is based on the company’s projection for comparable hotel RevPAR of $210-$213. Host Hotels expected comparable hotel RevPAR growth in the band of 7.25-8.75% from the prior year. It maintained the midpoint at 8% despite the impact of the wildfires in Maui, which is expected to persist in the fourth quarter, and continued macroeconomic concerns.

For the full year, the Zacks Consensus Estimate for AFFO per share is pegged at $1.92. The figure indicates a 7.26% increase year over year on 7.74% year-over-year growth in revenues to $5.29 billion.

Here Is What Our Quantitative Model Predicts:

Our proven model does not conclusively predict a surprise in terms of FFO per share for Host Hotels this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an FFO beat, which is not the case here.

Host Hotels currently carries a Zacks Rank of 3 and has an Earnings ESP of -5.25%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks That Warrant a Look

Here are two stocks from the broader REIT sector — Extra Space Storage Inc. EXR and American Homes 4 Rent AMH — you may want to consider as our model shows that these have the right combination of elements to report a surprise this quarter.

Extra Space Storage, scheduled to report quarterly numbers on Feb 27, has an Earnings ESP of +1.08% and carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

American Homes 4 Rent, slated to release quarterly numbers on Feb 22, has an Earnings ESP of +1.68% and carries a Zacks Rank of 3 at present.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Host Hotels & Resorts, Inc. (HST) : Free Stock Analysis Report

Extra Space Storage Inc (EXR) : Free Stock Analysis Report

American Homes 4 Rent (AMH) : Free Stock Analysis Report