What's in Store for Affiliated Managers (AMG) in Q2 Earnings?

Affiliated Managers Group Inc. AMG is slated to report second-quarter 2023 results on Jul 26, before the opening bell. While its earnings are expected to have improved in the quarter on a year-over-year basis, revenues are likely to have declined.

In the last reported quarter, the company’s earnings outpaced the Zacks Consensus Estimate. Results benefited from lower expenses, partly offset by a decline in the assets under management (AUM) balance and revenues.

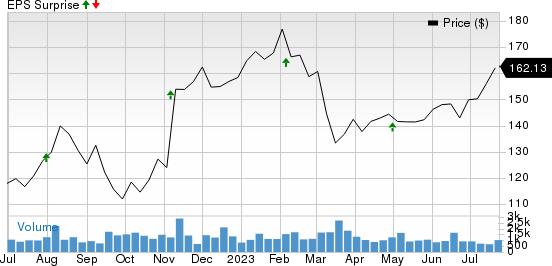

The company boasts an impressive earnings surprise history. Its earnings surpassed the consensus estimate in each of the trailing four quarters, the average beat being 3.1%.

Affiliated Managers Group, Inc. Price and EPS Surprise

Affiliated Managers Group, Inc. price-eps-surprise | Affiliated Managers Group, Inc. Quote

The Zacks Consensus Estimate for AMG’s second-quarter earnings is pegged at $4.23, which has been unchanged over the past seven days. The figure indicates a 5% rise from the year-ago quarter’s reported figure. Our estimate for economic earnings per share is $4.11.

The company expects economic net income (controlling interest) of $154-161 million. Economic earnings per share are expected between $4.06 and $4.26.

The consensus estimate for sales is pegged at $543 million, indicating a 10.1% year-over-year fall. Our estimate for total revenues is pinned at $542.8 million.

Other Key Expectations for Q2

Management expects adjusted EBITDA of $210-$220 million, including net performance fee earnings of $15-$25 million. Our estimate for adjusted EBITDA is $213.1 million.

The company expects interest expenses of $31 million, around the same level as that reported in the first quarter of 2023. We expect interest expenses of $30.7 million.

Controlling interest depreciation is expected to be at the first-quarter reported level of $2 million.

Net income (controlling interest) is expected between $108 million and $116 million. The company’s share of reported amortization and impairments is expected to be $29 million. Our estimate for the metric is $29.2 million.

Intangible-related deferred taxes are projected to be $15 million. Our estimate for the metric is $15.2 million.

Other economic items, which now include realized gains, are anticipated to be $2 million.

Earnings Whispers

According to our quantitative model, we cannot conclusively predict whether Affiliated Managers will be able to beat the Zacks Consensus Estimate this time. This is because it does not have the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Affiliated Managers is 0.00%.

Zacks Rank: The company currently carries a Zacks Rank #2 (Buy). While this increases the predictive power of ESP, we also need a positive ESP to be confident of an earnings beat.

Stocks to Consider

A couple of finance stocks, which you may want to consider, as these have the right combination of elements to post an earnings beat in their upcoming releases per our model, are Moody's Corporation MCO and Ares Management Corporation ARES.

The Earnings ESP for Moody's is +2.24%. MCO carries a Zacks Rank #2 at present. It is expected to report results on Jul 25. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ares Management is scheduled to release quarterly results on Aug 1. ARES currently carries a Zacks Rank #3 and has an Earnings ESP of +0.20%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Moody's Corporation (MCO) : Free Stock Analysis Report

Affiliated Managers Group, Inc. (AMG) : Free Stock Analysis Report

Ares Management Corporation (ARES) : Free Stock Analysis Report