Wheaton Precious (WPM) Gains on Solid Portfolio Amid Low Output

Wheaton Precious Metals Corp. WPM has been gaining from its diversified portfolio of high-quality and long-life assets. Its strong cash position enables it to pay a competitive dividend and invest in accretive streams. The company's debt-free balance sheet will enable further acquisitions.

However, the results will reflect the impacts of lower output at Salobo and the suspension of operations at Minto, as well as the temporary halt of production at Aljustrel.

Long-term Production Guidance Looks Promising

Wheaton Precious expects production to increase by approximately 40% over the next five years and be more than 800,000 GEOs by 2028. This will be primarily due to growth from operating assets, including Salobo, Antamina, Peñasquito, Voisey's Bay and Marmato.

Development projects that are in construction and/or permitted include Platreef, Blackwater, Goose, Mineral Park, Fenix and Santo Domingo. Productions for pre-development projects, including Curipamba, Marathon and Copper World, are anticipated toward the latter end of the five-year forecast period.

From 2029 to 2033, attributable production is expected to average more than 850,000 GEOs. This factors in additional production from pre-development assets, including the Cangrejos, Kudz ze Kayah, Curraghinalt, Victor, Toroparu and Kutcho projects, in addition to the Brewery Creek, Black Pine and Mt. Todd royalties.

Streaming Agreements to Drive Growth

Wheaton Precious has streaming agreements in place in high-margin assets that are operated by leading mining companies. Wheaton Precious receives the benefit from mine exploration and expansion activities carried out by these companies at no additional cost.

The company has a portfolio with more than 30 years of mine life based on proven and probable reserves. Around 93% of Wheaton’s current production comes from high-margin mines operating in the lowest half of their cost curve.

Low Output Acts as Concern

Wheaton Precious produced 619,608 GEOS in 2023, which was a meager 0.5% improvement from 2022. Higher-than-expected production at Salobo and Constancia was partially offset by lower production at Peñasquito due to the temporary suspension of the mine, owing to labor disputes.

On May 13, 2023, the company announced that activities at the Minto Mine had been ceased, and the Yukon government had taken over the care and control of the property. Also, on Sep 12, 2023, it was announced that due to low zinc prices, the production of zinc and lead concentrates at the Aljustrel Mine would be discontinued from September 2023 to the second quarter of 2025.

These two actions impacted WPM’s production number in 2023. The elimination of production from Minto and Aljustrel is expected to lead to a 25,000 GEOs reduction in the 2024 production projection. Also, higher production from Peñasquito and Voisey's Bay will be offset by lower production from Salobo. Overall, in 2024, GEO production is expected to be consistent with the 2023 reported levels.

Solid Balance Sheet Bodes Well

As of Dec 31, 2023, Wheaton remains debt-free. The company earlier extended its existing undrawn $2-billion revolving credit facility, which is expected to mature on Jun 22, 2028. The company had $546.5 million of cash on hand at the end of 2023.

Wheaton’s cash operating margins are among the highest in the mining industry, which enable it to pay a competitive dividend and continue to grow through accretive acquisitions.

Recent Acquisitions to Drive Performance

Wheaton continues to add streams, which have brought immediate production, as well as medium and longer-term growth, to its robust portfolio of assets. With a record eight acquisitions totaling just more than $1 billion in commitments in 2023, Wheaton strengthened its growth plan, increasing production and sustaining its long-term growth forecast.

In November 2023, the company announced that it entered a definitive agreement to acquire existing streams from Ivanhoe Mines' Platreef project and BMC Minerals' Kudz Ze Kayah project for a cash consideration of up to $455 million. In December 2023, it signed a royalty agreement with Vista Gold Corp. to acquire a 1% royalty on gross revenues from the sale or disposition of minerals from the Mt Todd gold property in Australia for $20 million in cash .

Price Performance

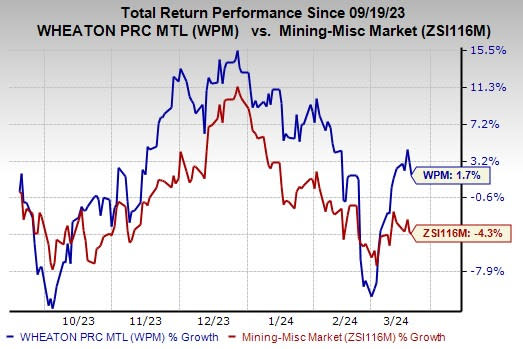

WPM shares have gained 1.7% in the past six months against the industry’s fall of 4.3%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Wheaton currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Ecolab Inc. ECL, Carpenter Technology Corporation CRS and Hawkins, Inc. HWKN. ECL and CRS sport a Zacks Rank #1 (Strong Buy) at present, and HWKN has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ecolab’s 2024 earnings is pegged at $6.39 per share, indicating an increase of 22.7% from the prior year’s reported number. It has an average trailing four-quarter earnings surprise of 1.7%. ECL shares have gained 29% in the past six months.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $4.00 per share. The consensus estimate for 2024 earnings has moved 1% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.3%. CRS shares have gained 1.2% in the past six months.

The Zacks Consensus Estimate for Hawkins’ fiscal 2024 earnings is pegged at $3.61 per share, indicating a year-over-year rise of 26.2%. The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised 4.3% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 30.6%. The company’s shares have rallied 27% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Wheaton Precious Metals Corp. (WPM) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report