What's in Store for Extra Space Storage (EXR) in Q2 Earnings?

Extra Space Storage EXR, a leading self-storage real estate investment trust (REIT) in the United States, is set to release its second-quarter 2023 earnings on Aug 3 after market close. The company has been steadily expanding its footprint and diversifying its operations. As the market anticipates the earnings announcement, this article provides an in-depth preview of EXR’s expected performance in the second quarter of 2023, considering overall industry trends, the company's growth strategy and recent acquisitions.

In the last reported quarter, this Salt Lake City, Utah-based REIT reported a core FFO per share of $2.02, which missed the Zacks Consensus Estimate of $2.05. Results reflected lower-than-anticipated revenues on lower occupancy levels.

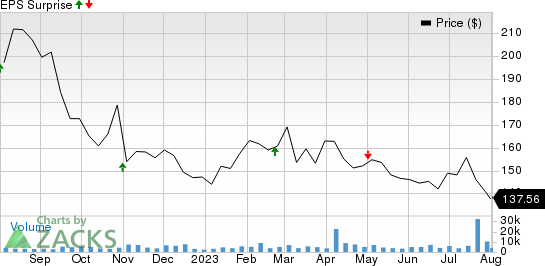

Over the trailing four quarters, the company surpassed the Zacks Consensus Estimate on three occasions and missed on the other, the average beat being 1.20%. The graph below depicts this surprise history:

Extra Space Storage Inc Price and EPS Surprise

Extra Space Storage Inc price-eps-surprise | Extra Space Storage Inc Quote

Factors to Consider

Extra Space Storage has been implementing a diverse growth approach, encompassing strategic acquisitions, third-party management services and joint ventures. Over the past years, the company has effectively carried out numerous acquisitions, which have extended its portfolio, enhanced its market share and delivered added benefits to its shareholders.

In the second quarter too, Extra Space Storage is likely to have continued to benefit from its solid presence in key cities and measures to boost its geographical footprint through accretive acquisitions and third-party management. In addition, EXR's ongoing focus on enhancing the customer experience through technology integration and improved operational efficiency is likely to strengthen its competitive advantage.

High brand value and technological advantage are expected to have aided Extra Space Storage’s top and bottom lines in the quarter under consideration. Also, this REIT is likely to have maintained a healthy balance sheet position.

However, with the pandemic’s impact waning, the self-storage industry is witnessing an elevation in vacating activity, resulting in falling occupancy levels. Tenants are likely to revert to more normal move-out behavior, leading to adverse pressure on rate growth in many markets. With a return of seasonality, rates and occupancy are likely to experience some pressure.

In the second quarter, we estimate same-store rental revenues to increase 5.1% year over year and operating expenses to increase 4.5%. Consequently, same-store net operating income is expected to grow 5.3% year over year.

Also, EXR operates in a highly fragmented market in the United States, with intense competition from numerous private, regional and local operators. In addition, there is a development boom of self-storage units in several markets. This high supply is likely to have fueled competition. Also, a hike in the interest rate is a concern for Extra Space Storage. Rising rates imply higher borrowing costs for the company, affecting its ability to purchase or develop real estate.

Projections for Q2

The Zacks Consensus Estimate of $452.12 million for quarterly property rental revenues suggests an increase from the prior quarter’s $433.96 million and the year-ago period’s $408.04 million. Management and franchise fees for the quarter are projected at $21.65 million, almost flat sequentially but ahead of the year-ago quarter’s $20.52 million. The Zacks Consensus Estimate of $524.85 million for quarterly revenues suggests a 10.5% increase year over year.

Extra Space Storage’s activities during the quarter were not adequate to gain analysts’ confidence. The Zacks Consensus Estimate for the quarterly core FFO per share has moved a cent south to $2.14 in the past two months. However, it calls for a 0.47% year-over-year rise.

Here Is What Our Quantitative Model Predicts:

Our proven model does not conclusively predict a surprise in terms of FFO per share for Extra Space Storage this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an FFO beat, which is not the case here.

Extra Space Storage currently carries a Zacks Rank of 3 and has an Earnings ESP of -1.34%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks That Warrant a Look

Our model shows that Ventas VTR and Americold Realty Trust, Inc. COLD have the right combination of elements to report a surprise this quarter.

Ventas is slated to report quarterly numbers on Aug 3. VTR has an Earnings ESP of +1.75% and carries a Zacks Rank of 2 presently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Americold Realty Trust, scheduled to report quarterly numbers on Aug 3, has an Earnings ESP of +1.96% and carries a Zacks Rank of 3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ventas, Inc. (VTR) : Free Stock Analysis Report

Extra Space Storage Inc (EXR) : Free Stock Analysis Report

Americold Realty Trust Inc. (COLD) : Free Stock Analysis Report