What's in Store for Global Ship Lease (GSL) in Q2 Earnings?

Global Ship Lease GSL is scheduled to release second-quarter 2023 results on Aug 3 before market open.

GSL has an appreciative surprise record as its earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average beat being 15.64%.

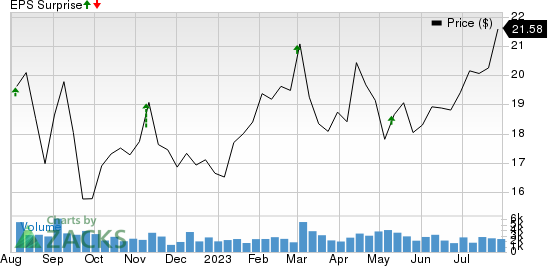

Global Ship Lease, Inc. Price and EPS Surprise

Global Ship Lease, Inc. price-eps-surprise | Global Ship Lease, Inc. Quote

Against this backdrop, let’s discuss the factors that might have impacted Global Ship Lease’s performance in the June quarter.

Bullishness surrounding the containership market is a huge boon for GSL and is likely to have boosted its top line in the soon-to-be-reported quarter. Increased fleet utilization with the gradual resumption of economic activities and an uptick in world trade are likely to get reflected in GSL’s impending results. High container rates are also likely to have strengthened the top line. The Zacks Consensus Estimate for second-quarter 2023 revenues is pegged at $158.18 million, implying an increase of 2.41% from second-quarter 2022 actuals.

A decline in oil price and the subsequent low fuel costs are likely to have enhanced the bottom-line performance in the to-be-reported quarter. The Zacks Consensus Estimate for earnings has increased 2% to $2.08 per share over the past 90 days. However, supply-chain woes are expected to have hurt GSL’s performance.

What Does the Zacks Model Say?

Our proven model does not conclusively predict an earnings beat for Global Ship Lease this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Earnings ESP: Global Ship Lease has an Earnings ESP of 0.00% as the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at $2.08. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Global Ship Lease currently carries a Zacks Rank #3

Stocks to Consider

Here are a few stocks from the broader Zacks Transportation sector that investors may consider since our model shows that these have the right combination of elements to beat on earnings this season.

Allegiant Travel ALGT has an Earnings ESP of +2.69% and a Zacks Rank #2. ALGT will release second-quarter 2023 results on Aug 2. Upbeat passenger volumes are likely to have aided ALGT’s performance. You can see the complete list of today’s Zacks #1 Rank stocks here.

ALGT has an expected earnings growth rate of 215.3% for the current year. The company surpassed the Zacks Consensus Estimate in two of the past four quarters, missing once and reporting in-line earnings in the other quarter. The average miss is 79.78%.

Copa Holdings CPA currently has an Earnings ESP of +0.82% and carries a Zacks Rank #3. CPA will release second-quarter 2023 results on Aug 9.

We expect CPA’s second-quarter performance to have been aided by upbeat air-travel demand. It has an impressive earnings surprise history, having surpassed the Zacks Consensus Estimate in each of the preceding four quarters by an average of 14.6%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Allegiant Travel Company (ALGT) : Free Stock Analysis Report

Global Ship Lease, Inc. (GSL) : Free Stock Analysis Report