What's in Store for Sally Beauty (SBH) in Q4 Earnings?

Sally Beauty Holdings, Inc. SBH is likely to register a decline in the top and the bottom line when it reports fourth-quarter fiscal 2023 earnings on Nov 14. The Zacks Consensus Estimate for net sales is pegged at $930.2 million, suggesting a drop of 3.4% from the prior-year quarter’s reported figure. The consensus mark for the fiscal 2023 top line is pegged at $3.7 billion, indicating a 2.1% decline from the year-ago period’s reported figure.

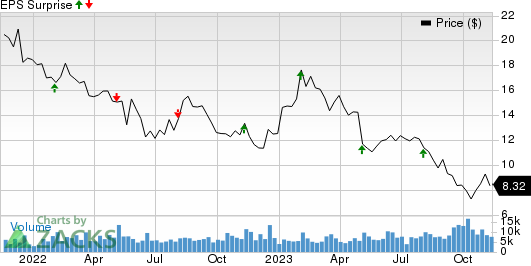

The Zacks Consensus Estimate for quarterly earnings has been unchanged in the past 30 days at 46 cents per share, indicating a decline of 8% from the figure reported in the prior-year quarter. The consensus mark for the fiscal 2023 bottom line is pegged at $1.87 per share, indicating a 13.4% decline from the year-ago period’s reported figure. The international specialty retailer and distributor of professional beauty supplies has a trailing four-quarter earnings surprise of 5.3%, on average.

Things To Consider

Sally Beauty has been battling a shrinking margin for the past few quarters. The company has been bearing the brunt of channel mix shifts between stores and the expanded Regis business. SBH’s international presence exposes it to the risk of adverse foreign currency fluctuations. Management expects fiscal 2023 net sales decline of low-single digits, thanks to unfavorable impact owing to store closures net of expected sales recapture rates.

Sally Beauty Holdings, Inc. Price and EPS Surprise

Sally Beauty Holdings, Inc. price-eps-surprise | Sally Beauty Holdings, Inc. Quote

Yet, the company is benefiting from the focus on three key strategic initiatives, which include customer centricity, growing high-margin-owned brands and carrying out innovations while increasing the efficiency of operations and optimizing its capabilities. The company focuses on acquiring new customers via marketing programs, differentiated product offerings and its strategic initiatives.

For fiscal 2023, Sally Beauty expects comparable sales growth of low single digits year over year on the back of growth in key categories, expanded Regis distribution, sales transfer from store closures and new strategic initiatives. Management expects a fiscal 2023 adjusted operating margin of 9-9.4% and gross margin of over 50%.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Sally Beauty this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Sally Beauty carries a Zacks Rank #4 (Sell) and has an Earnings ESP of +0.73%.

Some Stocks With a Favorable Combination

Here are some companies you may want to consider, as our model shows that these, too, have the right combination of elements to deliver an earnings beat.

Build-A-Bear Workshop BBW has an Earnings ESP of +0.66% and a Zacks Rank of 2. The Zacks Consensus Estimate for third-quarter fiscal 2023 earnings per share is pegged at 51 cents, suggesting no changes year over year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Build-A-Bear Workshop’s top line is expected to increase year over year. The consensus estimate for quarterly revenues is pegged at $107.6 million, which indicates an increase of almost 3% from the figure reported in the prior-year quarter. BBW has a trailing four-quarter earnings surprise of 21.6%, on average.

Costco COST currently has an Earnings ESP of +4.26% and a Zacks Rank of 2. COST is likely to register a bottom-line increase when it reports first-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $3.43 suggests an increase of 10.7% from the year-ago fiscal quarter’s reported number.

Costco’s top line is expected to improve from the prior-year fiscal quarter’s reported number. The consensus estimate for quarterly revenues is pegged at $57.7 billion, suggesting an increase of almost 6% from the prior-year fiscal quarter’s reported figure. COST has a trailing four-quarter earnings surprise of 2.1% on average.

NIKE NKE currently has an Earnings ESP of +0.45% and a Zacks Rank of 3. The company is likely to register top-line growth when it reports second-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for NKE’s quarterly earnings per share of 85 cents remains flat year over year.

NIKE has a trailing four-quarter earnings surprise of 27.1% on average. The consensus estimate for NKE’s quarterly revenues is pegged at $13.4 billion, indicating a rise of 0.7% from the figure reported in the prior-year quarter.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIKE, Inc. (NKE) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Sally Beauty Holdings, Inc. (SBH) : Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW) : Free Stock Analysis Report