Where Will Block Be in 1 Year?

Block (NYSE: SQ) is a trailblazer in digital payments, innovating on point-of-sale systems for small businesses while expanding its Cash App into a full-blown financial services app. The company is coming off a rough patch, but signs point toward a turnaround for the fintech. Although it's impossible to predict what will happen next, insights from management offer valuable clues about what investors can expect from Block in the next year.

Block is undergoing a transformation

Block's financial engine is driven by two sources: Square, its point-of-sale solution for small businesses; and Cash App, its money transfer app that's grown into a full-fledged financial platform. Last year, the company raked in $7.5 billion in gross profit, with $3.1 billion coming from Square and $4.3 billion from Cash App.

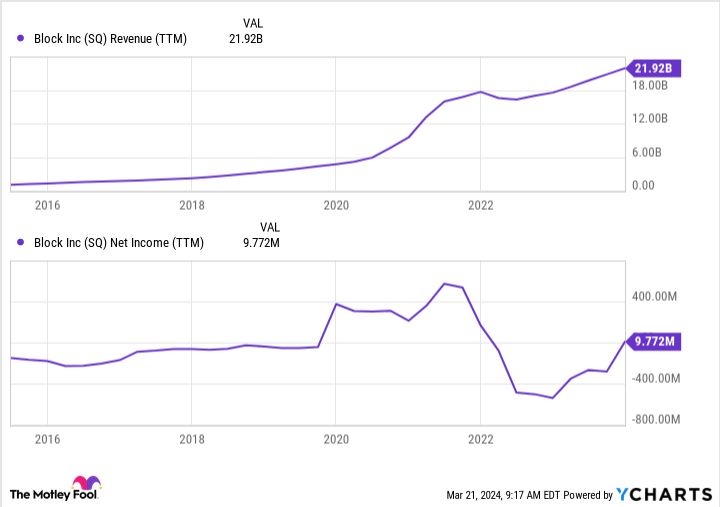

Block's growth has been impressive. Since 2020, the company has nearly tripled its gross profit. Its expansion has been fueled by its two main products, with Cash App leading the way, seeing its gross profit soar 250% over that period. This growth comes as Block expanded the Cash App beyond simple money transfers to banking, investing, saving, Bitcoin trading, and borrowing through its buy now, pay later (BNPL) offering, Afterpay.

All this growth has come at a cost, because the company's expenses outpaced its rising revenue. Since 2019, Block's net income has fallen every year, culminating in a $541 million loss in 2022. Although the company was doing a good job of expanding, declining income led to souring investor sentiment around the stock, which fell as much as 85% from August 2021 to October 2023.

Costs were rising across the entire tech sector, and coming into 2023, many companies announced layoffs and restructuring to rein them in. The most notable example was Meta Platforms, which dubbed 2023 "the year of efficiency." In late 2023, Block announced its own plans to cut costs and streamline its operations.

CEO Jack Dorsey told shareholders that the company would focus on efficiency and keep a cap on employees "until we feel the growth of the business has meaningfully outpaced the growth of the company." The fintech put its plan into action in the fourth quarter, posting net income of $178 million. At the same time, its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) and margins exceeded analysts' estimates.

Look forward to the next year for Block

Over the next year, Block will continue to prioritize streamlining operations and becoming more efficient, which should help boost its gross profit and operating margins.

To grow more efficiently, Block has reorganized its Square team and is focusing on building generative artificial intelligence (AI) into its product to help sellers expand their operations and increase their customer bases. Dorsey told investors he wants the "seller platform to be our superpower."

In addition, Block will continue to grow the Cash App, setting its sights on high-income households and turning them into regular users. One way it will do this is by encouraging direct deposits from households earning $150,000 or more. Block found that customers who deposit $2,000 or more monthly are 6 times more active.

To entice customers, the company will offer higher yields on savings accounts while also building out tools to help customers manage spending and subscriptions and build credit. It will also work to better integrate Afterpay, its BNPL financing option.

Block's recent earnings and plans for 2024 were met with a positive reaction from investors and analysts. Over the next year, analysts estimate that Block's earnings per share will be around $3.35, up 86% from last year. They also forecast that its revenue will top $25 billion, good for 14.2% growth year over year.

Block is set up for long-term success

Block is well positioned among the younger generations. According to The Motley Fool's Generational Investing Tools survey, Cash App is the most-used investing app across all generations. Usage is highest among millennials and Gen Z, with 54% and 50% of respondents, respectively, stating they use the app at least once a month.

The fintech is streamlining operations and made good progress on those initiatives in the fourth quarter. Over the next year, the company will work to better integrate its various financial offerings, which could help further strengthen its platform. Given its positioning among younger generations and focus on efficiency, the stock looks like an appealing one to buy today.

Should you invest $1,000 in Block right now?

Before you buy stock in Block, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Block wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Block and Meta Platforms. The Motley Fool has a disclosure policy.

Where Will Block Be in 1 Year? was originally published by The Motley Fool