What's in Store for West Pharmaceutical (WST) in Q2 Earnings?

West Pharmaceutical Services WST is scheduled to release second-quarter 2023 results on Jul 27, before the opening bell. In the last reported quarter, the company delivered an earnings surprise of 18.56%. WST’s earnings beat estimates in three of the trailing four quarters and missed the same in one, delivering an average surprise of 13.61%.

Q2 Estimates

Currently, the Zacks Consensus Estimate for revenues is pegged at $752.6 million, indicating a decline of 2.4% from the year-ago period’s level. The consensus mark for earnings is pinned at $1.95 per share, indicating a 21.1% deterioration year over year.

Factors to Note

West Pharmaceutical’s Proprietary Products was an important contributor to the company’s top-line growth in the first quarter. The segment is likely to have exhibited sustained strength in the second quarter as well.

Apart from this, the company is also expected to have witnessed margin expansion in the aforementioned segment. This is due to a favorable mix of products sold (stemming from high-value products’ [HVP] demand), production efficiencies and higher sales price.

WST has been witnessing a strong uptake of HVP components, which include Westar, Envision and NovaPure offerings. This trend is likely to have continued in the quarter to be reported.

The company has been making significant efforts to retain customers’ faith amid the uncertainty triggered by COVID-19. Apart from ensuring the safety and well-being of team members worldwide, it has successfully continued to manufacture and supply products to its customers. These initiatives might have favored WST’s second-quarter performance.

Although the top line declined during the first quarter, demand growth and a strong order book for 2023 are encouraging. The company’s better-than-expected revenue outlook is likely to get reflected in the second-quarter results.

West Pharmaceuticals’ business is exposed to foreign currency exchange rate fluctuations, which is likely to have adversely impacted its second-quarter performance. It also expects COVID-related sales to decrease further, after declining year over year in the past two quarters.

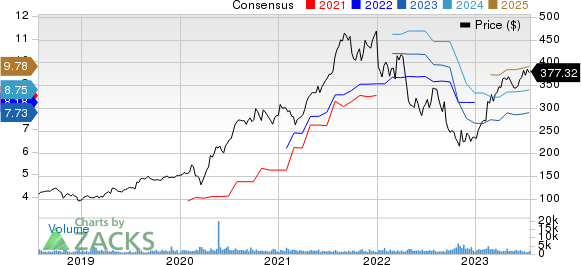

West Pharmaceutical Services, Inc. Price and Consensus

West Pharmaceutical Services, Inc. price-consensus-chart | West Pharmaceutical Services, Inc. Quote

What Our Quantitative Model Suggests

Per our proven model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here as you will see below.

Earnings ESP: West Pharmaceuticals has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #2.

Stocks Worth a Look

Here are a few medical stocks worth considering as these have the right combination of elements to come up with an earnings beat this reporting cycle:

McKesson MCK has an Earnings ESP of +1.22% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

MCK has an estimated long-term growth rate of 10.4%. Its earnings surpassed estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 3.42%.

Dentsply Sirona XRAY has an Earnings ESP of +3.39% and a Zacks Rank of #2 at present. Dentsply Sirona is scheduled to release fiscal second-quarter 2023 results on Aug 3.

XRAY’s earnings surpassed estimates in two of the trailing four quarters and missed the same in the other, delivering an average surprise of 10.47%. It has a long-term estimated growth rate of 9.3%.

Henry Schein HSIC has an Earnings ESP of +0.99% and a Zacks Rank of 2 at present.

HSIC has an estimated long-term growth rate of 8.1%. Henry Schein’s earnings surpassed estimates in three of the trailing four quarters and met once, delivering an average surprise of 2.97%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report