What's in Store for ARMOUR Residential (ARR) in Q3 Earnings?

ARMOUR Residential REIT, Inc. ARR is scheduled to report third-quarter 2023 results on Oct 25, after market close. The company’s results are expected to reflect declines in earnings and net interest income (NII) from the year-ago reported figures.

In the last reported quarter, the mortgage real estate investment trust (mREIT) posted distributable earnings available to common stockholders per share of 23 cents, which missed the Zacks Consensus Estimate of 26 cents. Results were affected by a steep decline in NII and higher expenses.

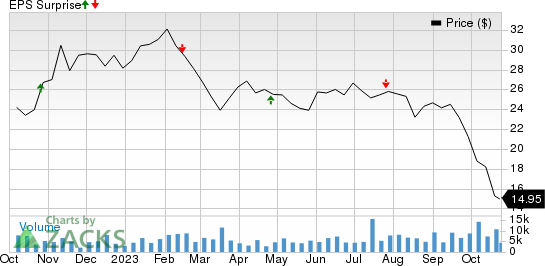

ARMOUR Residential’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters and missed in the other two, the average negative surprise being 3.30%. The graph below depicts this surprise history:

ARMOUR Residential REIT, Inc. Price and EPS Surprise

ARMOUR Residential REIT, Inc. price-eps-surprise | ARMOUR Residential REIT, Inc. Quote

Let’s see how things have shaped up prior to the third-quarter earnings announcement.

The mREIT sector was under pressure in the third quarter due to high volatility in the fixed-income markets. The widening of the spread is expected to have affected the tangible book values of the industry players.

As for ARMOUR Residential, the company does not seem to be immune from a challenging macro backdrop. Book value is expected to have deteriorated in the third quarter due to higher rates, wide mortgage spread and an expected decline in valuations on its Agency position.

Federal Reserve raised interest rates by another 25 basis points in the quarter under review. Thus, the policy rate reached 5-5.25% in July 2023, marking the 11th time FOMC has hiked interest rates in a tightening process that began in March 2022. In September, the rate hike was paused. With this, interest rates reached 5.25-5.5% in the third quarter, marking the highest level in around 22 years.

Given the rise in interest rates in the quarter, the company is expected to have seen a higher cost of funds in the third quarter. Since the company uses low-cost debt to invest in high-yielding mortgage securities, high rates during the quarter are expected to have increased interest expenses and affected the net interest margin.

Mortgage rates continued to increase in the third quarter, with the rate on a 30-year fixed mortgage reaching 7.31% in September, the highest level in nearly 23 years. The climb in mortgage rates, which kept home buyers on the sidelines, led to a smaller origination market, both purchase and refinancing, than the prior-year quarter.

However, prepayment speed is expected to have increased in the third quarter for ARR and have pressured its MBS holdings. This is expected to have increased net premium amortization in the quarter, limiting the scope for growth in interest income and average asset yield.

The consensus estimate for third-quarter NII of $4.51 million indicates an 82.1% fall from the year-ago reported figure.

Lastly, the company’s activities in the third quarter were inadequate to gain analysts’ confidence. Consequently, the Zacks Consensus Estimate for third-quarter earnings has been unrevised at $1.15 in a month. This indicates a year-over-year decline of 28%.

Earnings Whispers

Our proven model does not show that an earnings beat is likely for ARMOUR Residential this time around. This is because the company does not have the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: ARMOUR Residential has an Earnings ESP of 0.00%.

Zacks Rank: ARMOUR Residential currently carries a Zacks Rank of 3.

Stocks Worth a Look

Two stocks from the broader REIT sector, which you may want to consider as our model shows that these have the right combination of elements to report a surprise this time around, are Welltower WELL and Simon Property Group SPG.

Welltower is slated to report its quarterly numbers on Oct 30. WELL presently has an Earnings ESP of +0.75% and a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Simon Property is slated to report its quarterly numbers on Oct 30. SPG has an Earnings ESP of +0.12% and a Zacks Rank of 3 at present.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

ARMOUR Residential REIT, Inc. (ARR) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report