What's in the Offing for Kinder Morgan's (KMI) Q2 Earnings?

Kinder Morgan, Inc. KMI is set to report second-quarter 2023 earnings on Jul 19, after the closing bell.

In the last reported quarter, the company’s adjusted earnings per share of 30 cents beat the Zacks Consensus Estimate by a penny due to higher gathering and transport volumes. The positives were partially offset by lower contributions from Product Pipelines.

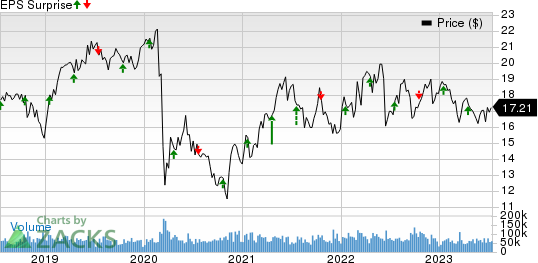

Kinder Morgan’s earnings beat the Zacks Consensus Estimate once, met twice and missed the same once in the trailing four quarters, the negative average surprise being 2.6%. This is depicted in the graph below:

Kinder Morgan, Inc. Price and EPS Surprise

Kinder Morgan, Inc. price-eps-surprise | Kinder Morgan, Inc. Quote

Estimate Trend

The Zacks Consensus Estimate for second-quarter earnings per share of 23 cents has witnessed no upward and two downward revisions over the past 30 days. The estimated figure suggests a 14.8% decline from the prior-year reported number.

The Zacks Consensus Estimate for second-quarter revenues of $4.4 billion indicates a 15.4% decline from the year-ago reported figure.

Factors to Note

Being a transporter of 1.7 million barrels per day of refined products, Kinder Morgan is the largest independent transporter of refined products in North America. Higher volumes transported in its pipeline systems are likely to have boosted the company’s profit levels in the second quarter.

The Zacks Consensus Estimate for KMI’s Natural Gas Pipelines segment’s earnings before depreciation expense and amortization expense (EBDA) for the second quarter is pegged at $1,202 million, suggesting an improvement from $1,134 million in the prior-year reported quarter. Our estimate for revenues from KMI’s Natural Gas Pipelines segment EBDA is also expected to increase year over year in the second quarter.

However, the Zacks Consensus Estimate for revenues from KMI’s Natural Gas Pipelines segment for the second quarter is pegged at $2,953 million, suggesting a decline from $3,356 million in the prior-year reported quarter. Our estimate for revenues from KMI’s Natural Gas Pipelines segment is also expected to decline year over year in the second quarter.

This is likely to have affected Kinder Morgan’s performance in the to-be-reported quarter.

Earnings Whispers

Our proven model does not indicate an earnings beat for Kinder Morgan this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP: KMI’s Earnings ESP is -8.23%. This is because the Most Accurate Estimate is currently pegged at earnings of 22 cents per share, while the Zacks Consensus Estimate is pegged at earnings of 23 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Here are some firms that you may want to consider, as these have the right combination of elements to post an earnings beat in the upcoming quarterly reports:

Viper Energy Partners LP VNOM currently has an Earnings ESP of +12.50% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Viper Energy is scheduled to release second-quarter earnings on Jul 31. The Zacks Consensus Estimate for VNOM’s earnings is pegged at 24 cents per share, suggesting a decline from the prior-year reported figure.

NuStar Energy, L.P. NS has an Earnings ESP of +8.82% and is currently a Zacks #2 Ranked player.

NuStar Energy is scheduled to release second-quarter results on Aug 3. The Zacks Consensus Estimate for NS’s earnings is pegged at 17 cents per share, suggesting a decline from the prior-year reported figure.

Southwestern Energy Company SWN has an Earnings ESP of +15.45% and is a Zacks #3 Ranked player at present.

Southwestern is scheduled to release second-quarter results on Aug 3. The Zacks Consensus Estimate for SWN’s earnings is pegged at 9 cents per share, suggesting a decline from the prior-year reported figure.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NuStar Energy L.P. (NS) : Free Stock Analysis Report

Southwestern Energy Company (SWN) : Free Stock Analysis Report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

Viper Energy Partners LP (VNOM) : Free Stock Analysis Report