What's in Store for Canopy Growth (CGC) in Q1 Earnings?

Canopy Growth Corporation CGC is scheduled to report first-quarter fiscal 2024 results on Aug 04, before the opening bell.

In the fourth quarter of fiscal 2023, the company reported a loss of 23 cents, lagging the Zacks Consensus Estimate by 91.7%.

The company missed estimates in all of the trailing four quarters, the average negative surprise being 141.6%.

Let's take a look at how things have shaped up prior to this announcement.

Factors at Play

Canopy Growth is likely to have experienced strong and consistent demand for legal cannabis products in the growing Canadian recreational cannabis market. CGC has been maintaining market leadership in the premium flower category. The company is also expected to have experienced continued growth in Australia and Poland, as well as improved performance in Germany, driven by new supply of high-THC flower. We expect these growth trend to have continued in the to-be-reported quarter on product development, which has been leading to faster product delivery to the market.

The company has also been growing its market share in vapes and edibles categories. Within edibles, the expansion of GCC's premium product offerings across the Deep Space brand with the introduction of Deep Space XPRESS gummies in the Canadian market is likely to have contributed to fiscal first-quarter 2024 performance.

The international medical cannabis business is focused on the continued growth of Australian and European sales. The improving consistency of supply of high-THC flower strains and the sales of new products, including the increased distribution of medically certified Storz & Bickel vaporizers are likely to have contributed to the company’s performance in the to-be reported quarter.

Canopy Growth’s acquired business, BioSteel Sports Nutrition is also likely to have contributed to company’s growth driven by the launch of BioSteel ready-to-drink beverages in the United States. The BioSteel-NHL partnership, which delivered incredible visibility for the brand during the Stanley Cup playoffs, is expected to have had a positive impact on the company’s revenues through the fiscal first quarter.

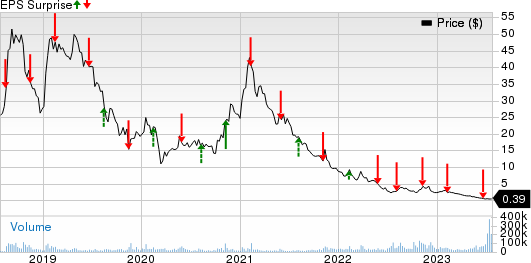

Canopy Growth Corporation Price and EPS Surprise

Canopy Growth Corporation price-eps-surprise | Canopy Growth Corporation Quote

In May 2023, Canopy Growth and Indiva en tered into a license assignment and assumption agreement providing Canopy Growth exclusive rights and interests to manufacture, distribute, and sell “Wana” branded products in Canada which accelerates Canopy Growth’s ability to leverage the Wana brand. In March 2023, canopy Growth launched Canada’s first-to-market cannabis infused beverage with naturally occurring caffeine under the Deep Space brand. The company also launched four new flavours under the Tweed brand. We believe these developments are expected to have contributed significantly to the fiscal first-quarter performance on the back of strong customer adoption.

Estimate Picture

The Zacks Consensus Estimate for first-quarter revenues of $70.8 million suggests a fall of 17.9% from the prior-year quarter’s reported figure.

The consensus mark for loss is pegged at 10 cents per share for the fiscal first quarter, narrower than the reported loss of 70 cents per share in the year-ago quarter.

What Our Model Suggests

Our proven model does not conclusively predict an earnings beat for canopy Growth this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, this is not the case here.

Earnings ESP: Canopy Growth has an Earnings ESP of -35.42%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

Stocks Worth a Look

Here are some medical stocks worth considering as these have the right combination of elements to post an earnings beat this quarter.

TG Therapeutics TGTX has an Earnings ESP of +12.00% and a Zacks Rank of #2. The company is expected to release second-quarter 2023 results soon. You can see the complete list of today’s Zacks #1 Rank stocks here.

TG Therapeutics has an expected earnings growth rate of 37.7% for 2023. TGTX’s 2023 projected revenues of $87.65 million indicate a surge from the year-ago reported figure of $2.8 million.

Dentsply Sirona XRAY has an Earnings ESP of +3.39% and a Zacks Rank of #2. Dentsply Sirona is scheduled to release second-quarter fiscal 2023 results on Aug 3.

XRAY’s earnings surpassed estimates in two of the trailing four quarters and missed the same in the other, the average beat being 10.47%. XRAY’s long-term expected growth rate is estimated to be 9.3%.

SiBone SIBN has an Earnings ESP of +12.2% and a Zacks Rank #1. SiBone is scheduled to release second-quarter 2023 results on Aug 7.

SIBN’s earnings surpassed estimates in three of the trailing four quarters and missed the same once, with the average surprise being 11.11%. The Zacks Consensus Estimate for SIBN’s second-quarter EPS indicates a 22.2% improvement from the year-ago reported figure.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DENTSPLY SIRONA Inc. (XRAY) : Free Stock Analysis Report

TG Therapeutics, Inc. (TGTX) : Free Stock Analysis Report

Canopy Growth Corporation (CGC) : Free Stock Analysis Report

SiBone (SIBN) : Free Stock Analysis Report