What's in the Offing for JetBlue (JBLU) in Q2 Earnings?

JetBlue Airways Corporation JBLU is scheduled to report second-quarter 2023 results on Aug 1, before market open.

JBLU has a disappointing earnings surprise history, having surpassed the Zacks Consensus Estimate in two of the preceding four quarters (two miss), the average miss being 78.4%. The Zacks Consensus Estimate has improved 11.1% to 40 cents per share over the past 60 days.

Let’s have a look at the factors likely to have influenced JBLU’s performance in the quarter under review.

Improved air-travel demand might have aided passenger revenues in second-quarter 2023. We expect passenger revenues to have risen 9.8% from second-quarter 2022 actuals. Total revenues are forecast to increase in the 4.5-8.5% range. Capacity is anticipated to increase in the 4.5-7.5% band.

Fuel expenses are likely to have affected the bottom line. Even though fuel price has come down from the highs witnessed earlier, it still remains at an elevated level. Average fuel cost per gallon in the June quarter is estimated to be between $2.75 and $ 2.90. Our projection for the metric is pegged at $2.76.

Management expects second-quarter 2023 earnings in the range of 35-45 cents per share. The midpoint of the guided range meets the Zacks Consensus Estimate of 40 cents.

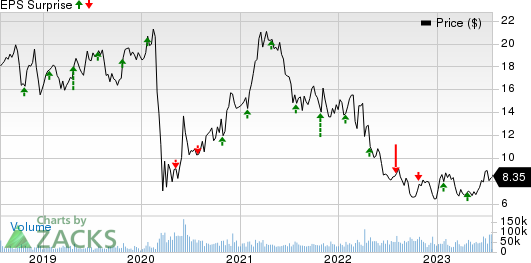

JetBlue Airways Corporation Price and EPS Surprise

JetBlue Airways Corporation price-eps-surprise | JetBlue Airways Corporation Quote

What Our Model Says

Our proven model conclusively predicts an earnings beat for JBLU this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is exactly the case here. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

JBLU has an Earnings ESP of +12.50% and a Zacks Rank #2.

Other Stocks to Consider

Here are a few other stocks from the broader Zacks Transportation sector that investors may also consider, as our model shows that these too have the right combination of elements to beat on earnings this time around.

SkyWest, Inc. SKYW currently has an Earnings ESP of +16.94% and a Zacks Rank #3. It will release second-quarter 2023 results on Jul 27.

SkyWest's fleet-modernization efforts are commendable as well.

Copa Holdings, S.A. CPA has an Earnings ESP of +0.82% and a Zacks Rank #2. CPA will release results on Aug 9. You can see the complete list of today’s Zacks #1 Rank stocks here.

Copa Holdings has an expected earnings growth rate of more than 100% for second-quarter 2023. CPA delivered a trailing four-quarter earnings surprise of 14.60%, on average. The Zacks Consensus Estimate for CPA’s second-quarter 2023 earnings has been revised upward by 94% in the past 90 days.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report