What's in Store for Commercial Metals' (CMC) Q4 Earnings?

Commercial Metals Company CMC is scheduled to report fourth-quarter fiscal 2021 (ended as of Aug 31, 2021) results on Oct 14, before the opening bell.

Which Way are the Estimates Headed?

The Zacks Consensus Estimate for the fiscal fourth-quarter revenues is pinned at $1.99 billion, suggesting growth of 41.5% from the prior-year period. The Zacks Consensus Estimate for earnings per share is pegged at $1.26 for the quarter, indicating a year-over-year increase of 59.5%.

Q3 Performance

In the last reported quarter, the company’s earnings and revenues increased year on year and surpassed the respective Zacks Consensus Estimates on both counts. Commercial Metals has a trailing four-quarter average earnings surprise of 17.5%.

Commercial Metals Company Price and EPS Surprise

Commercial Metals Company price-eps-surprise | Commercial Metals Company Quote

What Our Model Indicates?

Our proven model conclusively predicts an earnings beat for Commercial Metals this season. The combination of a positive Earnings ESP, and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), increases the chances of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Commercial Metals is +6.47%.

Zacks Rank: Commercial Metals currently flaunts a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Key Factors

Commercial Metals is likely to have benefited from the solid construction and infrastructure activity during the fiscal fourth quarter. The North America and Europe segment is likely to have benefited from strong recovery in industrial activities, driving demand for merchant bar and wire rod products in these regions. Increased spending on the residential and highway infrastructure activities are fueling robust demand for rebar and long product steel. These trends are likely to have supported the finished steel shipment volumes in North America and Europe during the fiscal fourth quarter.

Commercial Metals’ margin is anticipated to have benefited from high steel prices owing to the upsurge in demand across the major end-use markets. The company’s network-optimization efforts and cost-reduction initiatives are also likely to have contributed to margin performance during the quarter under review. The company has been implementing price rise across its mill products in response to the rapidly-rising scrap costs.

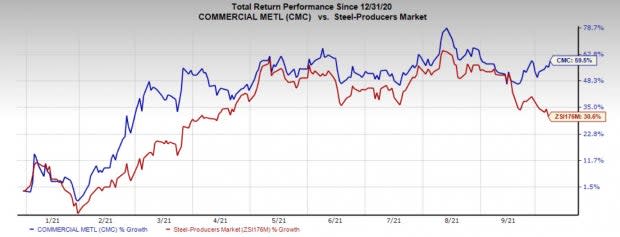

Price Performance

Commercial Metals’ shares have appreciated 59.5% so far this year, outperforming the industry’s growth of 30.6%.

Image Source: Zacks Investment Research

Stocks Worth a Look

Here are some stocks worth considering as these have the right combination of elements to post an earnings beat this quarter.

Jabil Inc. JBL has an Earnings ESP of +0.28% and holds a Zacks Rank of 2, at present.

Analog Devices, Inc. ADI has an Earnings ESP of +0.04% and carries a Zacks Rank #2, currently.

Walgreens Boots Alliance, Inc. WBA has an Earnings ESP of +0.99% and currently carries a Zacks Rank of 3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research