What's in Store for Medical Properties (MPW) in Q2 Earnings?

Medical Properties Trust, Inc. MPW — also known as MPT — is scheduled to report second-quarter 2023 results on Aug 8, before the market opens. The company’s quarterly results are expected to reflect a year-over-year decline in revenues and funds from operations (FFO) per share.

In the last reported quarter, this real estate investment trust (REIT), which acquires and develops net-leased hospital facilities, posted normalized FFO per share of 37 cents, in line with the Zacks Consensus Estimate.

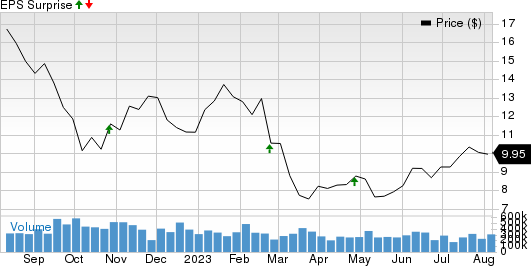

Over the trailing four quarters, MPT beat the Zacks Consensus Estimate on one occasion and met the same in the remaining three, the average being 0.56%. This is depicted in the graph below:

Medical Properties Trust, Inc. Price and EPS Surprise

Medical Properties Trust, Inc. price-eps-surprise | Medical Properties Trust, Inc. Quote

Factors at Play

During the second quarter of 2023, Medical Properties’ premium acute care portfolio is likely to have benefited from the favorable operating trends of the healthcare industry. Its healthy operator relationships and inflation-protected long-term leases are expected to have supported decent cashflow generation.

Also, MPW’s portfolio diversification efforts with respect to the operator and gains from past accretive acquisitions are likely to have driven its performance.

Further, continuing with its capital-recycling activities to enhance its balance sheet position, in May 2023, MPW concluded the disposition of seven Australian hospitals for AUD$730 million. The move marked the first (and larger) phase of the two-part sale of its Australian real estate investments. The proceeds from the sale were deployed to lower the company’s Australian term loan.

However, a rise in interest expenses amid a high interest rate environment and exposure to certain troubled operators might have cast a pall on the company’s quarterly performance.

The Zacks Consensus Estimate for second-quarter 2023 rent billed is pegged at $251.6 million. The figure suggests a 1.4% and 4.3% increase from the prior quarter’s $248.2 million and year-ago period’s $241.2 million, respectively.

Straight-line rent is estimated at $56.1 million, implying a fall from $56.7 million reported in the prior quarter and $58.5 million in the year-ago period.

The consensus estimate for income from financing leases stands at $13.1 million, suggesting a decline from $51.9 million reported in the year-ago quarter.

The Zacks Consensus Estimate for quarterly revenues is pegged at $352.8 million, implying an 11.9% fall from the prior-year quarter’s reported figure.

Medical Properties’ activities during the to-be-reported quarter were inadequate to garner analysts’ confidence. The Zacks Consensus Estimate for the quarterly FFO per share has been revised 2.6% downward to 38 cents over the past two months. Also, the figure implies a year-over-year fall of 17.4%.

Earnings Whispers

Our proven model does not conclusively predict a surprise in terms of FFO per share for Medical Properties this season. The combination of a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — increases the odds of a beat. However, that’s not the case here.

Earnings ESP: MPW has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: MPW currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other REITs

Welltower Inc.’s WELL second-quarter 2023 normalized FFO per share of 90 cents surpassed the Zacks Consensus Estimate of 86 cents. The reported figure improved 4.7% from the prior-year quarter’s actual.

Results reflected better-than-anticipated revenues. The total same-store net operating income (SSNOI) increased year over year, driven by SSNOI growth in the seniors housing operating (SHO) portfolio. Welltower also raised its guidance for 2023 normalized FFO per share.

Extra Space Storage Inc. EXR reported second-quarter 2023 core FFO per share of $2.06, which missed the Zacks Consensus Estimate of $2.14. Quarterly revenues of $511.4 million also lagged the Zacks Consensus Estimate of $524.9 million.

Results reflected lower-than-anticipated revenues on lower occupancy levels. Also, higher interest expenses were a dampener. EXR revised its 2023 outlook.

Equinix Inc.’s EQIX second-quarter 2023 AFFO per share of $8.04 surpassed the Zacks Consensus Estimate of $7.51. The figure improved 6.1% from the prior-year quarter.

EQIX’s results reflect steady growth in colocation and inter-connection revenues on the back of strong demand for digital infrastructure. The company also raised its AFFO per share guidance for 2023.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equinix, Inc. (EQIX) : Free Stock Analysis Report

Extra Space Storage Inc (EXR) : Free Stock Analysis Report

Medical Properties Trust, Inc. (MPW) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report