Wheels Up Experience Inc. Reports Fourth Quarter Earnings Amidst Strategic Repositioning

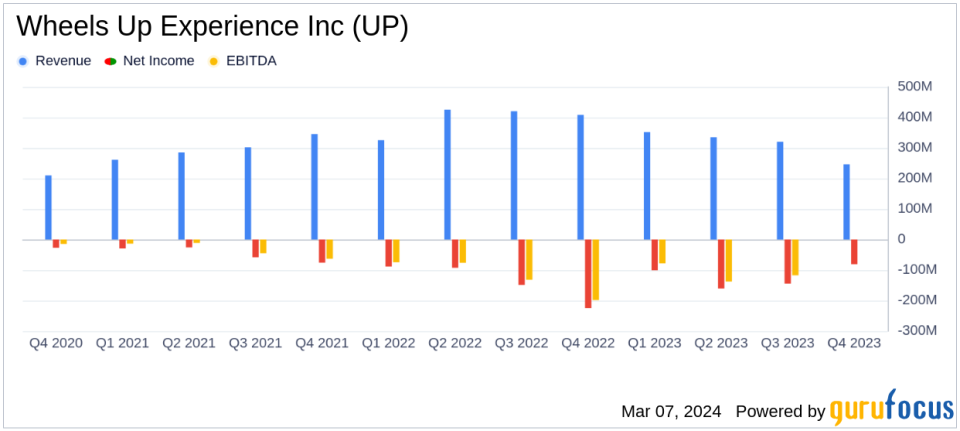

Revenue: Q4 revenue decreased by 40% year-over-year to $246 million, mainly due to the divestiture of the Aircraft Management business.

Net Loss: Net loss improved, decreasing to $81 million compared to the previous year, largely due to the absence of a goodwill impairment charge.

Adjusted EBITDA: Adjusted EBITDA loss improved by $5.6 million year-over-year to a loss of $38 million.

Active Members: A 21% decrease in active members year-over-year, with a focus on more profitable flying and Core members.

Operational Metrics: Live Flight Legs decreased by 26% year-over-year, while Flight revenue per Live Flight Leg remained consistent.

Liquidity: Cash balance improved sequentially from the third quarter, with additional capital secured from investors.

On March 7, 2024, Wheels Up Experience Inc (NYSE:UP) released its 8-K filing, detailing the financial results for the fourth quarter ended December 31, 2023. The company, a leading provider of on-demand private aviation in the U.S., is navigating through operational improvements and strategic repositioning, with a focus on profitability and partnership synergies, particularly with Delta Air Lines.

Financial Performance and Strategic Initiatives

Wheels Up's Q4 results reflect a strategic shift towards more profitable operations. The company's total revenue saw a significant decrease, primarily driven by the divestiture of its non-core aircraft management business and a reduction in flight revenue and aircraft sales. Despite the revenue decline, the company's net loss improved significantly, primarily due to the absence of a goodwill impairment charge that was present in the previous year's quarter.

The company's Adjusted EBITDA loss showed improvement, indicating progress in operational efficiency and cost reduction efforts. This is a critical metric for Wheels Up as it seeks to achieve profitability through scale and leveraging costs. The company's focus on profitable flying is further evidenced by the decrease in Active Members and Live Flight Legs, alongside a relatively stable Flight revenue per Live Flight Leg.

Operational and Market Challenges

Wheels Up's performance is indicative of the broader challenges faced in the private aviation industry, including a slowdown in demand. The company's strategic decision to regionalize its member programs and concentrate on Core members has led to a decrease in Active Members and Users. However, this focus on more profitable flying is essential for long-term sustainability in a competitive market.

The company's operational metrics, such as Total Completion Rate and On-Time performance, have met or exceeded targets, which is important for maintaining customer satisfaction and operational reliability. The introduction of the new UP for Business program and the strengthening of the partnership with Delta are strategic initiatives aimed at expanding Wheels Up's market reach and enhancing its service offerings.

Financial Health and Outlook

Wheels Up's balance sheet shows a sequential increase in cash and cash equivalents, indicating an improvement in liquidity. The addition of $40 million of investor capital from Kore Capital and Whitebox Advisors, part of a total secured new capital of $490 million, provides the company with resources to invest in its long-term business strategy.

The company's efforts to optimize its cost structure and fleet, as well as its strategic investment and partnership with Delta, position it to navigate the current market dynamics effectively. With new leadership appointments boasting extensive aviation experience, Wheels Up aims to lead the industry in performance and reliability.

"In our first full quarter since the strategic investment, we have made strong progress on a number of key fronts. Operationally, we continue to drive performance and strengthen our team. Commercially, we are rebuilding our sales pipeline, restoring customer confidence, and are seeing strong momentum in our joint efforts with the Delta sales teams," said George Mattson, Chief Executive Officer.

"We made significant progress over the past quarter to improve our business for a sustainable future," said Todd Smith, Chief Financial Officer. "We are continuing to optimize our cost structure and fleet to focus on profitability. With improving liquidity in the fourth quarter and our partnership with Delta, we believe we are well positioned to continue to invest in our business for the long term."

Conclusion

Wheels Up Experience Inc (NYSE:UP) is undergoing a period of strategic repositioning, with a clear focus on operational improvements and profitability. While the company faces industry-wide challenges, its partnership with Delta and recent capital infusions provide a solid foundation for future growth. Investors and stakeholders will be watching closely to see how these strategic initiatives translate into financial performance in the coming quarters.

Explore the complete 8-K earnings release (here) from Wheels Up Experience Inc for further details.

This article first appeared on GuruFocus.