What's in the Offing for Vornado (VNO) This Earnings Season?

Vornado Realty Trust VNO is scheduled to report second-quarter 2023 results on Jul 31, after market close. The quarterly results are likely to reflect a year-over-year decline in revenue and funds from operations (FFO) per share.

In the last reported quarter, this New York-based real estate investment trust’s (REIT) FFO plus assumed conversions as adjusted per share missed the Zacks Consensus Estimate by 3.23%. Although the quarterly results reflected better-than-anticipated revenues aided by healthy leasing activity, higher operating expenses acted as a dampener.

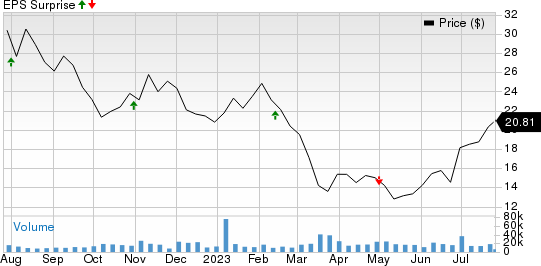

Over the trailing four quarters, Vornado’s FFO plus assumed conversions as adjusted per share surpassed the Zacks Consensus Estimate on three occasions and missed once, the average beat being 4.69%. This is depicted in the graph below:

Vornado Realty Trust Price and EPS Surprise

Vornado Realty Trust price-eps-surprise | Vornado Realty Trust Quote

Factors at Play

Per a Cushman & Wakefield CWK report, while demand for select premium office spaces continues to outperform the broader market, the overall recovery in the U.S. office market demand remains choppy, with recession fears lingering amongst occupiers.

The pace of job growth has been slower than in early 2022, and the rate of deceleration for office-using employment is higher. Amid this, the second quarter recorded a negative net absorption of 26.9 million square feet (msf), marking the lowest quarter in two years.

The overall gross leasing activity for the four quarters ending second-quarter 2023 was 289 msf. Further, leasing activity in the quarter slumped 24% year over year. While leasing slid for four straight quarters, it was still 49 msf (20%) above the pandemic-era low witnessed in the first quarter of 2021.

The Cushman & Wakefield report also highlights greater availability of sublease space (2.9% of the total inventory, almost three times the pre-pandemic norm of around 1%) as a key concern for this sector. The second-quarter national vacancy rate rose 70 basis points to 19.2%, reflecting the largest quarter-over-quarter increase since mid-2021. The national asking rent came in at $37.34 for the quarter.

As for Vornado, its premium, newly-developed properties are likely to have witnessed healthy demand during the quarter. In June 2023, the company signed a lease agreement with the United States’ premier healthy lifestyle brand — Life Time — for more than 53,000 square feet on the first three floors of its PENN 1 property adjacent to Madison Square Garden in New York City.

However, given the choppy-office market environment, we anticipate that leasing volume for some of Vornado’s properties, especially the older constructed ones with fewer amenities, may not have reached its full potential.

Additionally, limited consumers’ willingness to spend amid macroeconomic uncertainty might have curtailed the company’s Manhattan street retail’s performance to some extent during the second quarter.

These factors are expected to have impaired Vornado’s top-line growth, hurting its quarterly earnings. The Zacks Consensus Estimate for quarterly revenues is pegged at $440.3 million, suggesting a fall of 2.9% from the year-ago quarter’s reported figure. The consensus mark for Vornado’s New York revenues stands at $354.5 million, indicating a 2.7% decline from the prior-year quarter’s reported figure.

Further, in April 2023, expecting reduced projected 2023 taxable income due to higher interest expenses, VNO postponed its dividend payment until the end of this year. At the end of 2023, depending upon its taxable income for the year, the company will pay the dividend in either cash or a combination of cash and securities.

The Zacks Consensus Estimate for the quarterly FFO per share has been revised 1.6% northward to 64 cents over the past week. The figure, however, suggests a 24.1% decline from the prior-year period’s reported number.

Earnings Whispers

Our proven model does not conclusively predict a surprise in terms of FFO per share for VNO this season. The combination of a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — increases the odds of a beat. However, that’s not the case here.

Earnings ESP: Vornado has an Earnings ESP of -2.94%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Vornado currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Stocks That Warrant a Look

Here are some stocks that are worth considering from the REIT sector, as our model shows that these have the right combination of elements to deliver a surprise this reporting cycle:

American Tower AMT is slated to report quarterly numbers on Jul 27. AMT has an Earnings ESP of +2.82% and carries a Zacks Rank #3 presently.

Ventas VTR is scheduled to report quarterly numbers on Aug 3. VTR has an Earnings ESP of +1.75% and a Zacks Rank #2 (Buy) currently.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Tower Corporation (AMT) : Free Stock Analysis Report

Ventas, Inc. (VTR) : Free Stock Analysis Report

Vornado Realty Trust (VNO) : Free Stock Analysis Report

Cushman & Wakefield PLC (CWK) : Free Stock Analysis Report